High frequency indicators point to an ongoing robust recovery in economic activities. PMI manufacturing increased to a ten-month high of 57.6 in November 2021, increasing from 55.9 in October 2021. PMI services remained high at 58.1 in November 2021, its second highest level since July 2011. Gross GST collections at INR1.31 lakh crore remained above the benchmark of INR1 lakh crore for the fifth consecutive month in November 2021. According to recent information related to advance direct tax collections, a growth in excess of 50.0% has been recorded as on 16 December 2021[1]. The IIP grew by 3.2% in October 2021, close to its growth of 3.3% in September 2021. However, when evaluated over October 2019, IIP showed a strong growth of 7.8% in October 2021. Core IIP growth increased to 7.5% in October 2021 from 4.4% in September 2021. Merchandise exports growth was elevated at 27.2% in November 2021, reflecting a strong external demand. Overall exports growth during the month was driven by exports of oil, engineering goods and organic and inorganic chemicals.

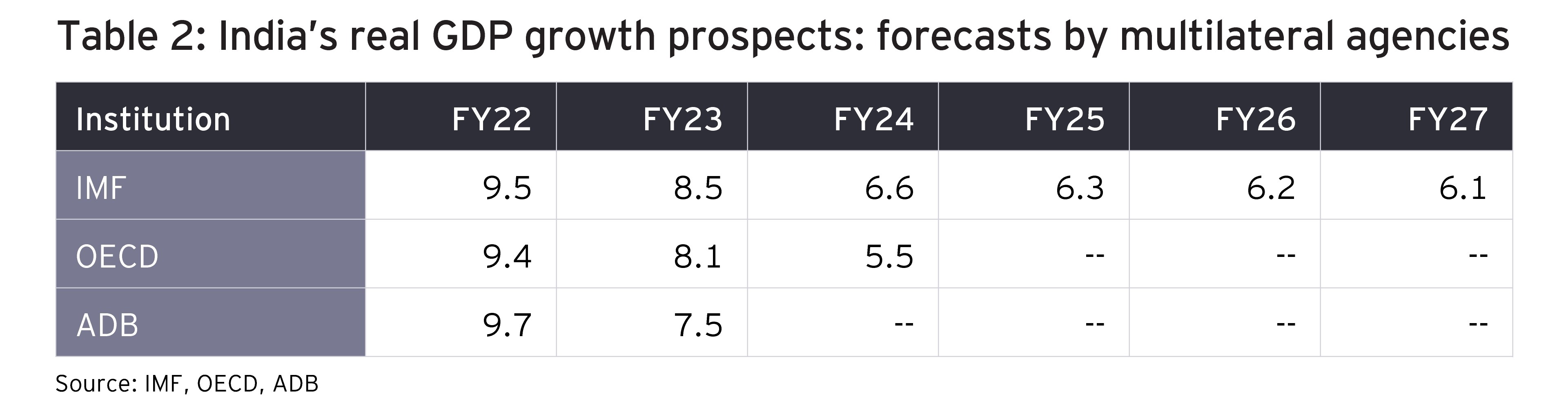

We expect that a real GDP growth of 9.5% in FY22 may be realized subject to government keeping up its infrastructure spending in the form of capital expenditure at levels consistent with the budget estimates or even higher than those. Further, the nominal GDP growth in 1HFY22 has amounted to 23.9% consisting of real GDP growth of 13.7% and an implicit price deflator (IPD)-based inflation of 9.0%. In 2HFY22, a real GDP growth of about 6% is required if the annual growth of 9.5% is to be maintained. However, inflation would remain under pressure and because of the WPI inflation remaining higher than the CPI inflation, we expect that the annual IPD-based inflation may be in the range of 7-7.5%. Thus, a combination of real growth of 9.5% and an IPD-based inflation of 7.25% may give a nominal GDP growth for FY22 of about 17.5%.

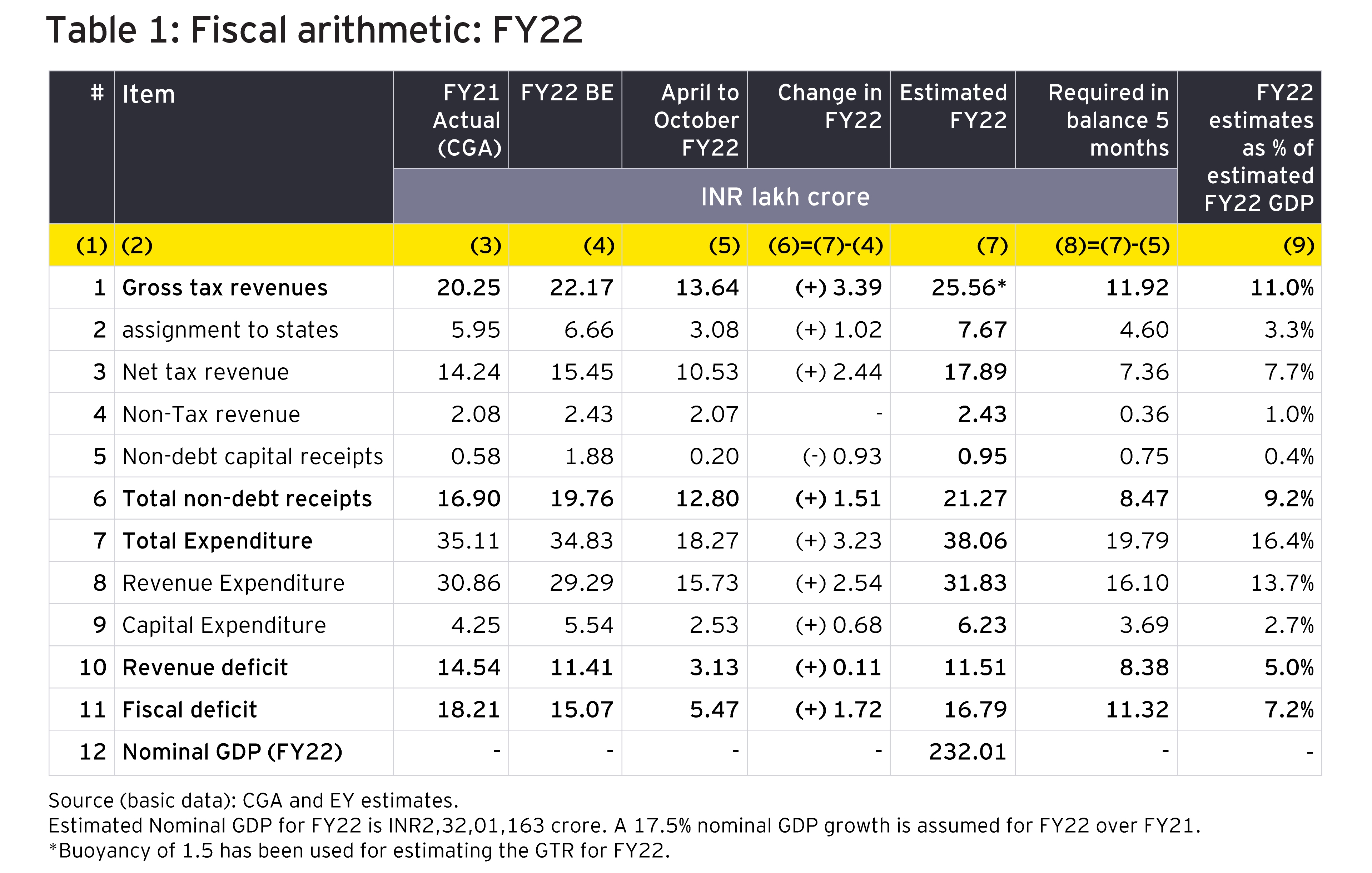

The FY22 budget had given a nominal GDP estimate of INR222.87 lakh crore which implies a nominal growth of 12.9% over the FY21 GDP (provisional estimates). Thus, nominal GDP growth in FY22 may have to be revised upward by a margin of 4% points or above. Considering this, the budget magnitudes may require to be reworked relative to GDP. Applying a 17.5% nominal growth on a base of INR197.45 lakh crore in FY21, the nominal GDP for FY22 is estimated at INR232 lakh crore, implying an increase of INR9.13 lakh crore over the budgeted magnitude. In the subsequent discussion, the revised budget magnitudes as percentage of GDP have utilized a nominal GDP magnitude of INR232 lakh crore.

Buoyant tax revenues: role of IPD-based inflation

Center’s gross tax revenues (GTR) have shown an unprecedented growth rate of 64.2% and a buoyancy of 2.7 in 1HFY22. The nominal GDP growth at 23.9% with an IPD-based inflation at 9.0% in 1HFY22 is the key reason for the buoyant tax revenues. During April-October FY22, Center’s GTR showed a growth of 55.8% over the corresponding period of FY21 and 29.7% over the corresponding period of FY20.

During April-October FY22, assignment to states relative to center’s GTR was lower at 22.6% as compared to the corresponding average of 34.9% during the last five years. This is also lower than the budgeted assignment to states as a proportion of GTR for FY22 which stands at 30%. This implies that in the remaining part of the current fiscal year, transfer to states in the form of sharing of tax revenues would increase substantially.

State governments will benefit in terms of their own tax revenues because of the higher nominal GDP growth and also because of the higher than budgeted realization of center’s GTR. States would also have a choice to either reduce their fiscal deficit or to maintain it at budgeted levels or even higher with a view to increasing capital expenditures. Thus, if both central and state governments keep supporting aggregate demand in the system especially through infrastructure spending, it should be feasible to achieve a real GDP growth of 9.5% or above.

Impact of underprovided expenditures on FY22 revised estimate (RE)

Recent trends indicate that some of the critical expenditure heads particularly food and fertilizer subsidies may have been underprovided for in the FY22 budget. The fertilizer subsidies were underprovided as a result of the recent pressure on petroleum prices. According to recent media information[2], the center’s buoyant tax collections in the current year enabled making a payment of nearly INR20,000 crore against oil bond dues and interest. This will lower the center’s interest outgo on oil bonds over the coming years. Of the total payment of INR20,000 crore, an amount of INR10,000 crore was made towards bringing down the principal amount under oil bond dues which is the first such payment since FY15.

There may be some under-provision of health expenditures also. The provision for COVID vaccines was limited to INR35000 crore. Since the pace of vaccination has gathered momentum and the coverage has been increasing by the day, there may be a need to provide for more central budgetary resources on this account. In the second supplementary demand for grants, an additional demand under the head “Ministry of Health and Family Welfare” of about INR7500 crore has been provided.

The first and second supplementary demand for grants based on demand for additional gross expenditure amounted to INR1.87 lakh crore and INR3.74 lakh crore, equivalent to 0.81% and 1.61% of estimated nominal GDP respectively. The government has proposed financing of these expenditures largely by the savings from within the Ministries/ Departments and additional expected recoveries within the Departments. As a result, the estimated net cash outgo which would be the additional pressure on budgetary resources is estimated at INR3.23 lakh crore which is 1.39% of the estimated nominal GDP.

Marginal revision of budgeted fiscal deficit for FY22

The fiscal deficit target of 6.8% of GDP for FY22 may come under pressure because of upward revisions in some expenditure items as well as under-realization of budgeted receipts especially non-debt capital receipts. Non-debt capital receipts for FY22 were budgeted at INR1.88 lakh crore. During April-October FY22, non-debt capital receipts stood at 10.5% of its budget estimate. Non-debt capital receipts which mainly include disinvestment receipts may fall well short of the budget estimates.

On the expenditure side, a number of items may exceed their budget estimates. These along with a reworking of the fiscal deficit numbers are summarized in Table 1.