Union Budget 2021

Our team of senior tax and policy professionals is ready to decode and analyze Budget 2021.

Register for

Budget 2021 Webcasts

For Budget 2021 analysis and highlights, join our webcasts.

Follow #EYonBudget2021

Assessing India’s GDP growth and FY23 budget prospects

Union Budget 2021-22: Key Highlights

1.

PM AtmaNirbhar Swasth Bharat Yojana with outlay of Rs 64,180 crore over 6 years

2.

Rs 5.54 lakh crore provided for capital creation in the infrastructure sector

3.

Voluntary vehicle scrapping policy to phase out old vehicles

4.

Disinvestment target pegged at Rs 1.75 lakh crore

5.

6.

LIC IPO to be out in FY22

Union Budget 2021-22: Sectoral highlights

- Increase in basic customs duty rate of auto components falling under chapters 70, 73, 85, 87 and 91 from 10 % to 15%

- Increase in basic customs duty rate for compressors falling under chapter 84 and instruments under chapter 90 from 7.5% to 15%

- Reduction in basic customs duty for ferrous & non ferrous metal products falling under chapter 72 & 74 used by domestic manufacturers for reducing cost of inputs by 2.5%

- Agriculture Infrastructure and Development Cess imposed on Petrol and Diesel with a consequent reduction in other duties and cess to ensure no additional burden on the consumer

- Temporary withdrawal of anti-dumping duty and countervailing duty on import of metals from certain countries including China, Germany, Vietnam, Korea and Indonesia

- Proposed TDS @0.1% on purchase of goods exceeding Rs 50 Lakh during a year

- Effective date of applicability of Significant Economic Presence remains unchanged – to apply from 1 April 2021 onwards

- Sale of motor vehicles covered under section 206C(1F) will continue to be governed by TCS provisions

- However, recently introduced provision under section 206C(1H) for TCS on sale of goods shall not apply in case new TDS provision is applicable

- Equalisation Levy provisions amended and scope seems to cover a wider set of transactions

- Introduction of Voluntary Vehicle Scrappage Policy to replace old vehicles likely to boost demand for newer and less polluting vehicles

- Announcement of significant allocation for construction of highways and roads. New scheme to augment public bus transport service likely to aid increase in demand for automobile industry and create job opportunities

- Rationalization of equalization levy provisions

- Taxation as royalty/ fee for technical services under the income-tax law would have priority over equalization levy

- Activities that would need to take place online for e-commerce supply or service to be regarded as “online sale of goods” and “online provision of services”

- Sale of goods and provision of services will be covered regardless of whether the e-commerce operator owns the goods or provides the service

- Applicability of Income-tax exemption for consideration covered by equalization levy aligned with 1 April 2020 along with date of applicability of equalization levy

- The amendments will take effect retrospectively from financial year starting from 1 April 2020

- No change in applicability of “significant economic presence” criteria for business connection

- Accordingly, as provided for by the Finance Act, 2020, the provision would be applicable from 1 April 2021

- Changes to the advance ruling process

- The exiting Authority for Advance Ruling (AAR) will cease to operate with effect from date to be notified by the central government

- Constitution of one or more Boards for Advance Ruling will be notified

- Central government will introduce a new scheme to impart great efficiency, transparency and accountability and also to introduce dynamic jurisdiction

- Advance rulings issued by the Board will be appealable before the high court

- The cases pending before the Authority for Advance Ruling on the notified date will be transferred to the Board

- Corresponding amendments will be made to the relevant provisions with effect from 1 April 2021

- Definition for “liable to tax” introduced

- The Income-tax Act, 1961 did not provide any specific definition of the term “liable to tax”

- The amendment will define this as a liability of tax on that person under the law of any country and will include a case where subsequent to imposition of such tax liability, an exemption has been provided

- The total budget outlay for healthcare is INR2.23 lakh crore vs. INR94,452 crores in FY 20-21 resulting in an increase of 137%

- Provision of INR35,000 crores for Covid-19 vaccine in FY 2021-22

- PMANSBY proposed to be launched with outlay of about INR64,180 crore over 6 years to develop capabilities of primary, secondary and tertiary care Health systems. strengthening existing national institutions, and create new institutions including set up of integrated public health labs, critical care hospital blocks, expansion of Integrated Health Information Portal, etc.

- Launch of Mission Poshan 2.0 in order to strengthen nutritional content, delivery, outreach, and outcome by merger of Supplementary Nutrition Programme and the Poshan Abhiyan;

- Launch of Jal Jeevan Mission (Urban) announced to aim universal water supply in all 4,378 Urban Local Bodies with 2.86 crores household tap connections, as well as liquid waste management in 500 AMRUT cities, with an outlay of INR2.87 lakh crores over 5 years

- The Urban Swachh Bharat Mission 2.0 will be implemented with a total financial allocation of INR1.42 lakh crore over a period of 5 years from 2021-2026

- Pneumococcal vaccine a Made in India product to be rolled across country

- With a view to ensure transparent and efficient regulation of the 56 allied healthcare professions, National Commission for Allied Healthcare Professionals Bill has been introduced in Parliament

- The National Nursing and Midwifery Commission Bill will be introduced with the intention of bringing about transparency, efficiency and governance reforms in the nursing profession

- Outlay for National Research Foundation expected to be INR50,000 50,000 crores, over 5 years to ensure overall reseach ecosystem of the country is strengthened with focus on identified national- priority thrust areas

- Health cess on Medical Devices imported by International Organization and Diplomatic Missions reduced from 5% to 0%

- PMANSBY – PM AtmaNirbhar Swasth Bharat Yojana

- Certain aspects of e-commerce equalisation levy clarified on a retrospective basis from 1 April 2020. M&E players impacted by the levy should analyse the impact:

- Exemption of income chargeable to equalisation levy to apply from 1 April 2020 onwards, instead of previously 1 April 2021

- Income taxable as “royalty” and “fees for technical services” excluded from the scope of the levy, thus removing the previous ambiguity around potential double taxation

- Scope of “online sale of goods” and “online provision of services” to include one or more of the following activities:

- Acceptance of offer for sale

- Placing of purchase order

- Acceptance of purchase order

- Payment of consideration

- Supply of goods or provision of services

- Consideration received or receivable” on which levy is chargeable to include consideration irrespective of whether the e-commerce operator owns the goods or provides the services

- Effective date of applicability of Significant Economic Presence remains unchanged – to apply from 1 April 2021 onwards

- Tax holiday for notified affordable rental housing projects introduced.

- Affordable housing projects approved up to 31 March 2022 (‘erstwhile 31 March 2021’) to be eligible for tax holiday.

- Additional interest deduction of INR 1.5 lakhs for acquisition of specified residential house property by individuals for loan obtained till 31 March 2022 (‘erstwhile 31 March 2021’).

- Deviation up to 120% (‘erstwhile 110%’) where sales consideration is less than stamp duty value for sale of residential units subject to specified conditions.

- Exemption from withholding tax on dividend credited or distributed to REITs.

- Time limit for investment in eligible start up for claiming exemption on long term capital gains derived by individual/HUF from sale of residential property extended till 31 March 2022 (‘erstwhile 31 March 2021’).

- Foreign Portfolio Investors to be permitted to provide debt funding to REITs.

- Establishment of Special Purpose Vehicle to monetise land owned by Government/ Ministries/ PSE.

- Increase in purchasing power of rural and urban consumers is likely because of focus on capital expenditure, infrastructure, affordable housing, health care etc.

- Capital expenditure – INR 5.54 lakh crores (FY 2021-22 BE) as against INR 4.12 lakh crores (FY 2020-21 BE)

- Health outlay INR 2.23 lakh crores (FY 2021-22 BE) as against INR 0.94 lakh crores (FY 2020-21 BE)

- Renewed focus on ‘Make in India’/ Indian manufacturing – sourcing strategies may be impacted

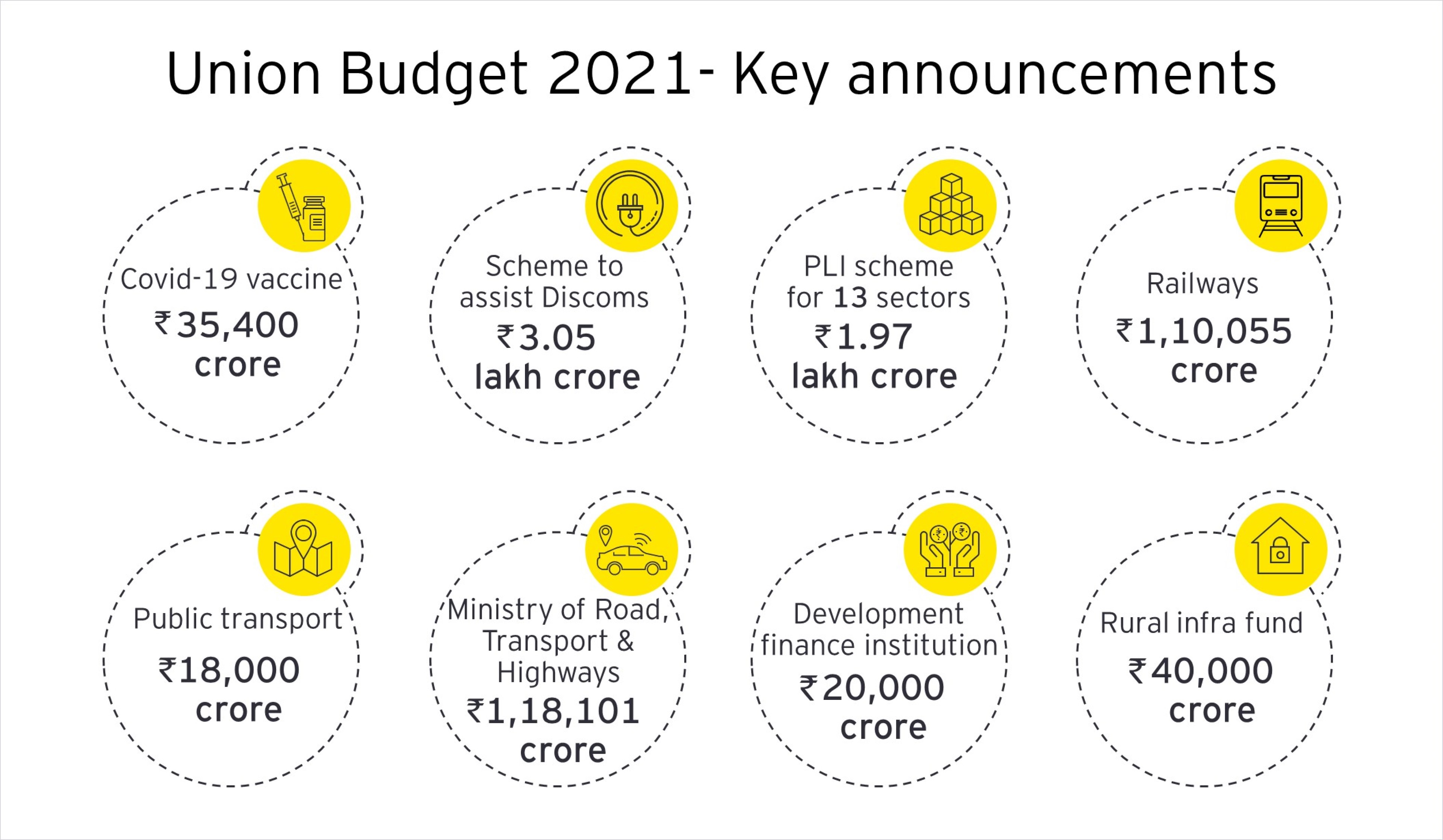

- PLI launched to create manufacturing global champions across 13 sectors with amount committed nearly INR 1.97 lakh crore in the next 5 years starting FY 2021-22

- Mega Investment Textiles Parks (‘MITRA’) Scheme to create world class infrastructure for global champions in the textile sector leading to creation of 7 textile parks over 3 years

- Rationalization of customs duty structure by eliminating outdated exemptions

- Rationalization of duties on raw material inputs to man made textiles/ gold and silver

- Incentives proposed for ‘start ups’ likely to support new entrepreneurs in retail and e-commerce sectors

- Incorporation of One Person Companies (OPCs) by allowing OPCs to grow without any restrictions on paid up capital and turnover, allowing their conversion into any other type of company, allowing Non Resident Indians (NRIs) to incorporate OPCs in India

- Extension of the eligibility for claiming tax holiday for start-ups by one more year - till 31st March, 2022

- Incentivizing funding of the start-ups, by extending capital gains exemption for investment in start-ups by one more year - till 31st March, 2022

-

To give impetus to digital payments, INR 1,500 Crores earmarked to promote digital payments - Internet services to be utilized for National Language Translation Mission for dissemination of governance-and-policy related knowledge

- Government to support development of a world class Fin-tech hub at the GIFT-IFSC by providing additional tax incentives

- National Digital Educational Architecture (NDEAR) to be set up to support educational planning, governance and administrative activities. This will support education eco-system architecture for development of digital infrastructure

- Government to launch data analytics, artificial intelligence, machine learning driven MCA21 Version 3.0. to have additional modules for e-scrutiny, e-Adjudication, e-Consultation and Compliance Management

- Social security benefits extended to gig and platform workers. Women will be allowed to work in night shifts with adequate protection

- Retrospective amendments introduced with effect from 1 April 2020 to provide clarification on the applicability of Equalisation Levy

- Consideration which is taxable as royalty and fees for technical service not to be included

- Nature of activities that would constitute online sale of goods or provision of services specifically listed

- Consideration from e-commerce supply shall include:

- Value of goods irrespective of whether the operator owns the goods

- Value of services irrespective of whether the services are provided or facilitated by the operator

- Rules to be notified for removing hardship faced by Non-Resident Indians due to double taxation of their accrued income in foreign retirement accounts

- To promote digital economy, threshold for tax audit to be increased to INR 10 crore for taxpayers carrying on business, provided 95% transaction are digital

- Requirement of furnishing GST Audit report in Form 9C has been removed

- Requirement of furnishing Annual return in Form 9 to be replaced with a self-certified reconciliation statement. Due dates to be notified.

- Zero-rating benefit in case of supplies made to SEZ units and developers to be curtailed only in cases where supplies used for authorised operations.

- Government to notify cases where refund of output tax on zero-rated supplies can be filed.

- Requirement of Input Tax Credit reconciliation with the invoice statement uploaded by supplier inserted in CGST Act.

- Linking of the foreign exchange remittance in case of export of goods with refund.

- Review of more than 400 old customs exemptions has been proposed through extensive consultations from 1st October 2021. A revised customs duty structure is proposed to be placed free of distortions.

- Any new customs duty exemption henceforth will have validity up to the 31st March following two years from the date of its issue.

- Basic Custom Duty rates on certain IT sector specific products like inputs related to machines capable of connecting to automatic data processing machines , ink cartridges etc. has been increased from NIL to 2.5%.

- To promote value addition in the mobile phone industry, Customs Duty on inputs, parts or sub-parts for manufacture of specified parts of mobile phones increased

- Custom Duty exemptions on inputs and raw material used to manufacture certain telecom equipment withdrawn to give thrust to domestic manufacturing

- In line with industry demand, benefit of concessional duty of customs extended to third party manufacturers

- The government has approved the policy of disinvestment of Central Public Sector Enterprises (CPSEs), which provides a clear roadmap for disinvestment in non-strategic and strategic sectors. In strategic sectors, including telecommunications, there will be a minimal presence of CPSEs

EY leaders on Budget 2021 announcements

Budget 2021 provides for concessional credit boost to farmers, enhanced allocation to various agriculture development funds, availability of Agriculture Infrastructure Fund to APMCs, expansion of Operation Green scheme to include additional 22 perishable products, 1,000 more mandis to be integrated with e-NAM, development of modern fishing harbors and fish landing centers.

These proposals aim for sustainable and consistent growth, thereby incentivizing the agriculture sector to grow into a modern business enterprise.

Aashish Kasad

EY India Tax & Regulatory Services Partner

The scrappage policy is a much-awaited development where apart from boosting demand in the sector it will simultaneously help reduce pollution and fossil fuel consumption while also enabling re-use of steel/aluminium. An extension of this policy to other aspects (for example, tyre scrappage) may help boost demand in related sectors while also helping India become more Atmanirbhar.

Vinay Raghunath

EY India Automotive sector Leader

Announcement by the Finance Minister on Voluntary Vehicle Scrappage Policy covering personal and commercial vehicles is a welcome step and should encourage demand for newer, less polluting vehicles. Government’s resolve to build additional roads, national highways and improve urban infrastructure and public transportation as evidenced by 34% increase in capital outlay for infrastructure will spur demand in the medium to long-term. Further, the rise in customs duty on certain auto parts left out in 2020 budget clubbed with production-linked incentive (PLI) scheme for auto sector appears to be a step towards making Bharat Atma Nirbhar and will have an adverse effect in short to mid-term till India gets self-reliant for those components. Overall, a Budget accelerating pace in the right direction.

Pramod Achuthan

EY India Partner and Automotive Tax Leader

With special emphasis on enhancing domestic manufacturing, 13 sectors have been earmarked by the Government for extended financial support over a period of next five years via the PLI schemes. Auto and auto components capture a significant share of the pie with one third of the budgets earmarked (approx. INR 57,000 crores) for this sector alone. Additional measures of increase in Customs duty rate on parts of vehicles (such as frames & forks, wheel rims & spokes, hubs, brakes, saddles, pedals & crank gears) from 10% to 15% appears to be an aim towards promoting domestic manufacturing. However, considering the fact that substantial imports by the Auto industry are done from Asian countries while obtaining benefits under various FTAs, the real on ground benefit would have to be ascertained in the due course of time. Further, the increase in customs duty is likely to lead to increased cost of vehicle manufacturing in short term till the time the manufacturing ecosystem for these components is developed in the country.

Saurabh Agarwal

EY India Tax Partner

Integration of 1000 more mandis into National Agriculture Market (eNAM) would lead to nearly 30% of the Agricultural Produce Market Committee (APMC) markets being connected and in terms of value, it would be more than 50% of the trade in APMCs. This would go a long way in enhancing the electronic trade in the country. Permitting APMCs to take benefit of Agriculture Infra Fund would further accelerate development of basic infrastructure in mandis. Also, the strengthening of Warehousing Development and Regulatory Authority (WDRA) to set up the commodity ecosystem would have twin benefits of increasing adaptation of Electronic Negotiable Warehouse Receipts (eNWR), thereby ultimately benefiting the famer and accelerating the e-NAM ecosystem development,”

Satyam Shivam Sundaram,

Partner, Government and Public Sector, EY India.

The Fifteenth Finance Commission has not recommended any change in the vertical share of states which has been retained at 41%. There is a greater emphasis on augmenting resources for the states through grants-in-aid particularly revenue deficit grants. The volume of revenue deficit grants has been increased to INR 1,18,452 crores in 2021-22 as against INR 74,340 crores in 2020-21. The coverage has also been increased to 17 states from 14 states last year. Using higher grants as a means of fiscal transfers is a preferred mode of transfers when it is difficult to forecast central tax revenues due to economic uncertainty. The Finance Commission has also permitted a higher fiscal deficit for the states in 2021-22 at 4% of GDP for states considered together, but it is to be brought down in line with the FRBM requirement of 3% of GDP by 2023-24. The Finance Minister has indicated that the FRBM Act will now be amended. The central government, at least in the medium term, may be allowed to incur a higher fiscal deficit since in their case, it is to be reduced to less than 4.5% of GDP by 2025-26.

D. K. Srivastava

Chief Policy Advisor, EY India

The government’s push behind creating a world class International Financial Services Centre (IFSC) in India is commendable. India is best placed to serve the globe in terms of development of new technologies. A Fintech Hub at the IFSC is, therefore, very logical and a very promising proposal.

Anish Tacker

EY India Tax Partner

Infrastructure sector is expected to get a significant boost from reforms to ease foreign investment, particularly participation of the pension funds in infrastructure sector such as issuance of zero-coupon bond and relaxation regarding commercial activities. Setting up of a professionally managed Development Finance Institution (DFI) will be critical for speedy launch of the National Asset Monetisation Pipeline and to fund new infrastructure projects, for which the government has allocated INR 20,000 crore in this budget.

The government has allocated INR 5.54 lakh crore for capital creation in the infrastructure sector. The transport sector has received a fair share of allocation in the budget with new economic corridors being planned to boost highways and railways sector. The government has also allocated INR 1.18 lakh crore for the roads and highways sector and INR 18,000 crore for the public transport in this year’s budget. About 8,500 km of road and highway projects are being planned to be awarded by March 2022 including the new road corridor projects. Railways have seen a significant allocation in this year’s budget with a total allocation of INR 1.1 lakh crore, mostly on the capital expenditure including the railways corridors. The National Rail Plan 2030 to create a future-ready railways system will be critical for boosting and bringing investment into the Railways sector.

Abhaya K Agarwal

EY India Infrastructure Leader

The government has done well by focussing on reviving growth rather than being unduly worried by the immediate term Fiscal Deficit given the special circumstances though one does hope that returning to the path of Fiscal consolidation happens sooner than later.

In this regard the thrust on increase in Capex in particular on building Infrastructure can have a multiplier effect on promoting growth and provide a much-needed boost to demand and employment generation. The announcements regarding Disinvestment & Strategic Sale, Development Financial Institution, and Asset Reconstruction & Management Company are indeed welcome. More could have been done to promote private investment in Infrastructure & to promote Indian innovation and R&D efforts.

Pranav Sayta

EY India International Tax and Transaction Tax Leader

The dedicated focus, holistic approach and the constant endeavour of the Indian Government to improve the overall health and wellbeing of people is a welcome move. Budget 2021 is largely focused towards strengthening the basic government healthcare infrastructure with introduction of critical care hospital blocks, Public Health Units, Health emergency centres etc. Also, a specific allocation of INR 35,000 crores towards vaccination lays down a roadmap of the central government to vaccinate more than 50-60 cr population of India in FY 2021-22. Lastly, the expansion of integrated health information portal to all states/ UTs hopefully is a step towards digitalisation of health care records and connection with all public health labs.

Hitesh Sharma,

Tax Partner and Life Sciences leaders, EY India

The announcements made for the steel sector in the Budget are largely around making steel available in the right quality and quantity at competitive prices to enable speedy infrastructural development planned for the country. Reduction in customs and anti-dumping duty on steel imports and zero customs duty on scrap imports will benefit the secondary steel manufacturers to supply steel for construction of roads, ports and bridges and add to a more cost effective supply base for steel. 11,000-km of highways and metros, rapid rail transport projects for 27 cities and a long-awaited vehicle scrappage policy will boost the demand for steel and aluminium.

Saurabh Bhatnagar

Partner and National Leader, Metals & Mining, EY India.

Focus on asset monetization through InvIT of pipeline assets will enable unlocking of value and generate additional resources for expansion of oil & gas pipelines. Announcement of an independent Gas Transport System Operator for facilitation/ coordination of booking of common carrier capacity in all-natural gas pipelines on a non-discriminatory open access basis, is a welcome move and will help to maintain transparency and integrated operationalization of idle/short term capacity of gas network which will go a long way in meeting gas needs of the economy. Further, in a bid to provide additional fillip to existing CGD network, it is proposed to add 100 more districts in next three years to the City Gas Distribution network. This move goes hand in hand with the Government’s objective to improve availability of natural gas across the country and to promote natural gas consumption in overall primary energy consumption mix in India.

Raju Kumar

EY India Oil and Gas Tax Partner

For Budget 2021, it seems FM has listened to and sought to implement all the major suggestions made by economists and businesses alike. Thus, a massive dose of expenditure outlays skewed towards capital expenditure is proposed in critical areas such as healthcare and infrastructure. Also, some significant announcements for the financial sector including bank privatisation and setting up stressed assets structures for NPAs have been announced. Whilst the fact that no major changes in the design or rates of direct taxation signals strong resolve to have stability in the tax regime, there are certain welcoming changes to clarify or provide relief in appropriate cases. For example, the time limit for reopening of past cases has been reduced from six to three years and foreign shareholders in Indian companies will get the benefit of lower withholding rates on dividends under tax treaties. However, disallowance of deduction on goodwill in merger transactions is an unexpected dampener. Also, the announcement of a dispute resolution committee for only small taxpayers is disappointing as there is a crying need for an omnibus mediation channel for all taxpayers, especially where large tax disputes are likely to arise.

Sudhir Kapadia

Tax Leader, EY India,

A very sensible Budget. Given the landscape of doom and gloom – Kudos to the Finance Minister for keeping it together. Contrary to fears of Covid cess/ additional surcharges, wealth tax, the Finance Minister has kept her eye on whats going to help the economy. Significant focus on Capital expenditure as set out the Budget in the proposals is really the need of the hour. Expenditure on infrastructure and increase FDI in insurance and disinvestment and privatisation of PSU banks are path breaking.

The continued focus on making the lives of the tax payers easy by proposed measures such as – No tax return filing requirement for persons aged 75 years and above earning only pension income, pre filled tax returns, faceless assessments expanded to include Tax tribunals, dispute resolution committee, reduction in time limit for reopening of tax assessments, advance tax to be paid only on declared or actual dividends, extension of time limit for additional deduction of Rs. 150000 for interest on loan taken by first time home owners extended until 31 March 2022, amongst other investor protection measures- are all very positive. Some pain as redemption from ULIPs where premium exceeds Rs. 250000 for ULIPS purchased on or after 1 Feb 2021, Interest on the employee’s contribution exceeding Rs.250,000 to Provident Fund becoming taxable, some impact of Agricultural Infrastructure Development cess on purchase of gold, certain food items, alcohol etc . All in all – a prudent budget!

Sonu Iyer

National Leader, Personal Tax Services, EY India

The Union Budget 2021 targets 100% electrification of broad-gauge railways to be achieved by 2023. As of August 2020, 65% electrification has been achieved. This is a welcome move by the government as it will reduce dependence on conventional fuels and increase efficiency. It is hoped that a significant part of this will be from renewable energy.

Significant focus on asset monetisation including Power Grid Corporation of India and other transmission assets will enable unlocking value and generate additional revenue for transmission companies that can hopefully be partly shared with consumers to bring down tariffs.

A revamped scheme with an outlay of over Rs. 3 lakh crore would be launched for distribution turnaround through infrastructure creation and interventions such as smart metering and feeder separation. While providing for this scheme, Union Budget 2021 also puts additional pressure on Discoms to improve by providing the choice of suppliers to consumers through a special framework. This has been pending for a long time and is welcome and will require the separation of carriage and content.

Somesh Kumar

EY India Power & Utilities Leader

Allocation of Rs 2,23,846 crores (137% increase compared to FY 2020-21) towards healthcare is not only in line with the immediate requirement to deal with pandemics like COVID-19 but also consistent with the National Health Policy 2017, which aspires to increase expenditure on healthcare to 2.5% of GDP.

Further, the new centrally sponsored scheme PM Aatmanirbhar Swasth Bharat Yojana will provide an additional impetus and complement the NHM budgets to accelerate the development of primary, secondary, and tertiary health care infrastructure.

It is also heartening to see that there is a special focus with substantially increased allocation on social determinants of healthcare including launch of Mission Poshan 2.0 to improve nutritional outcomes, Jal Jeevan Mission ensuring universal water supply, Urban Swachh Bharat Mission focussing on solid and waste water treatment, source segregation of garbage, reduction in single-use plastic, reduction in air pollution, among others. This increased allocation would not only improve the health outcomes but also go a long way in the achievement of 5 out of 17 Sustainable Development Goals (Zero Hunger, Good Health & Wellbeing, Clean Water & Sanitation, Sustainable cities & Communities & Climate Action).

Satyam Shivam Sundaram

EY India Government and Public Sector Partner

Railways have seen a significant allocation in Union Budget 20021, with a total allocation of INR 1.1 lakh crore, mostly on the capital expenditure including the railways corridors. The National Rail Plan 2030 to create a future-ready railways system will be critical for boosting and bringing investment into the Railways sector.

Abhaya K Agarwal

EY India Infrastructure Leader

Focus on Make in India, increase in custom duties, Atmanirbhar Bharat, Infrastructure, construction and capital expenditure announced in Union Budget 2021 are likely to promote domestic manufacturing and improve employment levels.

Sourcing structures for retailers and FMCG companies dependent on imports may have to be revisited and focus on sourcing India-made products may increase. Purchasing power in the hands of rural and urban consumers through heavy spend on healthcare, infrastructure, housing, market borrowings and spend, is likely to make retailers and consumer companies smile. No increase in direct taxes is likely to add cherry to the cake.

Paresh Parekh

EY India Retail Tax Leader

The government has allocated INR 5.54 lakh crore for capital creation in the infrastructure sector. The transport sector has received a fair share of allocation in the budget with new economic corridors being planned to boost highway and railways sector.

The government has allocated INR 1.18 lakh crore for the roads and highways sector and INR 18,000 Cr for the public transport in Union Budget 2021. About 8,500 km of road and highway projects are being planned to be awarded by March 2022, including the new road corridor projects.

Abhaya K Agarwal

EY India Infrastructure Leader

The long-standing demand of the telecom companies for a mechanism of liquidation of accumulated input credit has not been addressed in Union Budget 2021. Government has increased customs duty rates on parts and components for manufacture of telecom equipment and mobile phones which may increase and promote component level manufacturing in India.

Vishal Malhotra

EY India Telecom Tax Leader

More from EY leaders on Budget 2021 announcements

Our latest thinking on Budget 2021

Contact us

Like what you’ve seen? Get in touch to learn more.