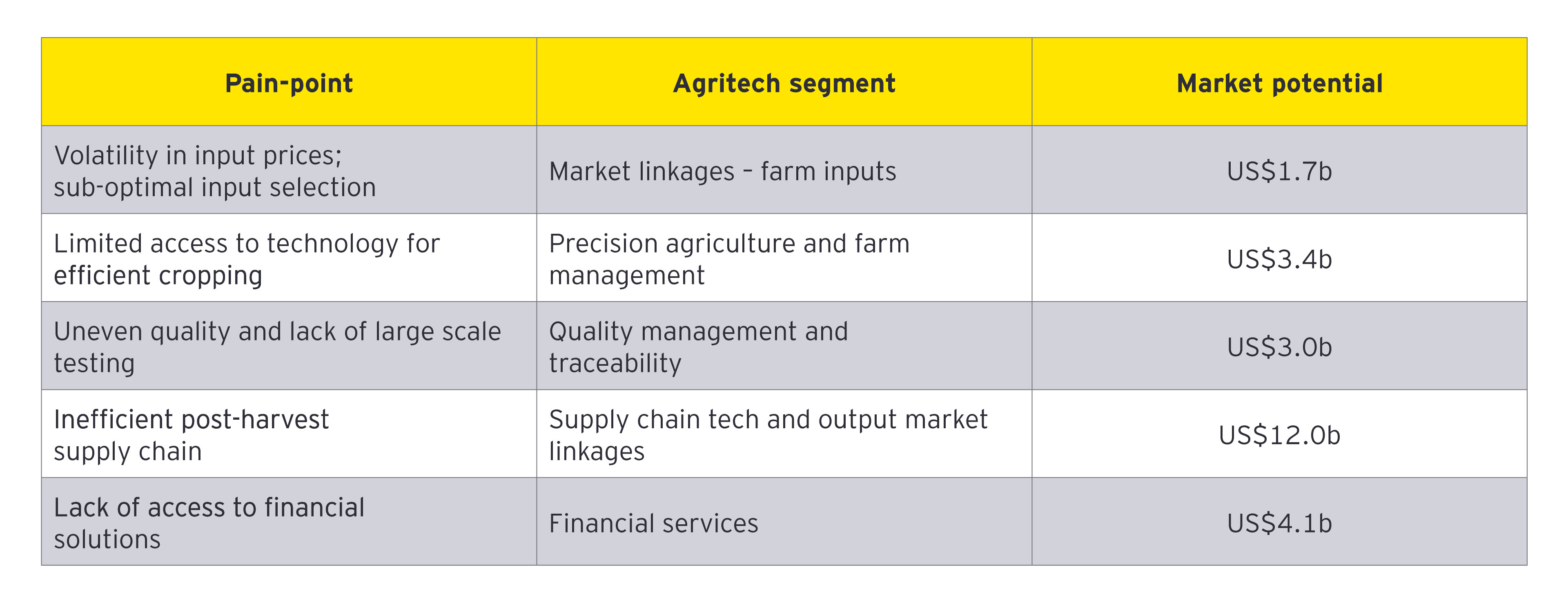

Agritech players are transforming the way agriculture is traditionally being done across all stages of the value chain.

- For instance, players in market linkages: farm inputs segment are seamlessly blending technology with physical infrastructure to offer farm inputs at a greater price certainty

- Precision agriculture and farm management players are helping farmer improve their yields by up to 30%

- Quality management and traceability players are helping farmers realize better realizations by incentivizing high quality produce

- Players operating in supply chain tech and output market linkages segment are eliminating inefficiencies such as high wastage of farm produce, which is a win-win for both farmers as well as consumers

- Financial services players could serve 30% of farmer households through access to credit, and 65% of farmer households through access to crop insurance

- Business models in the agritech space could be trifurcated into:

- Margin-based models where players create market linkages on the input or output side, and earn margins on the buy-sell spread

- Subscription-based models where players offer a mix of software, hardware and services to help farmers improve crop yields, track quality of produce or trace the produce across value chain

- Transaction-based models where players charge based on the number of transactions served such as loans or insurance policies

Demand side drivers such as evolving consumer dynamics towards consuming healthier food due to urbanization, imperative to reduce food wastage in India, environmental factors such as climate change and water shortage are helping drive the adoption of agritech in the country.

Agritech players operating in the addressable segments in India have received a cumulative investment funding of US$532m as of April 2020. A comparison with global investment funding patterns reveals that Precision agriculture and farm management companies in India are under-funded. Global investors can harness their learnings from their global success stories in these segments to help them realize their full potential in India.

It is heartening to see both the central and state governments proactively launch initiatives to promote agritech ecosystem in the country. For instance, the National Agricultural Market (eNAM) initiative aims to remove information asymmetry in pricing through an electronic trading portal. State governments are forming technology partnerships to forecast prices of agricultural produce using AI to help farmers in efficiently planning their harvest cycle. Encouraging localized data collection on soil health and providing access to government research facilities to agritech start-ups could further help accelerate the adoption of agritech.

Lessons from countries such as the US and Israel call for building of a robust agritech policy framework in India which includes collaboration between all market participants such as farming communities, agritech companies, food processing organizations, technology providers and research institutions. Cross-country collaboration on agritech technologies and operating models could be driven through such a policy framework.

Despite the strong investment activity in the last few years, the market penetration in the sector is still very low (~1%). We believe that the untapped market potential and opportunities in agritech will continue to drive growth in this space over the next decade.

As the agritech ecosystem matures, there are a few potential scenarios that could play out in the sector. There is an opportunity for players to expand horizontally across agritech segments to own the end-to-end relationship with the farmer. There is also an opportunity for some of the large retailers and ecommerce players to expand their grocery presence through backward integration into the agritech space. Finally, food processing companies could also acquire agritech companies to keep a tight check on their quality and operations.

Going forward, we could witness an increase in penetration of segments such as financial services, precision agriculture and farm management and quality management and traceability considering the tremendous market potential that these segments offer and the degree of investment funding these segments have witnessed. Agritech startups need to develop scalable business models with higher unit economics while enabling instead of displacing traditional value chain participants to succeed in these segments.