View from the demand side

On the demand side, private final consumption expenditure (PFCE), the segment with the largest weight, contracted for three successive quarters in the COVID year before showing a recovery in 4QFY21. Although PFCE grew by 19.3% in 1QFY22, this mainly reflected base effect due to a contraction of (-)26.2% in the corresponding quarter of FY21. In terms of magnitude, PFCE in 1QFY22 was lower than its corresponding level in 1QFY20 by INR2.41 lakh crore. In the case of government final consumption expenditure (GFCE), which could have been subjected to policy intervention, a large contraction was experienced in 2QFY21 at (-)23.5%. It is also notable that in 1QFY22, it is the only demand segment that contracted with reference to 1QFY21 by (-)4.8%. The third component of demand, namely gross fixed capital formation (GFCF) also contracted in the first two quarters of FY21. In 1QFY22, the base effect was quite large for this segment. Despite a growth of 55.3%, its magnitude in real terms compared to 1QFY20 was lower by a margin of INR2.11 lakh crore. For these three domestic demand segments, we may expect a robust growth in 2QFY22 due to base effects.

Exports and imports contracted in the first three quarters of FY21. However, positive outcomes were observed for these segments in 1QFY22 with exports showing a growth of 39.1% over a contraction of (-)21.8% in 1QFY21. We expect both exports and imports to show high growth in all the quarters of FY22 both because of base effect and recovery of global and domestic demand.

Performance of output sectors

On the output side, COVID’s maximum adverse impact, apart from construction, was on the transport and storage sector, which had contracted by (-)48.1% in 1QFY21. This was one of the two sectors which contracted in all the four quarters of FY21. The other sector to show such persistent contraction was mining and quarrying. In the case of financial, real estate et.al sector, the contraction was confined to the first two quarters of FY21. Manufacturing contracted very sharply in 1QFY21 and after that, by only a small margin before showing a positive growth in 3Q and 4Q of FY21. Due to contraction and low growth characterizing FY21, growth performance of these sectors in the remaining quarters of FY22 are likely to be influenced by base effects. Agriculture was the only sector which showed robust growth in all the four quarters in the COVID year. Agriculture’s performance in 1QFY22 with a growth of 4.5% is also quite exemplary. In the case of mining and quarrying and manufacturing, although recovery has taken place in 1QFY22, it has not been adequate to surpass their absolute magnitudes in 1QFY20.

Policy support to growth

The role of fiscal policy stimulus is reflected through the demand and output segments of the national income accounts. In the case of demand, its contribution is largely through the segment called GFCE and to some extent, through GFCF. With respect to GFCF, the national income data does not separately provide information on the contribution by the government. On the output side, the government’s contribution is largely reflected in the sector called public administration, defence and other services. In both cases, growth in 1QFY22 was less than desirable in spite of an improvement in the Center’s tax revenue performance. CGA’s fiscal data released recently showed that the Center’s gross tax revenues (GTR) grew sharply by 83.1% during April-July FY22 over the corresponding period of FY21, and by 29.1% over the corresponding period of FY20. The Center’s fiscal deficit in the first four months of FY22 amounted to only 21.3% of the budgeted target as compared to the corresponding average level of 90% over the last four years. A significant policy space is opening up for the government to raise its demand and its contribution to output in the remaining part of the current fiscal year. By increasing the coverage of vaccination and the pace of investment in health infrastructure within the strategy of expanding the overall infrastructure investment, the adverse impact of COVID’s likely third wave could be bypassed or at least curbed . As revenues improve, expenditures can be increased further without reducing the budgeted fiscal deficit level of 6.8% of GDP. The central government has also permitted the states to borrow up to 4% of their respective GSDPs, that is 1% point more that their legislated target, of which 0.5% points has been earmarked for additional capital expenditure.

In regard to monetary policy, while the RBI has continued to maintain its accommodative stance, the repo rate has been kept constant at 4.0% since May 2020. Given that CPI inflation has remained under pressure, the RBI may not undertake any further repo rate reduction in the near future. The monetary policy would only be playing a supportive role while the main impetus to growth may need to come from the fiscal side.

The Ministry of Finance in collaboration with the NITI Aayog has recently released the guidelines and the detailed program relating to the National Monetization Pipeline (NMP) which is estimated to garner INR6 lakh crore over the period FY22 to FY25. For FY22, the estimated amount is INR0.88 lakh crore[3]. The NMP would cover more than 12 line ministries and more than 20 asset classes. The NMP was launched with a view to finding resources for supporting the National Infrastructure Pipeline (NIP). The aggregate estimated value of the NMP amounts to about 14% of the proposed outlay for the Center under NIP (INR43 lakh crore). The period for NMP has been kept co-terminus with the balance period of the NIP. NMP aims to provide a medium-term roadmap for generating a flow of income from services provided by the core assets owned or operated by government agencies.

In the context of disinvestment, some positive news pertains to Air India where financial bids have now been received, and the likely auction of 5G spectrum in February 2022. Another asset class pertains to government ownership of land for which also a suitable asset monetization strategy needs to be put in place. The present NMP focuses on generation of recurring non-tax revenues rather than one-time monetization of assets. Its success would largely depend on the efficiency and extent of participation of the line ministries.

On 15 September 2021, the government approved an amount of INR30,600 crore to back security receipts issued by National Asset Reconstruction Company Limited (NARCL) for acquiring stressed loan assets. The NARCL and India Debt Resolution Company Limited (IDRCL) have been set up by the banks. Public sector banks would maintain 51% ownership in NARCL which proposes to acquire stressed assets of a value of INR500 crore or above amounting to a total of about INR2 lakh crore in phases while remaining consistent with the regulations of the RBI. The acquisition would be through 15% cash and 85% in security receipts which would be backed by the government guarantees valid for five years[4]. The NARCL-IDRCL structure is expected to facilitate in the consolidation of debt, which is currently fragmented across a large number of lenders. This would lead to quicker action on resolving stressed assets and better value realization. Eventually, these initiatives would bring about improvement in bank’s valuation and enhance their ability to raise market capital.

Global growth prospects

The OECD has also projected a robust recovery in global growth to 5.7% in 2021 and 4.5% in 2022 helped by strong policy support, deployment of effective vaccines and resumption of economic activities, particularly in the services sector. In its assessment, global GDP has surpassed its pre-pandemic level, but output in mid-2021 was still 3.5% lower than projected before the pandemic. This represents a real income shortfall of over US$4.5 trillion (in 2015 PPPs), and is broadly equivalent to one year of global output growth in normal times. Output and employment gaps remain in many countries, particularly in emerging market and developing economies (EMDEs) where vaccination rates are low. Among Advanced Economies (AEs), growth is projected to remain strong in the US and the Euro area at 6.0% and 5.3% respectively in 2021. A higher investment spending in the Euro area helped by the Next Generation EU funds, and an expected additional boost to infrastructure spending in the US are likely to aid growth in 2021 as well as in 2022. Downside challenges to growth emanate from the possibility of a larger than anticipated impact of the Delta variant and inflationary pressures in the US, Canada, UK and some EMDEs.

COVID vaccination success may normalize growth

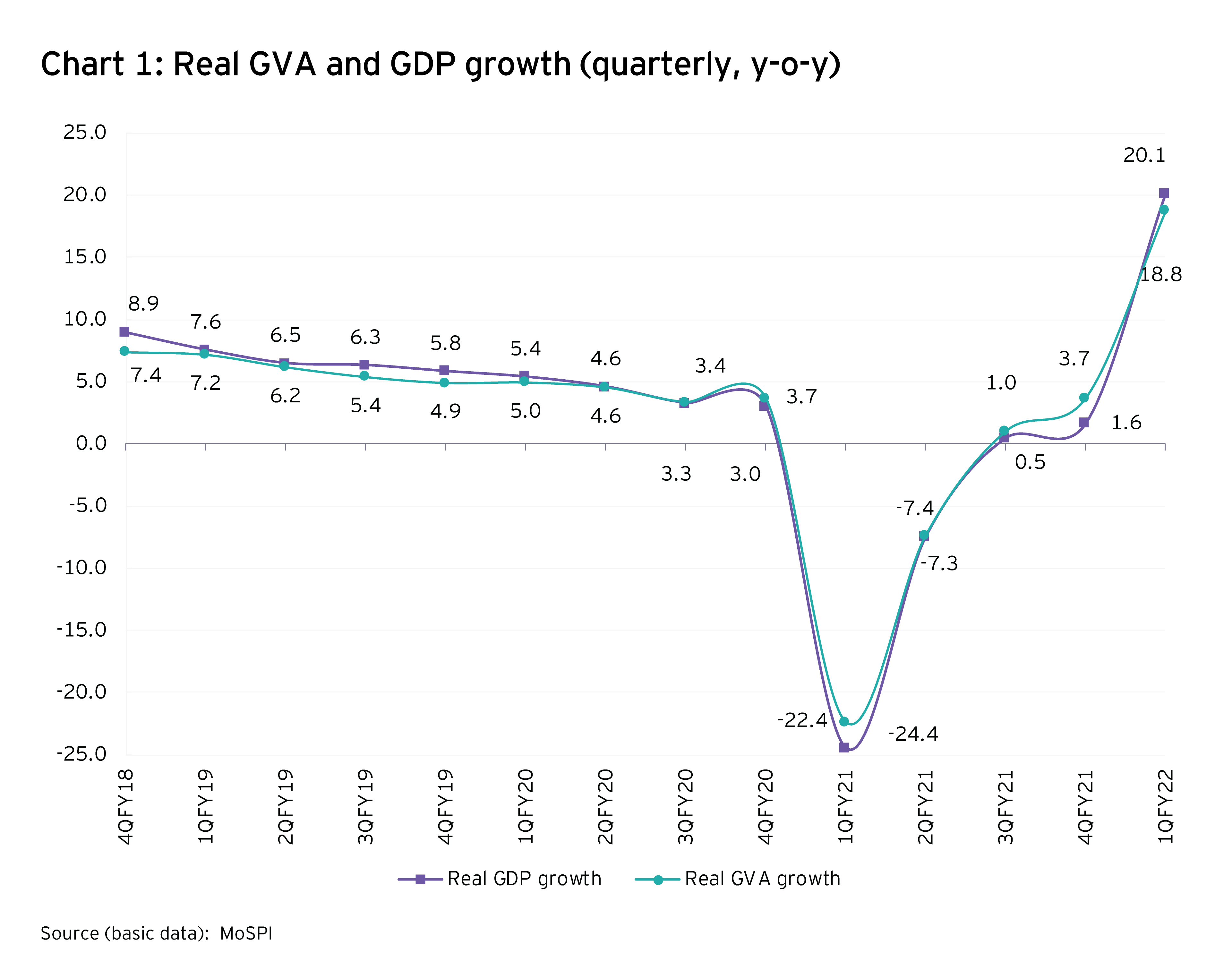

India’s GDP data for 1QFY22 has signaled a robust recovery although reflecting strong base effects. We estimate that as compared to RBI’s quarterly growth estimates for 2Q, 3Q and 4Q of FY22 at 7.3%, 6.3%, and 6.1% respectively, the economy would have to grow by an additional margin of 0.32% points in each quarter on average to make up for the shortfall in the 1Q growth relative to the RBI’s estimate at 21.4%, if its projected growth of 9.5% in FY22 is to be achieved.

Even a growth rate of 9.5% in the current year will mean that over a period of two years, the magnitude of India’s real GDP would increase by a margin of 1.6% in FY22 as compared to the real GDP level of FY20. With the COVID vaccination in India gathering pace in recent weeks, the likelihood of a severe third wave of COVID is progressively receding. India has already administered 82 crore vaccines to its population, with 21 crore of its citizens having already received both the doses. A daily vaccination rate of one crore is now being crossed time and again and a record was established on 17 September 2021 with 2.5 crore citizens getting vaccinated by midnight[5]. Many other developed countries are now experiencing severe bouts of COVID incidence in spite of large vaccination campaigns. Under these circumstances, India may be one of the first countries to break out of COVID’s stranglehold on its economy. We may now prepare for uplifting our growth to levels above 7% on a sustainable basis. This would facilitate restoration of fiscal consolidation and a period of post-pandemic high level of sustained growth in a global economy which may continue to struggle for some more years.