Industry experts suggest that healthcare services should also be brought under the GST net, especially the private sector segments, so that the burden of taxes on inputs and input services could be relieved. In lieu of this, it becomes important to revisit the existing GST rate structure for healthcare services and rationalize the GST rate structure. Consequently, it might help in transmitting the cost benefits of GST and may also facilitate formalizing the healthcare segment further. However, to determine the appropriate GST rate structure for the healthcare sector, it may be important to estimate the quantum of embedded taxes which remains blocked in the healthcare value chain and gets loaded into the healthcare cost, raising it significantly.

With this objective, EY, in collaboration with the Healthcare Federation of India (NATHEALTH), studied the issue of embedded taxes in the healthcare sector covering two major segments - hospitals and testing labs under the healthcare establishment.

Key Insights

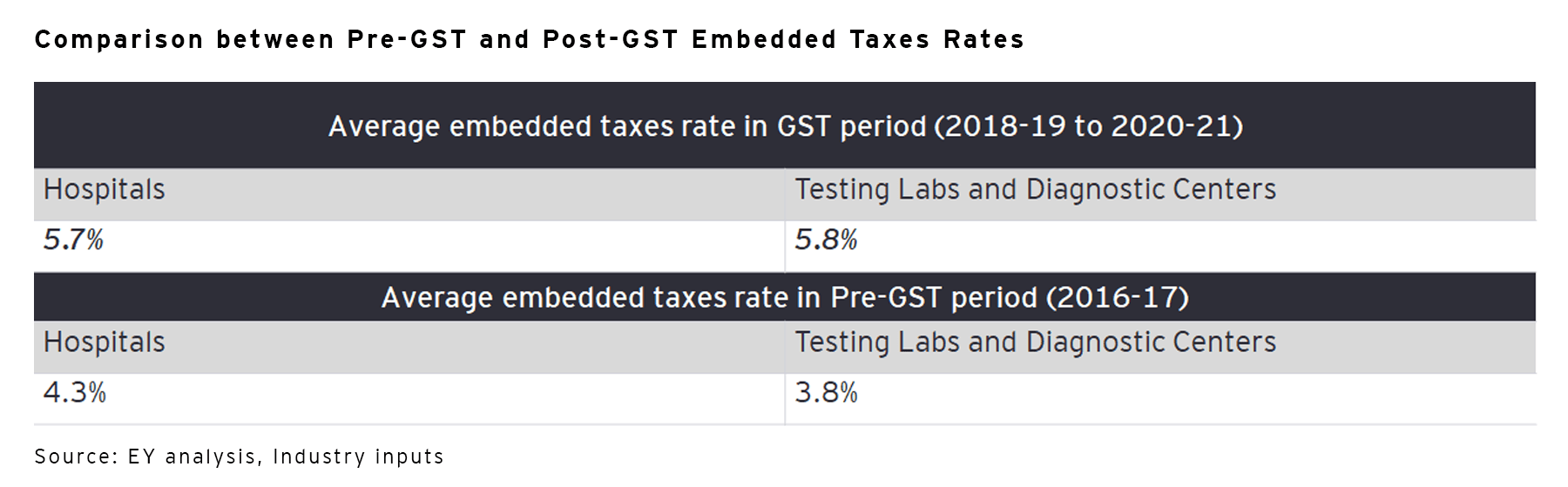

The embedded taxes for hospitals encompass the total GST amount paid by hospitals for procurement of their inputs to provide the output services, which are exempted from the GST and account for nearly 6 per cent on an average of their total expenses in a year. Nonetheless, across the three years, the embedded tax rate stayed at an average of 5.7%.

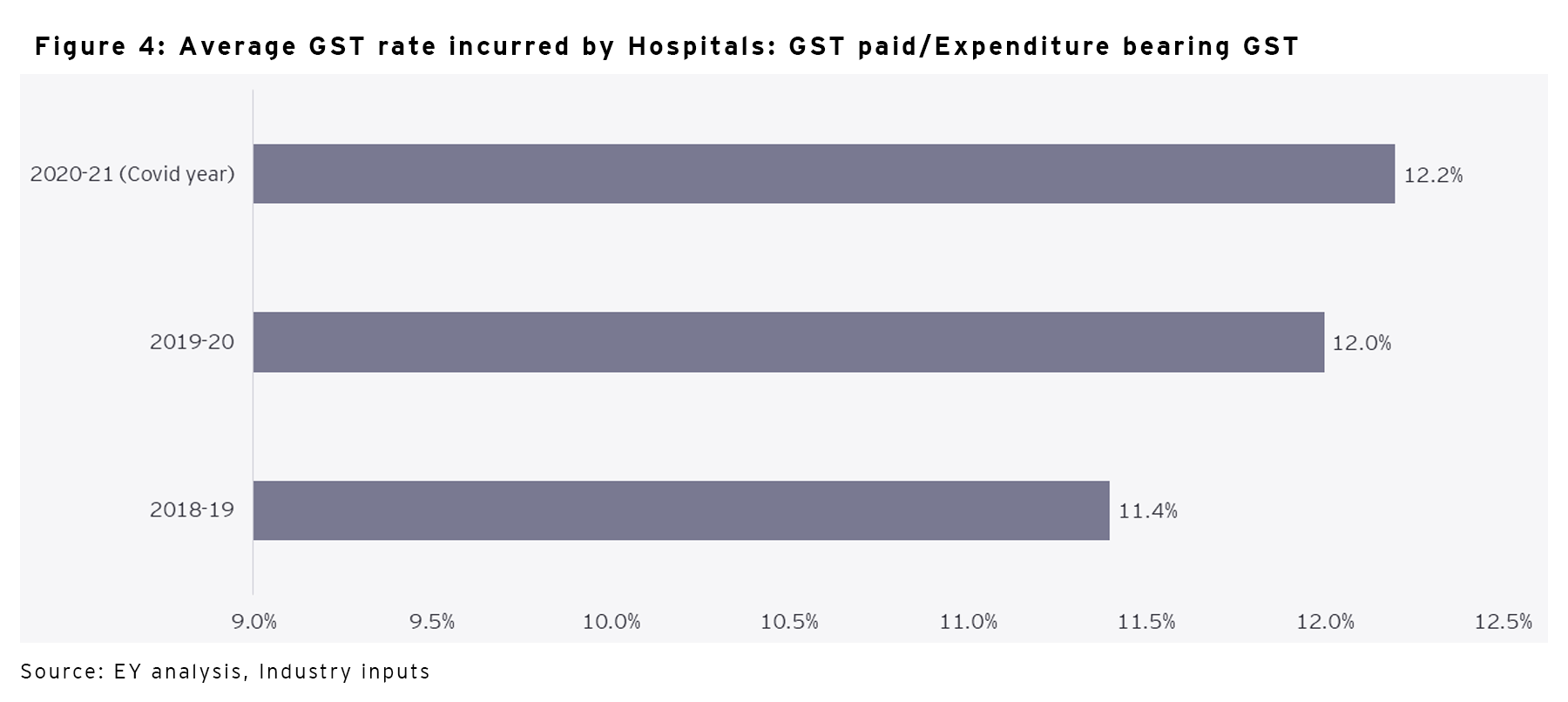

However, the average GST rate levied on the procurement of inputs over the past three years has been about 12 per cent on an average and has only been rising, indicating the rising share of high-rated GST bearing inputs as in the chart below.