The Indian auto sector is one of the early adopters of digitization in manufacturing, but the journey so far has been slow and uncertain due to apprehension about its benefits and returns.

The auto industry in India has been under recessionary conditions between July 2018 and January 2020 due to certain regulatory changes, need to shift to electric vehicles and changes in consumer preferences. With the COVID-19 pandemic outbreak, another crisis has hit all industries hard across the world.

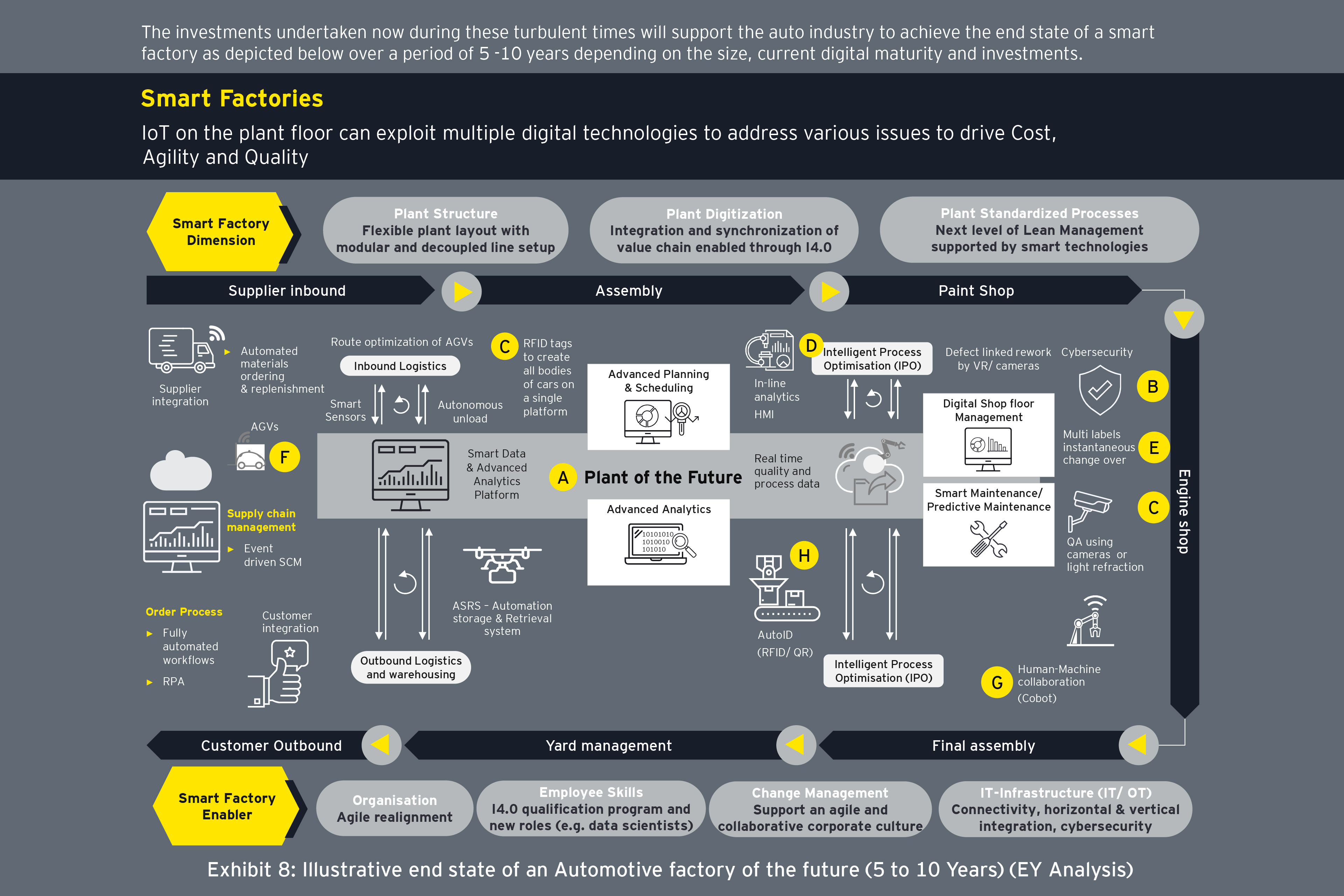

The auto sector in India is likely to witness further slowdown in demand, non-availability of labor, concerns on health and safety management on the shop- floor. This report reflects upon what the automotive OEMs need to do NOW, and how they should respond with an increased pace of adoption of hyper-intelligent digital technologies in the NEXT, thereby building resilience to such events in the BEYOND phases for the auto manufacturing sector. It answers the question: What should the automotive industry do to achieve resilience and develop immunity against market uncertainties in future?

The ongoing nationwide lockdown to contain the virus has led to a significantly negative impact on both the macroeconomy and auto sector. It has amplified the sector’s existing vulnerabilities by disrupting both manufacturing and supply chain. The automotive industry had an expected loss of 7.5 lakh units in production in March 2020 alone, which is ~1% of the total units produced in 2019, because of the lockdowns to combat the Covid-19 outbreak. Even after the lockdown is lifted, it will take 6 -18 months for demand to pick up. Due to the disruption, sales are likely to plunge by another ~20% as compared to 2019.

Due to growing apprehensions during the lockdown, workmen are refraining from attending work.

Some shop floors have been left deserted. Further, due to large scale migration of labour across India, availability & redeployment of contract labour post lockdown is a major concern. Contract labour accounts for more than half of India’s auto industry’s workers. The lockdown could lead to several complexities around supply of contract labour forcing companies to automate and thereby reducing the reliance on contract labour.

On the other hand, the cycle of money flow from customers to dealers to OEMs and ultimately to Tier 1 and 2 suppliers has been disrupted, leaving behind an outstanding of INR500 – 1000 crore in this short period. An estimated INR 20,000 crore worth of unsold inventory is currently lying with the auto manufacturers and revenue loss/day of about ~INR 2,300 crore is estimated for the auto sector in India.

What should the organizations do to proactively prepare for post lockdown scenarios (NOW):

- Employee safety is paramount: Use of right protective gear, face shield, gloves.

- Social distancing as per new norms.

- Staggered shift schedule as per GOI guidelines.

- Developing an Infectious Disease Preparedness and Response Plan.

- Caution in use of equipment on the shop floor.

- Redefining or modifying plant layouts to reduce man to machine ratio.

- Redefine SOPs to accommodate the post-COVID working environment.

What is the ‘New Normal’ for the automotive manufacturers and component suppliers?

Digital adoption on manufacturing shop floors in India is at a nascent stage. As per EY Digital Manufacturing India Survey 2019, only 23% of the large manufacturing firms in India have a clear digital strategy. However, unlike other industries, the Automotive shop floor still leads in the adoption of emerging technologies in India. A few factories in India are using substantial automation in their production lines – physical robots, Automated Guided Vehicles, Artificial Intelligence, Machine Learning, and Predictive maintenance.

Smart factory combines traditional manufacturing excellence approach with IT-OT integration to significantly increase performance. The exhibit below illustrates a typical journey towards digital maturity; starting from implementing manufacturing excellence frameworks to embedding it in daily processes through digital applications and finally leveraging emerging technologies to build an ecosystem that is smart and optimized in performance.