- 66% of manufacturing companies voted for big data, predictive analytics as their top investment priority in the next 1-2 years, followed by the Industrial Internet of Things and sensors, cloud/integrated platforms and robotic process automation

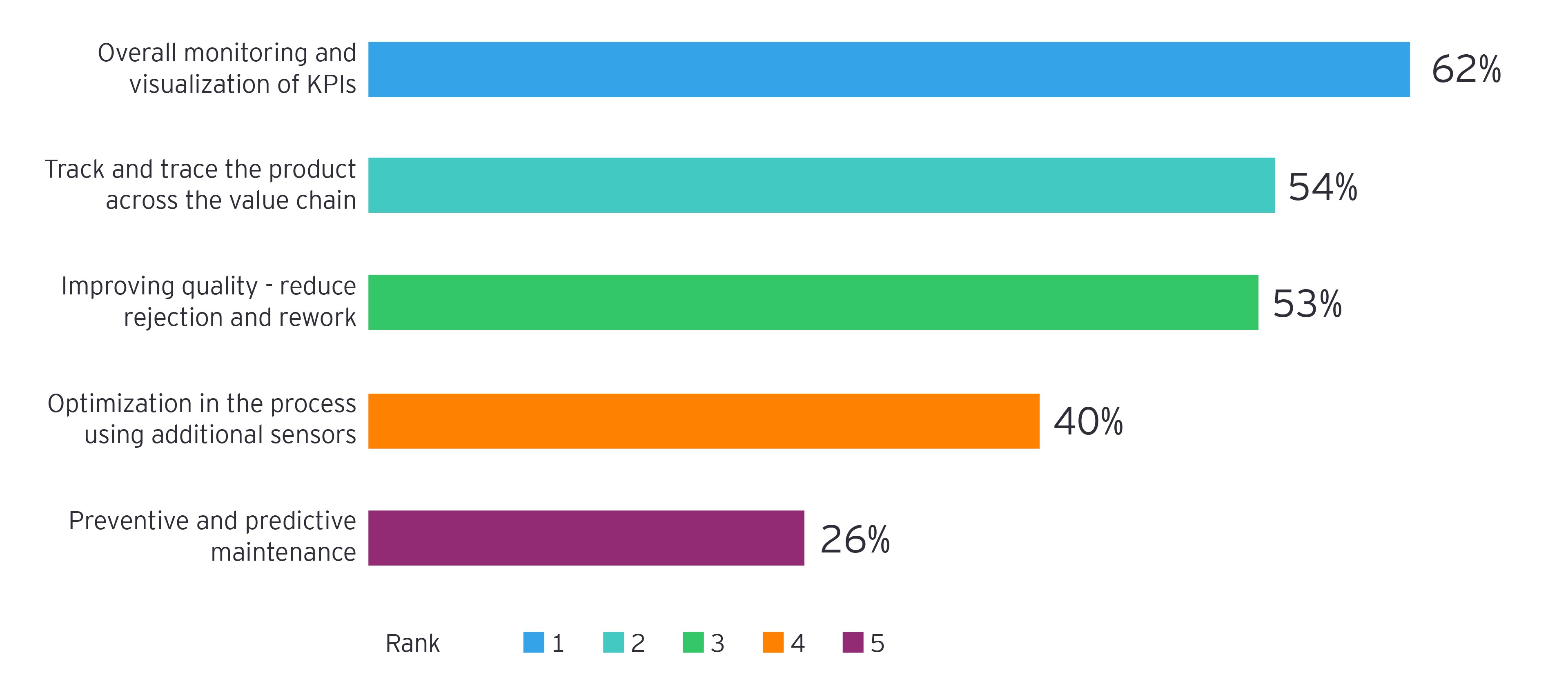

- 62% of respondents see maximum benefit of digital manufacturing in monitoring and visualization of key performance indicators (KPIs)

- While 60% respondents have a broad understanding of digital manufacturing, only 23% of manufacturing companies have a clear digital strategy

New Delhi, March 5: As significant disruptions across Industrial Internet of Things (IIoT), big data and predictive analytics continue to capture the attention of manufacturers, an EY study titled “Will the next transformation in manufacturing be led by digital?” found that 66% of manufacturing firms in India ranked big data and predictive analytics as the top investment priority in technology in the next 1-2 years. While 63% of the organizations ranked sensors and Industrial Internet of Things (IIoT) as the second key priority, as many as 33% ranked cloud/integrated platforms along with robotic process automation as the third key priority for investment for transforming their current manufacturing process. The report incorporates first-hand perspectives of major manufacturing firms in India on the recent technological advancements and their adoption, as part of a survey conducted by EY.

Ashish Nanda, EY India Supply Chain Leader said, “Concepts such as Industry 4.0 and Smart Factory, which interconnect the shop-floor ecosystem through emerging technologies, are now a reality. Digitization continues to transform manufacturing processes around the world leveraging technologies such as IIoT, artificial intelligence, advanced robotics, etc. However, the adoption of digital technologies in India is still in its infancy, considering that manufacturers have started using these technological advancements recently and with limited scope. Going by the success stories though, it is perhaps essential for manufacturing organisations in India to first understand and then embark on this digital transformational journey to remain competitive and attain world-class status.”

The findings of the report highlight the level of adoption of digital manufacturing and India’s preparedness level, the key driving factors, expectations on the benefits and existing challenges that manufacturers face in India.

Adoption of digital manufacturing in India:

While 60% respondents have a broad understanding of digital manufacturing, only 23% of manufacturing companies have a clear digital strategy.

Level of preparedness:

While 63% organizations are somewhat prepared in terms of their hardware infrastructure with basic software only 9% are ready to a large extent with intelligent infrastructure that connects different processes. 20% organizations are prepared to a good extent with appropriate hardware and software for data monitoring.

Factors driving digital manufacturing in India:

The key factors driving digital manufacturing in India include predictive maintenance, connected supply chain, reduced energy consumption, production optimization, lower price of sensors and high computing needs and connected customers.

Key findings