EY DigiCorporateTax: automated solution for corporate tax compliances and reporting

EY DigiCorporateTax - a modular, cloud based comprehensive enterprise-level solution designed to revolutionize and streamline varied aspects of corporate tax compliances, and reporting.

EY DigiCorporateTax – A path breaking solution transforming the gamut of corporate tax compliances

Progressively, corporate tax compliances have become data intensive and complex, triggering the need to collate large data sets and perform complex reconciliations across filings. All this needs to be completed within tight deadlines with an expectation of value added and error free filings. Yet, on the ground, Tax teams tend to struggle with manual processes and excel sheets due to lack of automation and limited configuration of Enterprise Resource Planning (ERP) for corporate tax reporting.

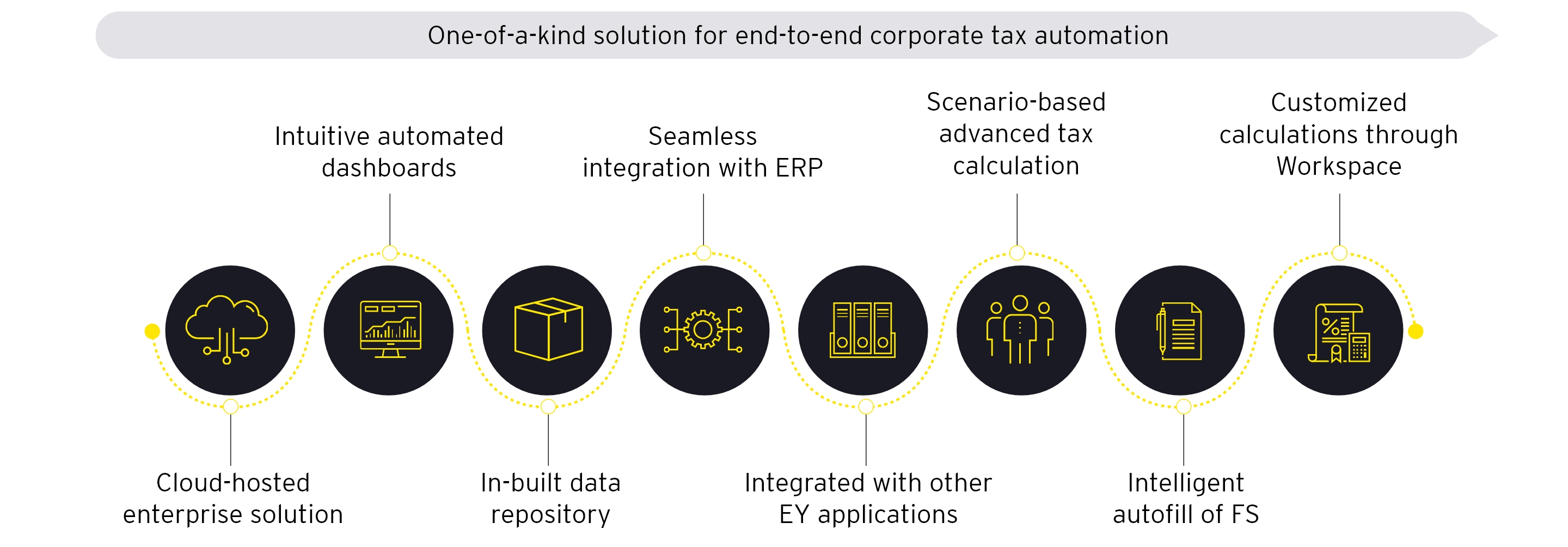

EY DigiCorporateTax is the first cloud-based enterprise level solution automating varied aspects of corporate tax compliance life cycle across multiple scenarios of advance tax calculation, tax provision computations, Tax Audit Report (TAR) preparation, and Income Tax Return (ITR) finalization.

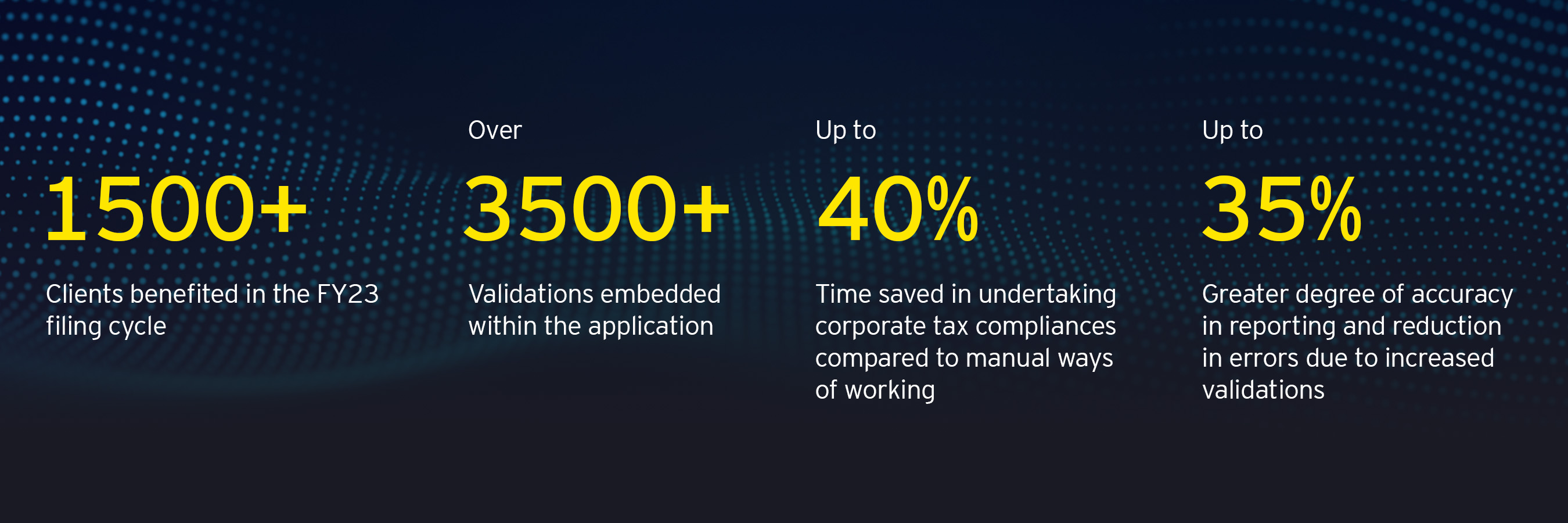

Highlights of DigiCorporateTax

EY DigiCorporateTax – NextWave of digital transformation in corporate tax compliances and reporting

How EY DigiCorporateTax differs from existing market solutions?

Why choose EY DigiCorporateTax?

- Access from anywhere, anytime

- Reduced people dependency and overcome off-line ways of working

- Greater efficiency & accuracy in reporting (on account of features like autofill of financial statements, bulk upload of excel templates, consolidation of division / unit level data at an entity level, etc)

- Lesser chances of adjustments in 143(1) intimations due to in-built validations

- No fear of data loss / form refill efforts due to quick version and schema updates

- Ease of collation, consolidation and reporting of voluminous data across divisions/ units

- In-built workflow and audit trail for better governance, control and effective management reporting