Curbing inflation while supporting growth: active role of fiscal policy

Inflation and growth are two critical inputs in the formulation of both monetary and fiscal policies. In India, the monetary policy framework (MPF) has guided the RBI to remain more focused on controlling inflation while the Ministry of Finance at the Center has been left with the relatively broader responsibility for managing growth while keeping in mind the FRBM norms.

Pushed by sustained inflationary pressures, the RBI, in two consecutive meetings held in May and June 2022, increased the repo rate by 40 and 50 basis points respectively. Together, these have taken the repo rate to 4.9% from 4%, a level at which it was retained from May 2020 to April 2022. Alongside, the RBI also indicated gradual withdrawal of its accommodative stance and revised upwards, its FY23 CPI inflation forecast to 6.7% from 5.7% projected earlier. The RBI changed its base assumption regarding the average price of Indian crude basket in FY23 to US$105/bbl. from US$100/bbl. as assumed in April 2022.

With respect to the FY23 GDP growth, the RBI has retained its forecast at 7.2%, same as in April 2022. The April 2022 forecast was revised down from 7.8% estimated earlier in February 2022. Many multilateral agencies including the World Bank, the IMF and the OECD have also reduced India’s growth prospects for FY23. The lowest amongst these is that by the OECD at 6.9%. Even at this revised lower level, India’s GDP growth prospects for FY23 are tangibly above the global average growth projection and the growth projections for major peer countries.

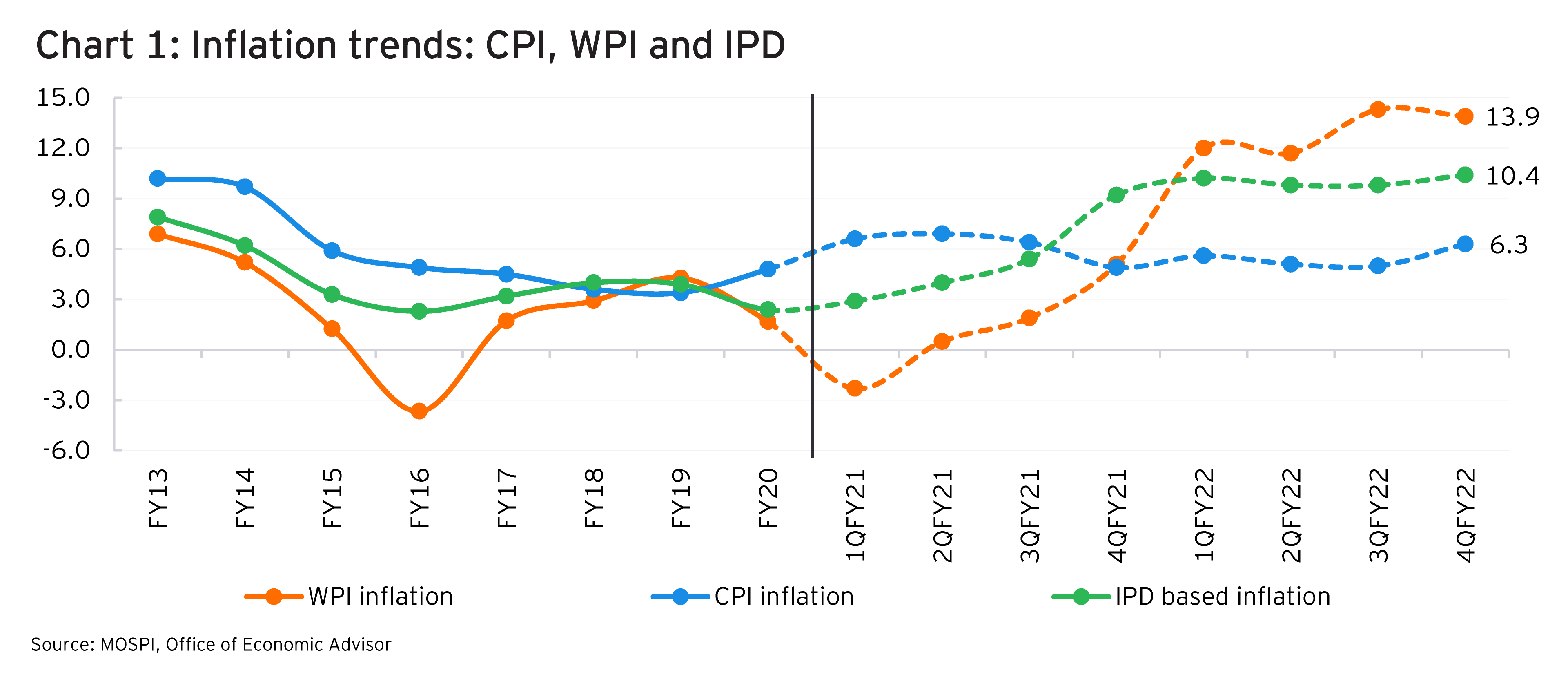

One positive spinoff of the high inflationary trends is that the IPD-based inflation turned out to be 10.0% in FY22, its highest level since FY11. Correspondingly, nominal GDP growth was at 19.5%. This, combined with a buoyancy of 1.7, yielded a growth of 33.8% in Center’s gross tax revenues (GTR) in FY22, enabling a marginal reduction in Center’s fiscal deficit relative to GDP at 6.7% as compared to the revised estimate of 6.9%.

Going forward, in FY23, the IPD-based inflation may remain high given the current inflationary trends. We estimate that an IPD-based inflation of 10% or more may be feasible implying a nominal GDP growth of about 18%. Combined with a buoyancy of 1.2, Center’s GTR may show a growth of close to 22%, exceeding the budgeted growth of 9.6% for FY23 by a wide margin. Applying this growth of 22% on the actual collections for FY22 as per the CGA, the magnitude of Center’s GTR in FY23 would exceed the corresponding budget estimates by nearly INR5.5 lakh crore, benefitting both the central and state governments. This additional fiscal capacity may be used to bolster both government consumption and investment expenditure after taking into account, inflation-linked increases in expenditures on items such as food and fertilizer subsidies. Some of this additional fiscal capacity may also be used for further reducing excise duty and VAT on petroleum products thereby applying a brake on the inflationary momentum.

Major advanced economies are aggressively increasing their policy rates to contain the inflationary pressures. With CPI inflation in the US reaching a 40-year high of 8.6% in May 2022, the Federal Reserve, in its June 2022 monetary policy meeting, increased the benchmark Federal Funds rate by 75 basis points to a range of 1.5% to 1.75%, its largest rate hike in a single meeting since 1994. The Fed officials expect the year-end Federal Funds rate to rise to 3.4%, up from 1.9% as projected earlier in March 20222. With the sustained uplifting of the US Fed interest rate, there would continue to be an outflow of foreign exchange from India and a reduction in the rate of foreign exchange inflows into India. This may put pressure on the exchange rate which would remain another important cost side pressure on inflation since there would be a continued increase in import cost. India’s balance of payments situation would also deteriorate adversely affecting both inflation and growth. The RBI may have to increase the repo rate in the next few MPC meetings. It is thus the fiscal policy which will have to play a strong growth-supporting role. In FY23, real GDP growth may turn out to be 7.2% or higher contingent upon a strong fiscal stimulus.