The better the question

As a start-up, where do you want to end up?

The company wanted a futureproof and scalable system to manage accounting, payroll and tax processes.

A multinational specialty pharmaceutical group, headquartered in Europe, had recently set-up its business in India. As a start-up in the pharma sector in India, the company had limited visibility on the ever-changing and complex tax, compliance and regulatory environment surrounding the business.

With growing digitalization of tax and finance compliances across the globe and in India, the company was looking at a solution that leveraged digital solutions to help them in driving long-term efficiencies and agility in their tax and finance functions.

Further, given that the scale of operations for the client was likely to increase over the years, they needed a scalable and futureproof framework capable of risk-managed compliances.

To this extent, the client was seeking a trusted business advisor with strong industry and domain knowledge to help them in setting-up and running their accounting, payroll, and tax processes.

The better the answer

We integrated multiple tax and finance processes into one solution

Through a technology driven delivery model, the company could re-imagine its future-state tax and finance function.

The pharma company was looking at employing an integrated solution which could help them with the following:

- Setting-up and operating the accounting, payroll and tax processes by leveraging subject matter expertise and deep industry knowledge.

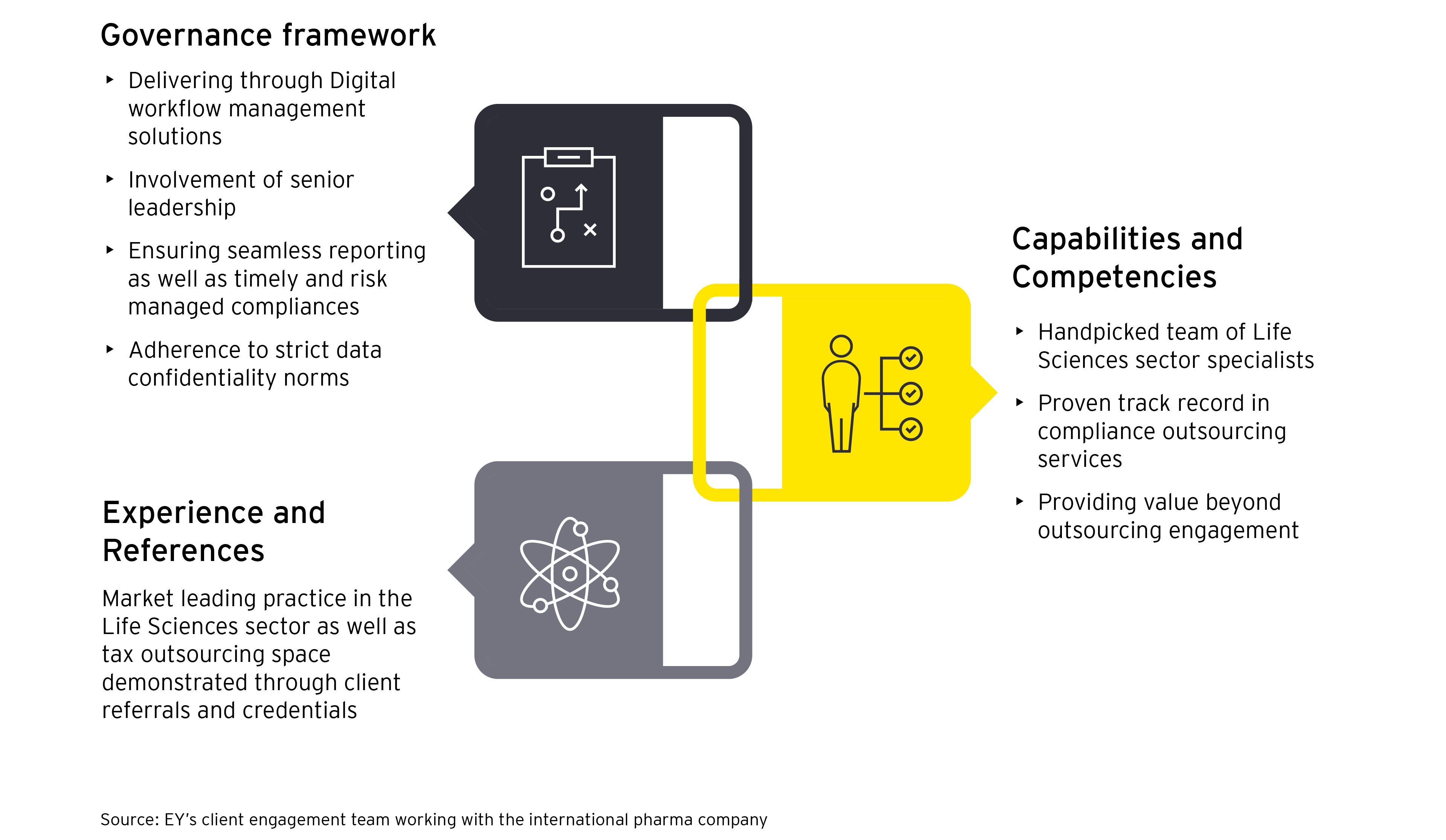

- Establishing a robust governance framework that enables timely and risk-managed compliance, complete visibility, and continued quality improvements.

- Delivering tax and finance compliance efficiencies through a digital solution and ensure that the organization was prepared to respond to the digitalization of administrations.

We built and provided an integrated finance-tax offering as a single service provider to the client. Under this offering, EY supported the organization across the spectrum of their accounting, payroll and tax requirements, including corporate tax, indirect tax compliances, routine tax audit and statutory audit support and tax advisory work.

Based on the identified themes, we helped the client build a strategic tax and finance function, with industry leading practices, through the following:

The better the world works

Our solutions and market expertise are enabling growth and strategic expansion

We are helping unlock long-term efficiencies through robust governance, skill set integration, sector knowledge and experience.

With EY managing accounting, payroll and tax processes, the organization could focus on growing its operations in India and strategic initiatives. The organization realized that it could effectively navigate changes in the highly dynamic tax and regulatory environment, including matters such as emerging digital tax filing requirements.

We created a large impact for the company through the following key levers:

EY’s solutions and services help organizations starting up in India establish their operations across multiple functions backed by deep industry expertise and skills.