In our fourth edition of the annual survey, we compiled responses from 140+ companies across 20+ industries on their tax transformation journey.

Take a self-assessment

Want to self-assess the current state of your tax function and understand how to future-proof it?

Key findings of the report are as follows:

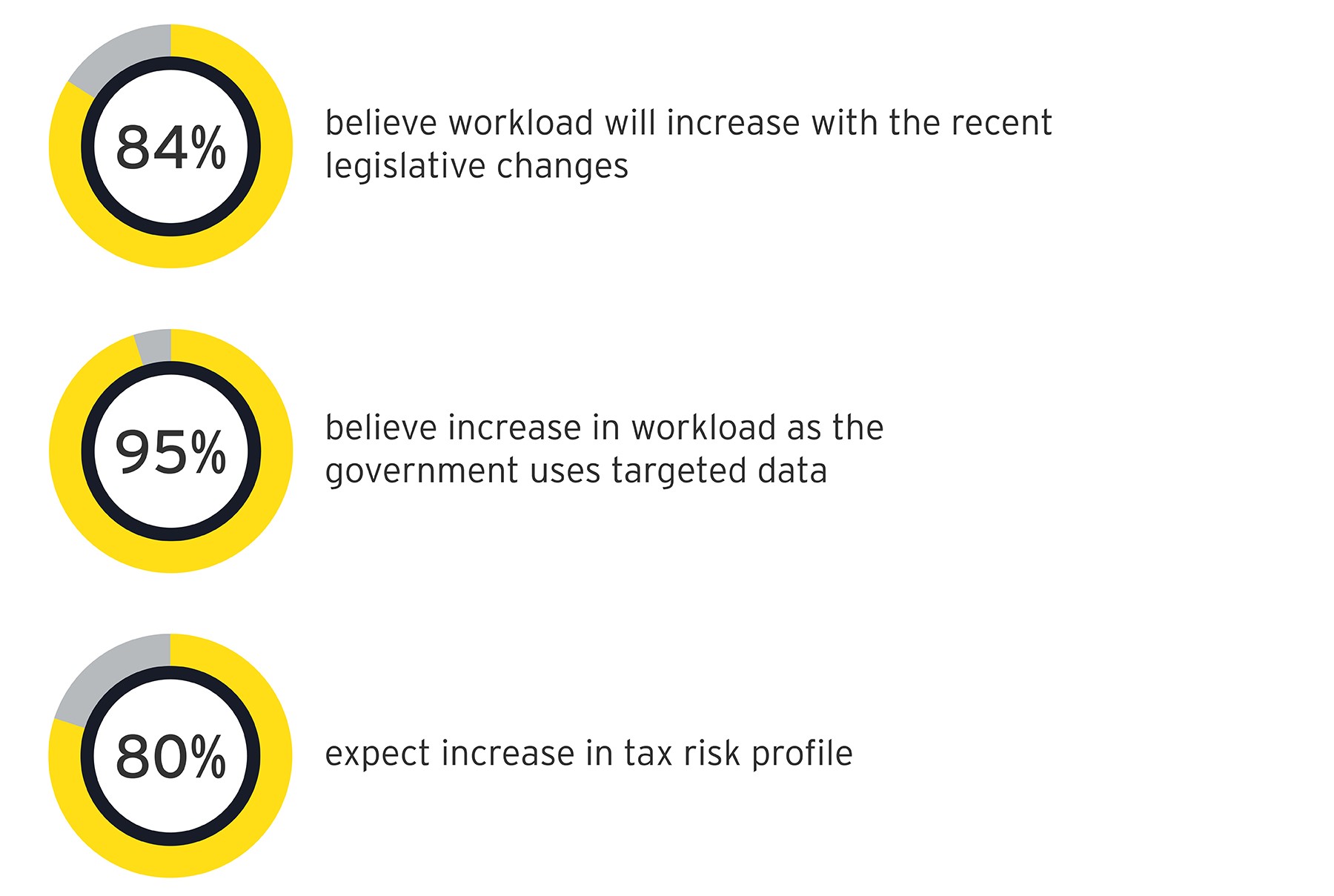

Impact of legislative reforms

A multitude of legislative and technological amendments have been introduced by the Indian Government to bring in more transparency and simplification.

While workload increases, budgets continue to be stretched and is increasingly getting diverted to more strategic/value-adding activities.

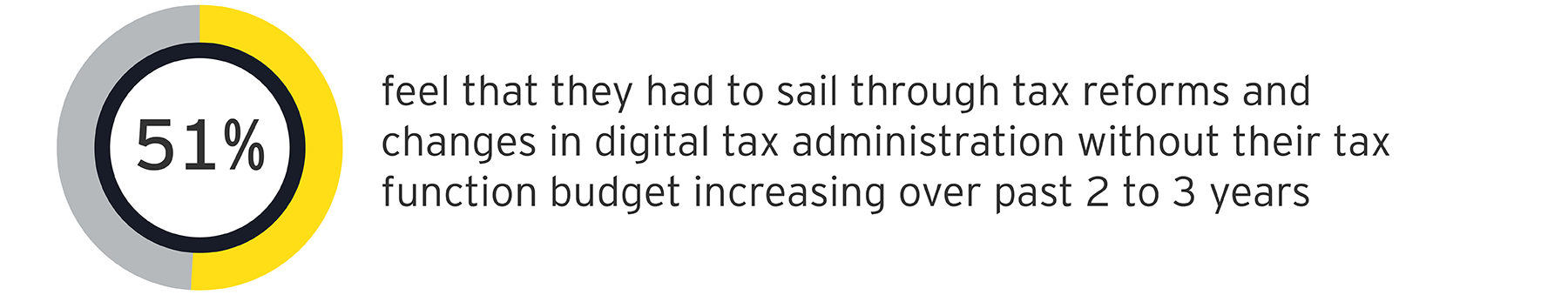

Changing role of tax function

In today’s evolving tax space, tax functions are assuming a critical position in driving business decisions.

Having identified the need for increased business collaboration as a key focus area, tax functions have also ranked “adding value to business” as their top challenge. Hence, it is critical to reimagine the current operating model to achieve the desired future state where tax function spends most of its time on value-added activities.

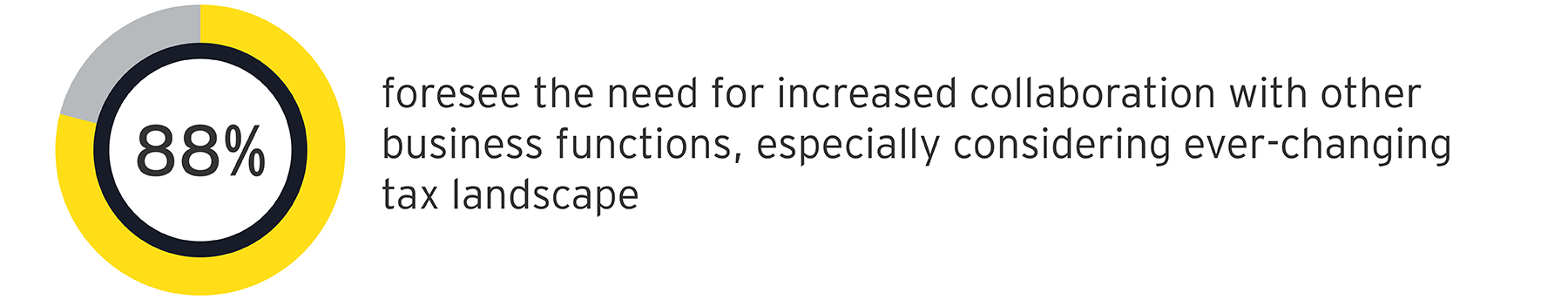

Talent demand and skills

The need for tax functions to carry specialized knowledge and in-depth expertise in all the domains is increasing in recent times. One person single-handedly specializing across all facets of tax does not seem realistic.

This clearly implies the need to reconsider talent strategy specifically in these times of ‘Great Resignation’.

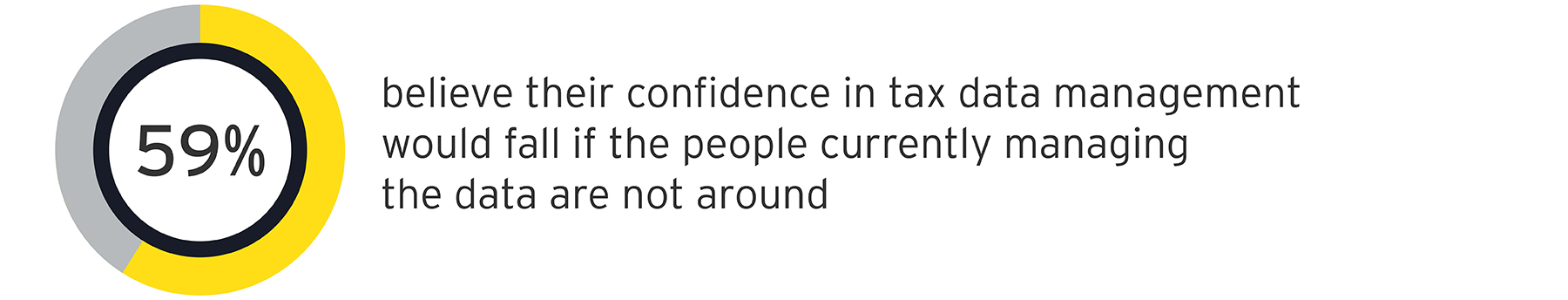

Data Management

It is crucial for organizations to understand the importance of data management during all stages of data lifecycle

Thus, it is important that the tax functions move ahead of traditional methods, and stay one step ahead around how they collect, analyze, use, report, and store data.

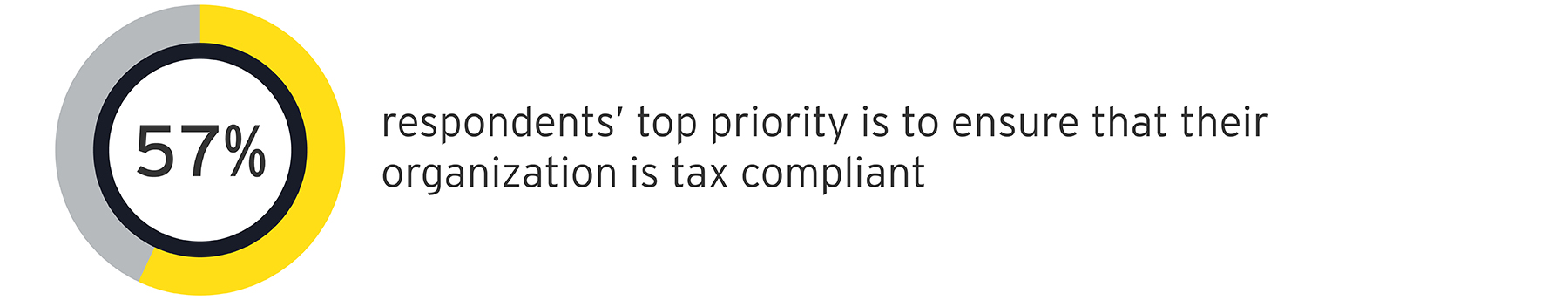

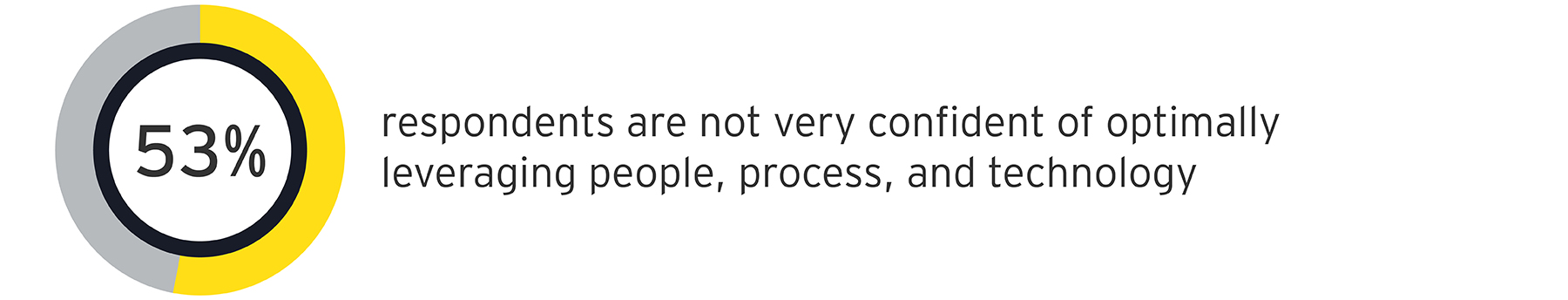

Optimal Tax Function

Optimum utilization of three important components — people, processes, and technology are quintessential to be able to achieve an optimal tax function.

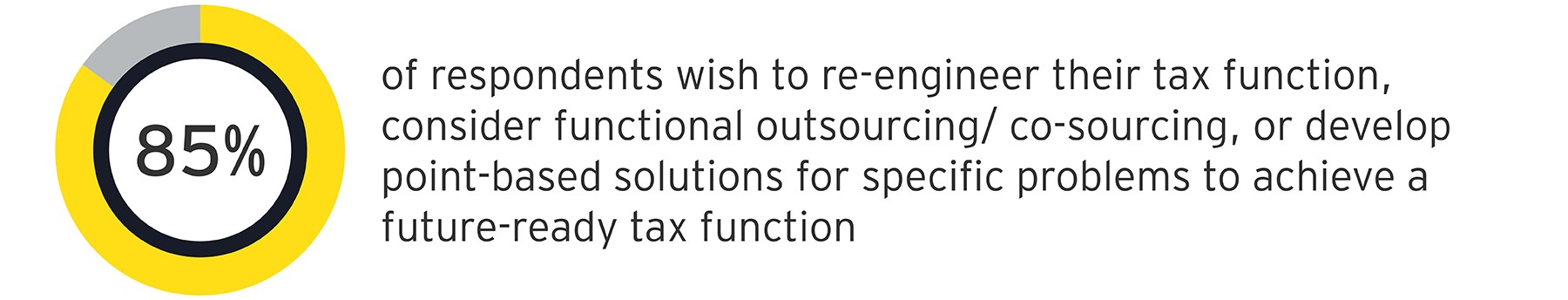

Future-proofing

Various approaches are being adopted to achieve a best-in-class tax function. Parameters, such as value creation, risk management, time and capital investment, resource availability, responsibility, institutionalization, transparency, and accountability, are to be kept in mind while choosing the best approach.

Take a self-assessment

Want to self-assess the current state of your tax function and understand how to future-proof it?

The team

Contact us

Like what you’ve seen? Get in touch to learn more.