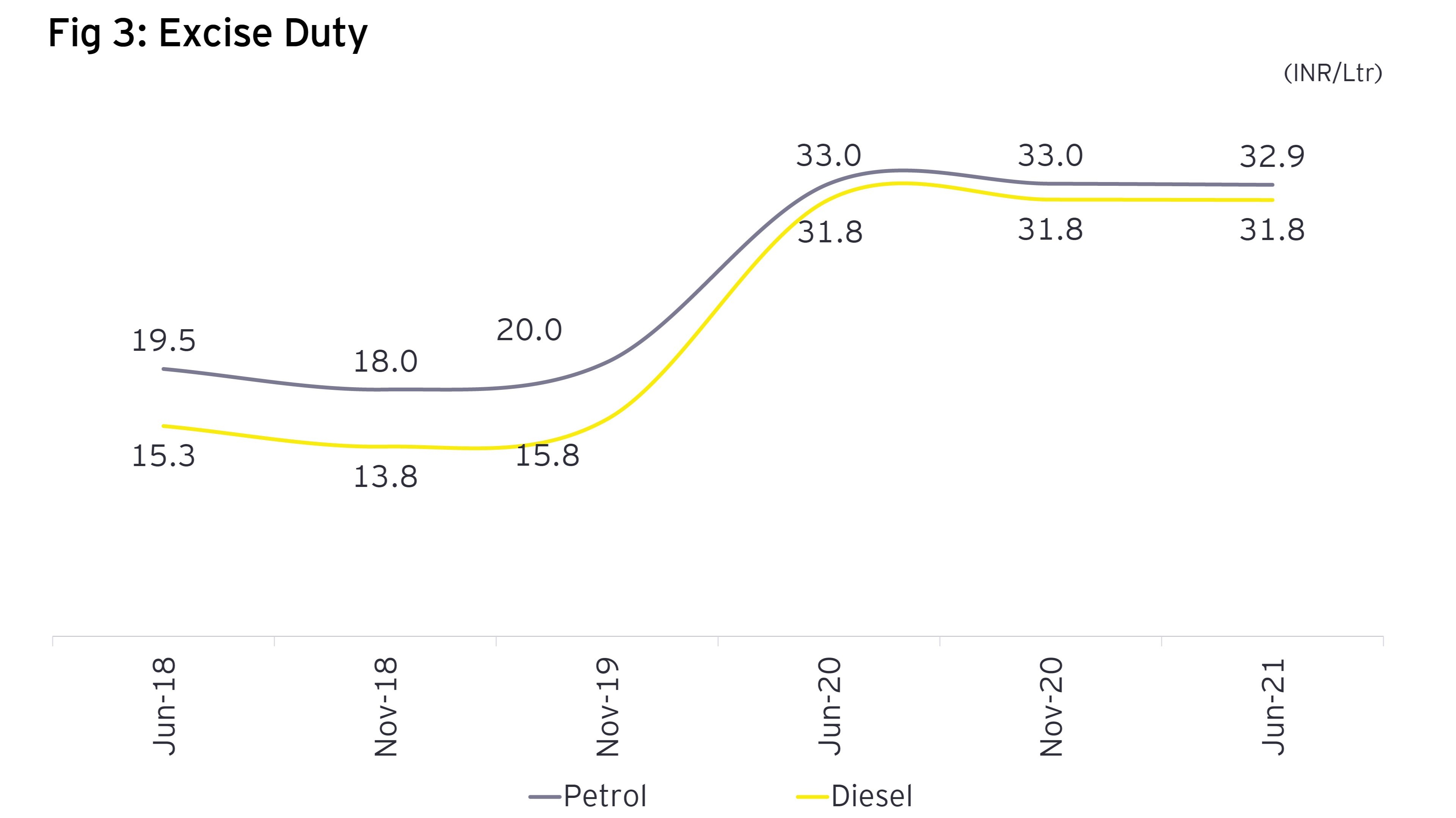

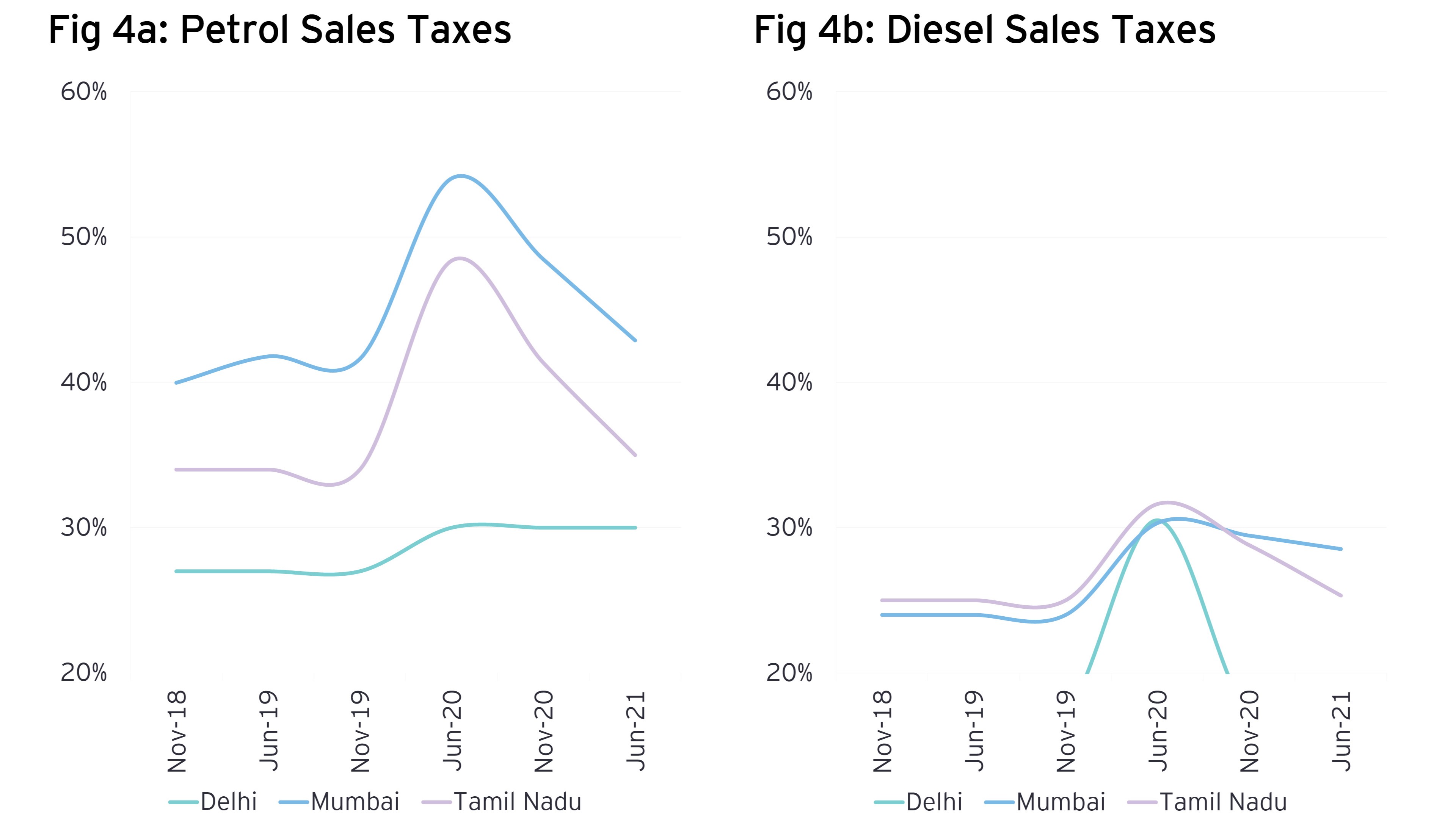

Therefore, the high taxes on domestic oil prices only make sense if the government uses the money collected on capital expenditures where the fiscal multiplier is very high. If the oil tax revenues are only used to fill in the hole created by the shortfall in revenues, then the overall gains may be miniscule as the revenue gains come at the expense of shortfall in GDP and deterioration of macroeconomic situation. To the government’s credit, capital expenditure has been maintained in the Union Budget. In the Union Budget 2021-22, capital expenditure as a ratio of GDP is the highest in recent years. Spending has been focused on the infrastructure sector.

Future prognosis

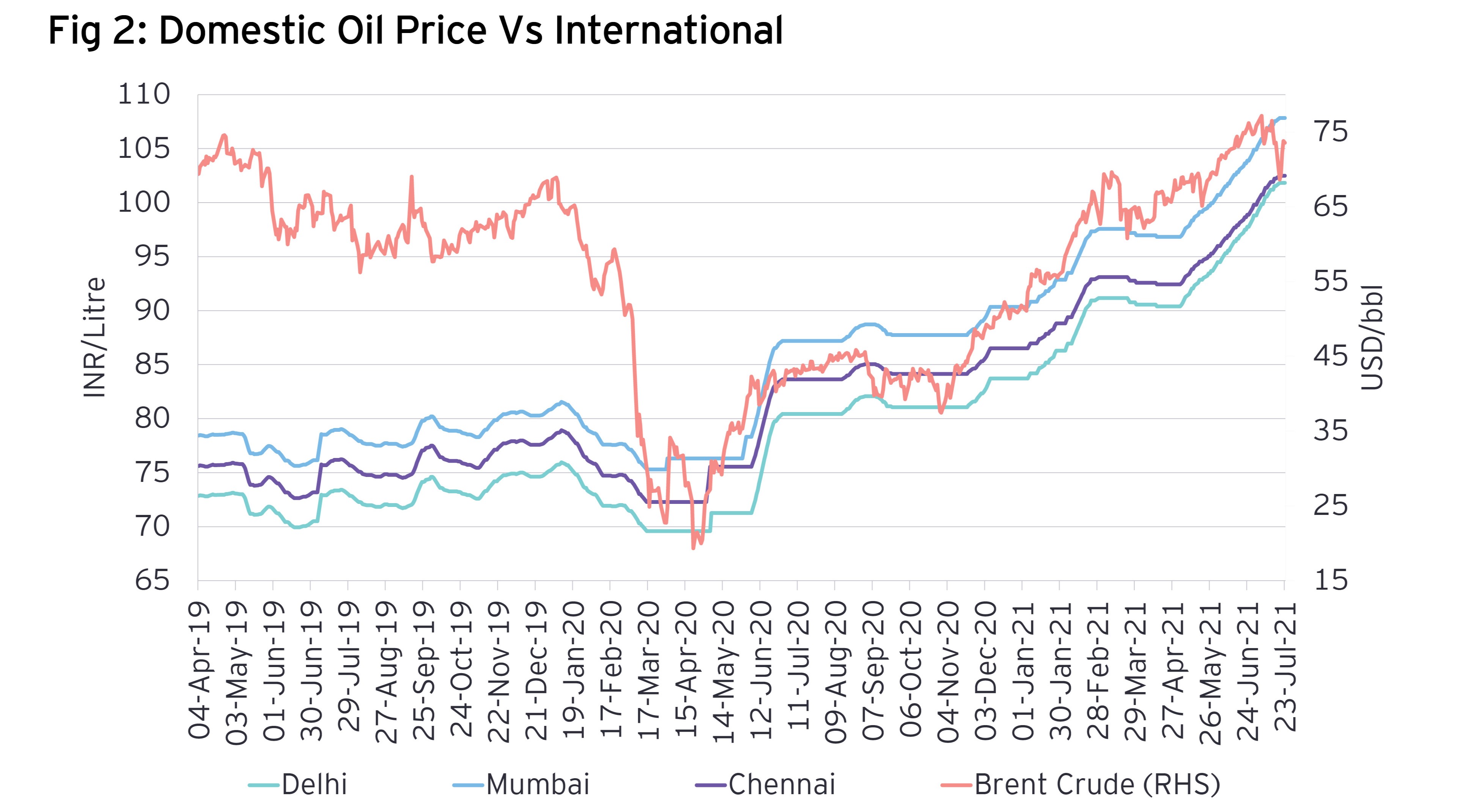

OPEC recently decided to increase the production of crude oil, after weighing the trade-offs of higher oil prices in terms of revenues generated vs. the negative effect on demand for petroleum products.

Although the revenue pressure on the government may stay in the near future, the recent fall in crude oil prices may provide respite to consumers and the economy.

An important factor currently at play is the long term decarbonization strategy of the government and promotion of renewable energy, natural gas and electric vehicles. In this sense, the taxes on petrol and diesel form a kind of green tax on vehicles in India. Also, sustained higher oil prices may push consumers towards buying electric or natural gas vehicles. The government may want to continue to provide that impetus to sunrise sectors of the economy.

(This article is authored by Navneeraj Sharma and Chinmaya Goyal, Senior Managers, EY India).