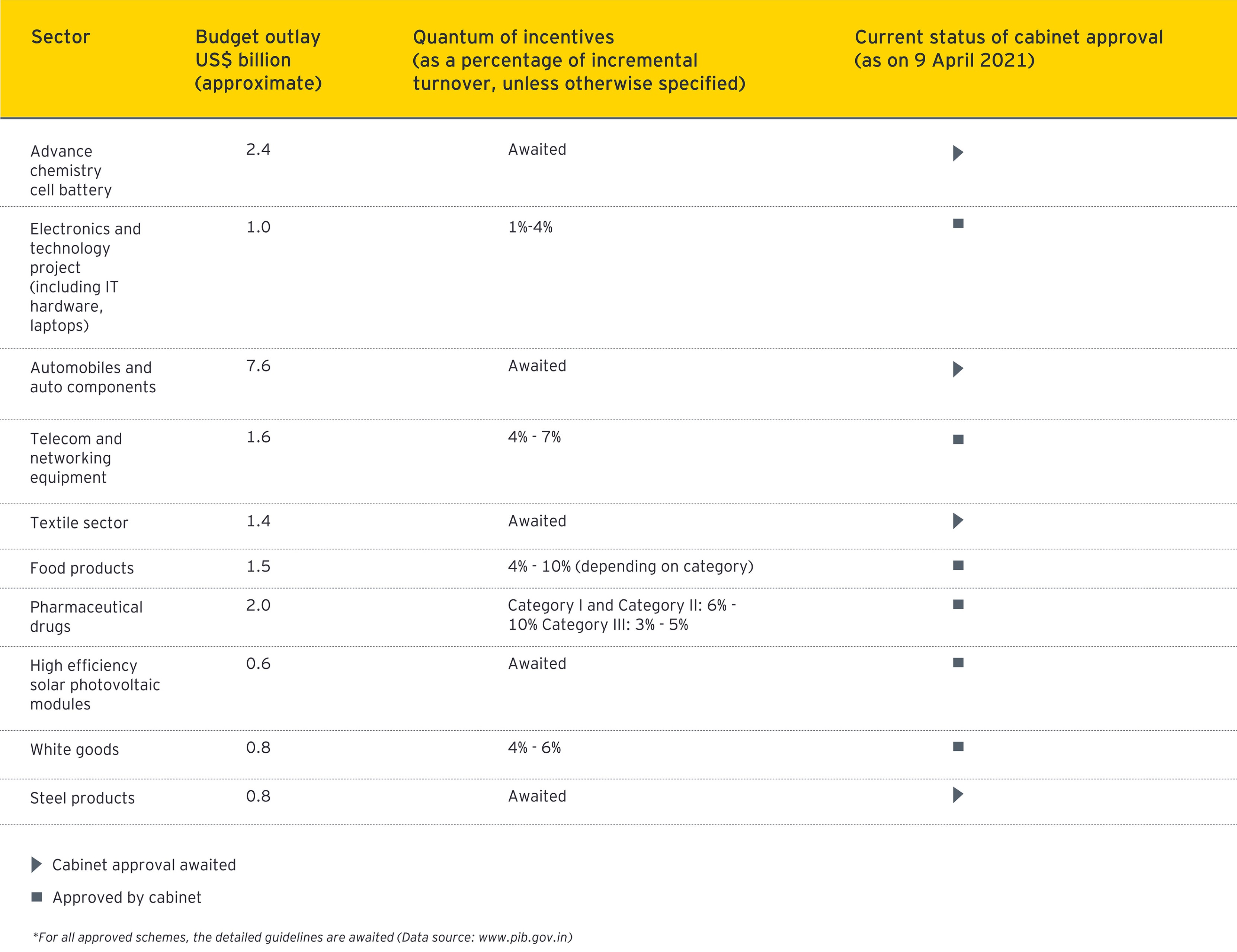

In the ensuing paragraphs, we explore the nuances of the sectors covered under the PLI schemes.

- Automobiles and auto components

This sector accounts for over 7.1%1 of the nation’s GDP. Particularly reeling under the impact of the economic slowdown, this announcement is being welcomed, especially since it has been granted the largest budget outlay for incentives. The scheme will comprise of further sub-schemes aimed at encouraging growth across the ecosystem, i.e., for the component makers as well as the OEMs.

- Advanced chemical cell batteries

With electric vehicles (EVs) slated to gradually become mainstream, it was only natural that incentives be formulated for battery manufacturers. So far, investors desirous of venturing into this space were hesitant owing to the lack of fiscal support and the slow rate of EV adoption in India. With this announcement, investors have begun firming up their plans. These investments should go hand in hand with EV adoption over the next ten years, while also reducing the dependence on imports. The scheme is largely targeted at large players.

This is the second scheme for the sector. The first round focused on the manufacture of critical drugs, while the coverage has been extended to various categories of pharmaceutical products now. Previously, applicants were chosen on the basis of their proposed manufacturing capacity and selling price. The base for eligibility has now been changed to global manufacturing revenue. A special sub-group will also be created for MSME units.

Despite being the world’s largest producer of some agricultural commodities, the food processing sector in India is still in nascent stages. The benefits accruing from the PLI scheme are expected to cascade to the farmers and help harness the massive employment generation potential in the sector.

This is a niche sector, which was hitherto not given large incentives. The scheme should help the nation build manufacturing capacities in certain grades of steel which are currently imported. Overall, it is also expected to lead to an increase in total exports.

- Solar photovoltaic modules

Despite its tremendous potential, the lack of financial and policy incentives in this sector has long impacted its growth, creating a greater reliance on imports. While this scheme may benefit only a handful of players, it is certainly expected to amplify the manufacturing capacity.

- White goods (air conditioners and LED lights)

Largely centered around encouraging full-fledged manufacture in India, as opposed to assembly units, these schemes should contribute to the establishment of a global supply chain footprint in India

The scheme aims to offset the huge import of telecom equipment. The incentives are likely to go up to 20 times the minimum investment threshold. Recognizing the need for additional support to MSME units, it allows them additional incentives in the initial years. This scheme would aid the ongoing focus towards digital transformation.

This scheme aims to shift the production from natural fibers to man-made fibers and technical textiles. This would aid alignment of the sector to global consumption patterns.

As indicated in our previous article on PLI, investors are chosen for PLI based on a detailed evaluation of their proposals submitted online. Once approved, they are granted incentives on fulfilling the commitments. The schemes have an inbuilt evaluation and monitoring mechanism to ensure performance standards are met. Their simplistic structure and transparent design should lead to swift processing and appraisals.