The key challenges for insurance companies

The fact that the timing of the lockdown owing to the pandemic was during the end of the financial year, compounded the problem because insurers normally witness heightened business activities, closing of accounts, disbursement of commissions, and payment of premiums during this period. However, the regulators provided a major concession to customers for delay in payment of premiums. While the move helped insurers too, they had to carry out other regular activities such as sending renewal notices, change in nomination, and other services like change in payment mode etc. without a stop. The major challenge for insurance companies was the availability of required digital infrastructure at employees’ homes, such as internet connectivity and virtual meeting tools, to ensure business continuity. Simultaneously, they also had to ensure, absolute data security and productivity, and ensure the comfort of employees who had to work with digital tools for long hours.

Some of the other issues included fear, anxiety, and confusion amongst the employees which might have arisen due to the unprecedented situation presented by the pandemic. COVID-19 has also brought in different types of people issues while working from home. For example, some women staff are finding it difficult to balance office work and personal life at home; some men are finding WFH stressful because they are receiving work at odd hours, even on Sundays; and in some cases employees, especially sales personnel, are finding it challenging to maintain performance levels, communication, and connectivity while WFH.

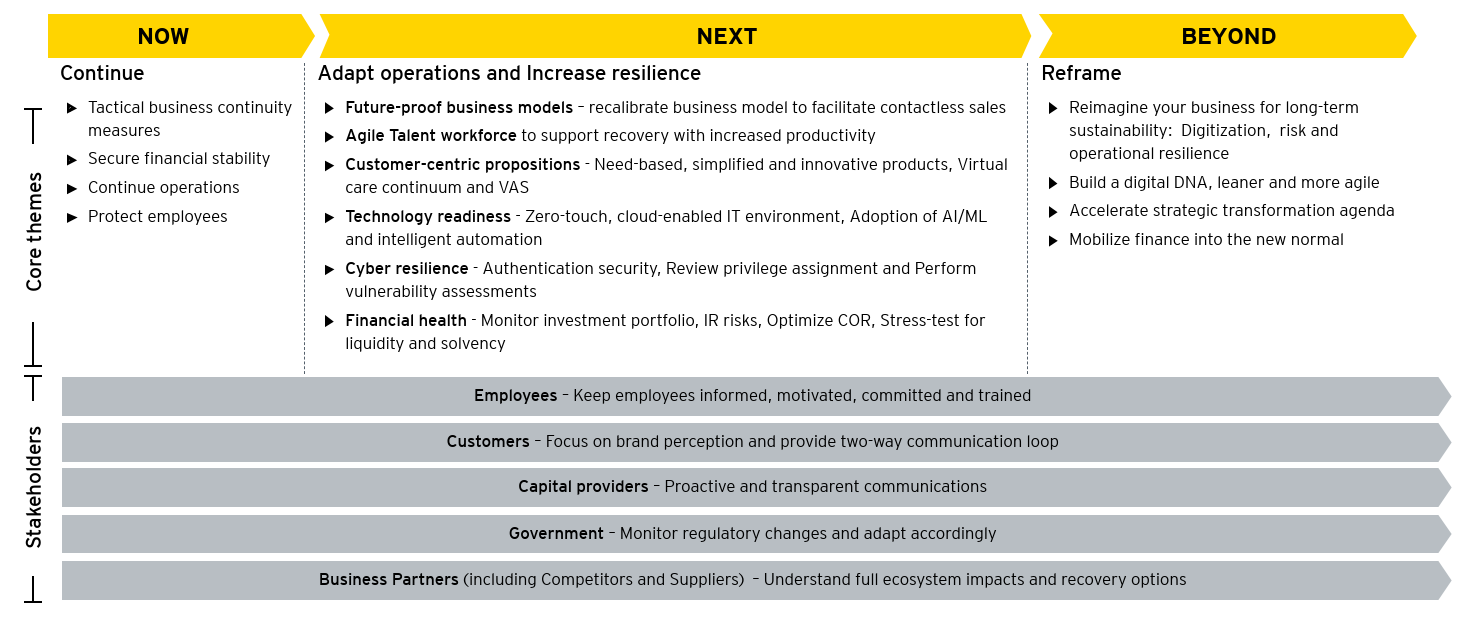

EY framework on adapting to the new normal