The future looks to be very interesting for the dietary supplements market, as more companies from the pharmaceutical industry and the FMCG industry enter the market, invest in product technology and brands, and influence consumption habits amongst consumers.

Which are the big consumer bets?

Diverse needs and multitude of available solutions make it difficult for companies to decide on the innovation funnel. There are large and established needs like heart health, blood pressure, menstrual care, allergies, but consumers have preferred adopting the medicinal route for many of them. Our analysis suggests three clear criteria for establishing the innovation bets for a company:

- How widespread is the need? (addressable consumer base)

- How serious is the illness/ wellness need?

- What is the efficacy of the preventive solution

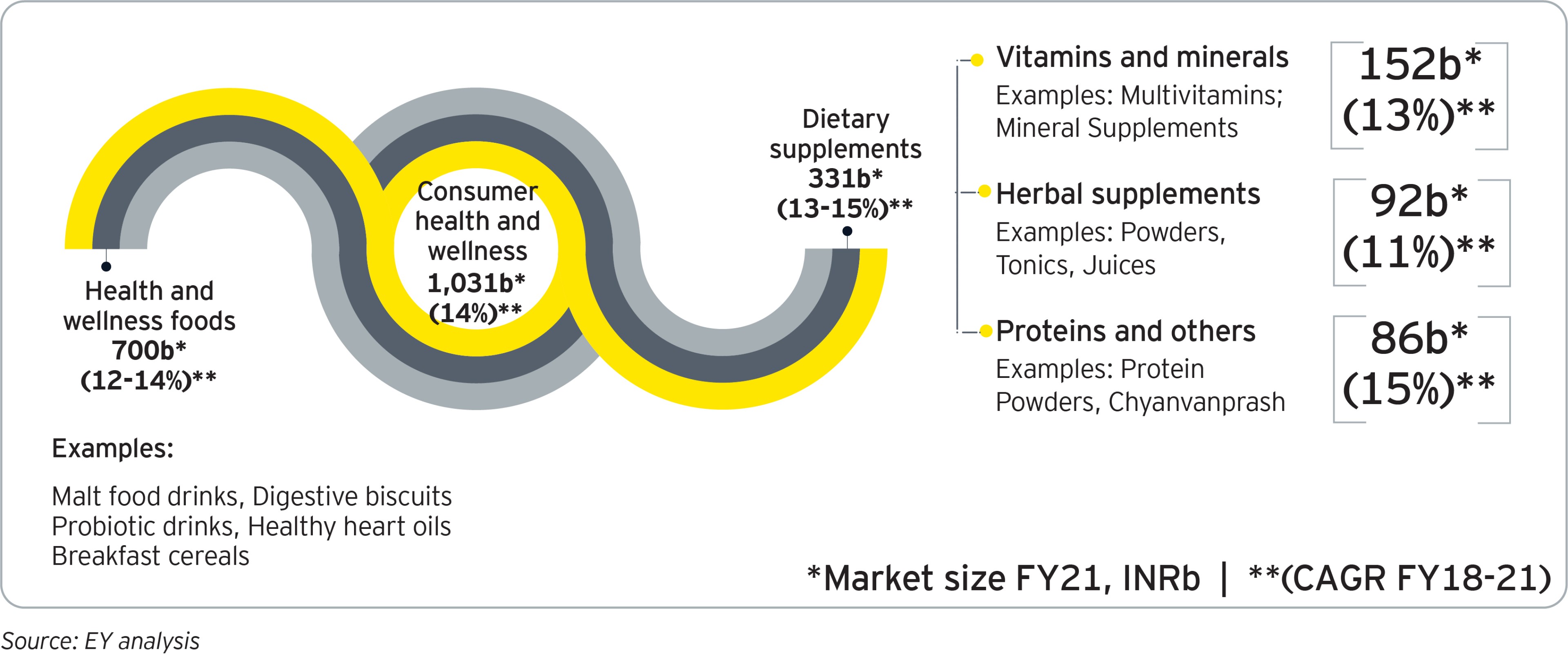

Pharmaceuticals + FMCG = Nutraceutical’s market in India

Product technology, solution efficacy and medical advice of pharmaceuticals coupled with marketing, demand creation and push based distribution of FMCG companies. Many companies from pharmaceutical and FMCG industries want to discover this sweet spot. From a category attractiveness perspective, the gross margins of formulation driven products are much higher than foods products, making this play interesting. Companies are working hard to establish differentiated planks on the concept of inner and outer wellness. Additionally, the growing interest in natural and ayurvedic products has encouraged companies already active in the area to assert their credentials more strongly, while also attracting the attention of players from pharmaceuticals.

Consumer companies are keen to build their medical credentials and capabilities, with the aspiration to eventually achieve higher margins available from these products across their portfolio. They have an inherent advantage in branding, consumer market expertise, and access to mass distribution channels. However, they are still learners in the fields of scientific innovation, regulatory affairs, and medical marketing expertise.

In the next five years, we expect consumer product companies to invest in demand creation and increasing consumer education using virtual equivalents of multi-level marketing (MLM), medical representative models, social media-based influencing, and direct-to-consumer (D2C) approaches.

Industry challenges in realizing future potential