India, 11 June 2020: The COVID-19 pandemic has become a trigger for transformation to a digitally-driven customer engagement and sales operations for industrial products organizations, states EY’s latest report ‘Is contactless sales the new reality for industrial products?’. The report states that manufacturers and aggregators should deploy an integrated online portal and ensure that the online conversations are seamlessly integrated into offline conversations and result into customer fulfilment, thereby, increasing their geographical outreach and delivering all the expectations from a real salesman.

According to the report, owing to COVID-19, what has now changed is that not just awareness but all aspects of the sales process including negotiation, transaction, channel engagement and internal reviews have started to migrate to digital in the industrial products space. Before COVID-19, organizations had already started to move to digital platforms in the lead generation and customer awareness space, however, relationship management, actual sales closure and sales reviews were still largely done in person.

Ashish Nanda, Partner and India Leader- Supply Chain and Operations, EY India, said, “Indian industrial products companies face a multitude of challenges in the ‘now’, ‘next’, and ‘beyond’ phase including limited face-to-face customer engagement activities such as trade fairs, reprioritization of spends from physical engagement mediums, transition of various workstreams onto digital platforms, among others. As companies enter into the next and beyond phase, an integrated platform with a digitally enabled agile salesforce will become a critical criterion for not just consumer engagement and sales conversion but also dealer engagement and internal sales team reviews. This is the right time to take decisions and act on digital initiatives which can truly change existing operating models and therefore, enhance the organization’s resilience to withstand any future disruption.”

According to the report, the trend is now accelerated towards industrial consumerism, with more erstwhile industrial organizations learning from other industries on how to engage with customers digitally, and also how to manage their own operations digitally. Interestingly along with being the need of the hour, this will also lead to greater process efficiencies, increased returns and lower costs. The best organizations will however not just stop there but use the opportunities to rethink their operating models now having digital at the center.

The report states that industrial products organizations could benefit from following four strategies in these uncertain times:

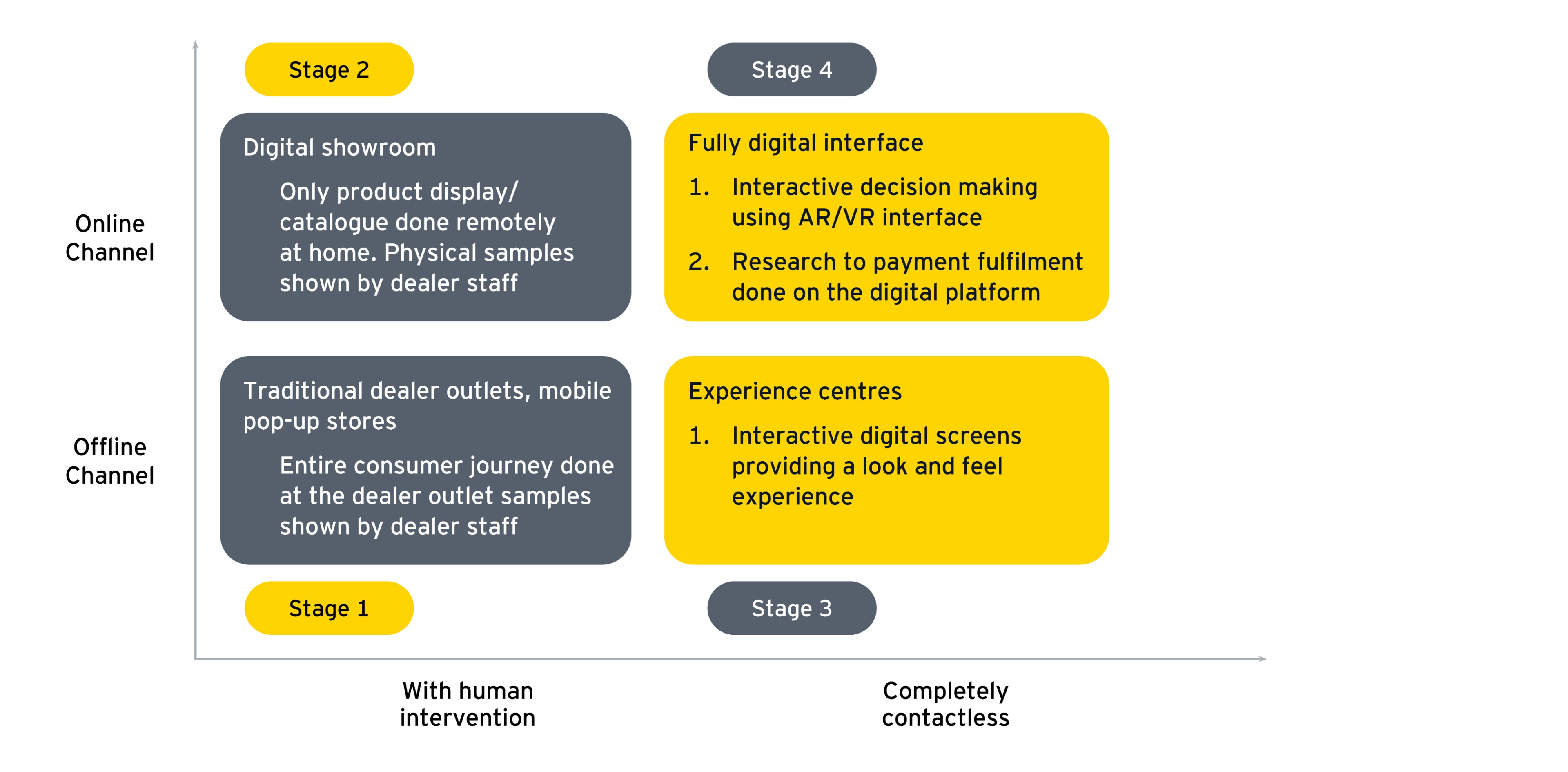

- Contactless sales operations and customer engagement: Contactless sales operations include rethinking the customer journey along with the sales journey including hand offs with other functions and even other organizations. For example dynamic monitoring of markets at district level, creating mixed physical and virtual beats for field team to connect with dealers and customers, training the field work force on engaging online to convert leads to sales, having one source of data truth and using analytical reports are some of the immediate imperatives. While making changes internally may be the first priority, changing business models on working with financiers or contractors or mechanics as the case may be needs a cultural shift on learning to working with “partners” rather than “vendors” and “dealers”.

- Distributor/ dealer liquidity management and operations oversight: The contactless model needs to identify and onboard distributors and dealers up front to actually achieve change. There is a need to map existing fulfilment centers for delivery while the contact centers act as co-ordination centers for enquiry and deciding on the other commercial agreements. There is a need to monitor that channel partners stay viable using data lead decision making triggers. In fact sales teams have very seldom interacted with the channel in non-physical medium be it planning or review- for both parties this will be something new.

- Trade spend planning and execution - net revenue management: Creating a real time spend dashboard to monitor spends and identifying triggers for change, identifying top micro-markets and prioritizing spends at market-product-spend axis in real time is an opportunity that organizations will be loath to pass by. The ROI improvement and business case is clear.

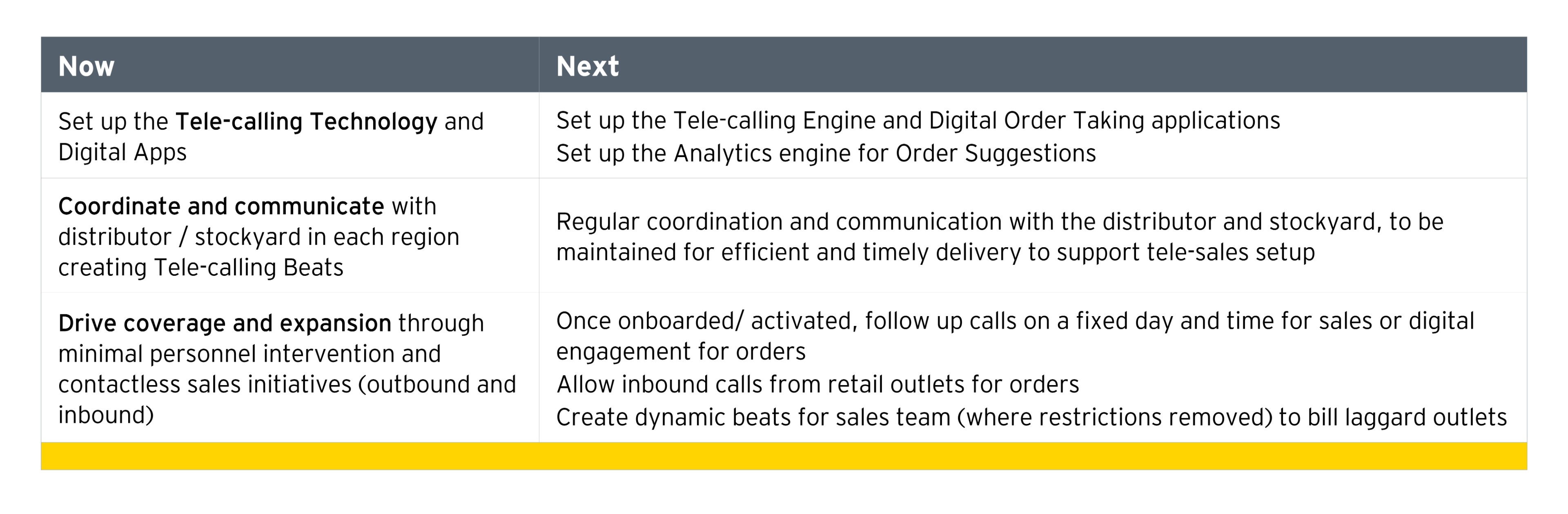

- Enablers for activation of contactless engagement- To run the contact centre and digital engagement, one needs to adapt, Now and Next initiatives.