Importance of strong governance frameworks in the VC ecosystem

Effective governance for start-ups stands on three pillars - founder mindset, investor mindset and Board members.

Start-ups, often characterized by their innovative spirit and dynamic nature, are susceptible to a plethora of risks ranging from operational and financial challenges to reputational threats. In the volatile world of entrepreneurship, maintaining the trust of investors, clients, and employees is paramount.

Therefore, after formal due diligence, analysis and checking the capability of team, business model, PMF, valuation, need of funding and its deployment, etc., when investors finally trust a startup enough to invest, the founders must understand that it is their fiduciary responsibility to deploy the capital diligently and as agreed upon with investors.

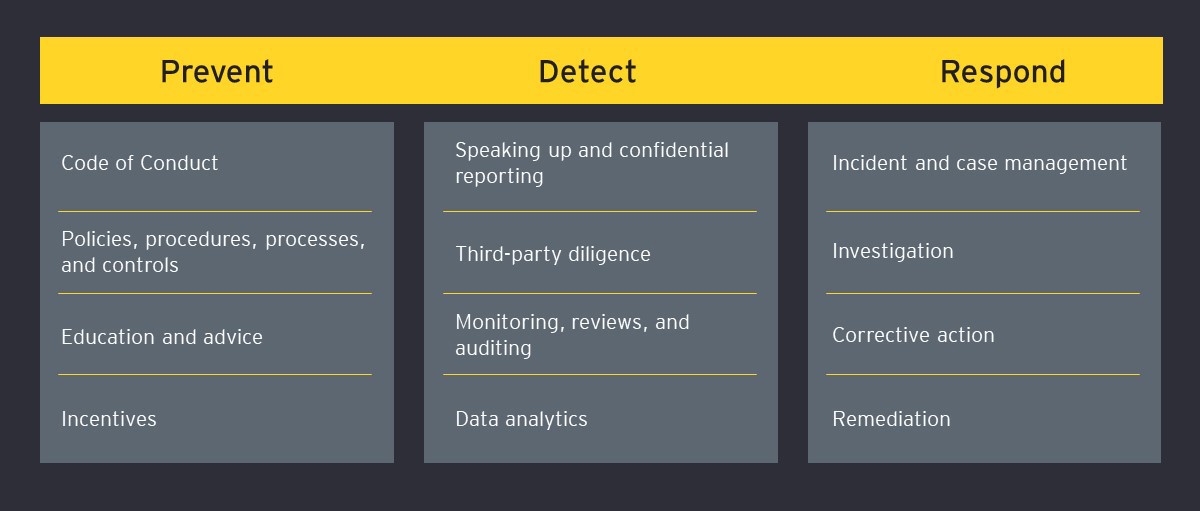

Pivots happen all the time but a healthy ‘start-up founder-VC investor’ relationship, built on a foundation of efficient and timely reporting, self-installed checks, and internal reporting, i.e., implementing governance strategies for growth, can lead to not just exemplary corporate culture but also be a road to creating a successful business empire. A robust corporate governance framework plays a pivotal role in establishing and upholding ethical standards, transparent decision-making, and accountability. It can help start-ups balance growth with sustainability.