The acceleration of both demand and expansion stems partly from government and corporate decarbonization initiatives, and partly from government and corporate targets for hydrogen-powered vehicles.

In December 2015, 194 countries signed the Paris Agreement,2 which pledges to keep a global temperature rise this century below 2 degrees Celsius and to pursue efforts to limit the temperature increase to 1.5 degrees Celsius. The agreement also requires all signatory countries to make their best effort in dealing with the impacts of climate change.

To achieve these ambitious goals, countries around the world have to take material steps to reduce their greenhouse gas emissions.

- In 2019, the European Union (EU) introduced legislation (European Green Deal)3 that would aim to reduce the EU’s greenhouse gas emissions to between 50% and 55% below 1990 levels by 2030.

- China, meanwhile, has taken steps to require “480 million tons of carbon capacity from steel production to meet ‘ultra-low emission’ standards by 2020.”4 It is also upgrading its power grid to reduce their reliance on coal for energy production.

- In the US, California has led the way, with the Global Warming Solutions Act of 2006,5 which set a statewide limit on greenhouse gas emissions. In 2016, the state aimed higher, raising the goal for greenhouse gas emission reduction to 40% below 1990 levels by 2030.

Another reason organizations are considering green hydrogen now versus 10 years from now is that by being a pioneer in the green hydrogen arena, they see opportunities to seize a competitive advantage. Technology companies have been the first to move, motivated to be early to market with better, more efficient, more cost-effective electrolyzers and fuel cells. Private equity firms with significant amounts of cash on hand are also making bets on green hydrogen through mergers and acquisitions — a clear sign of booming interest.

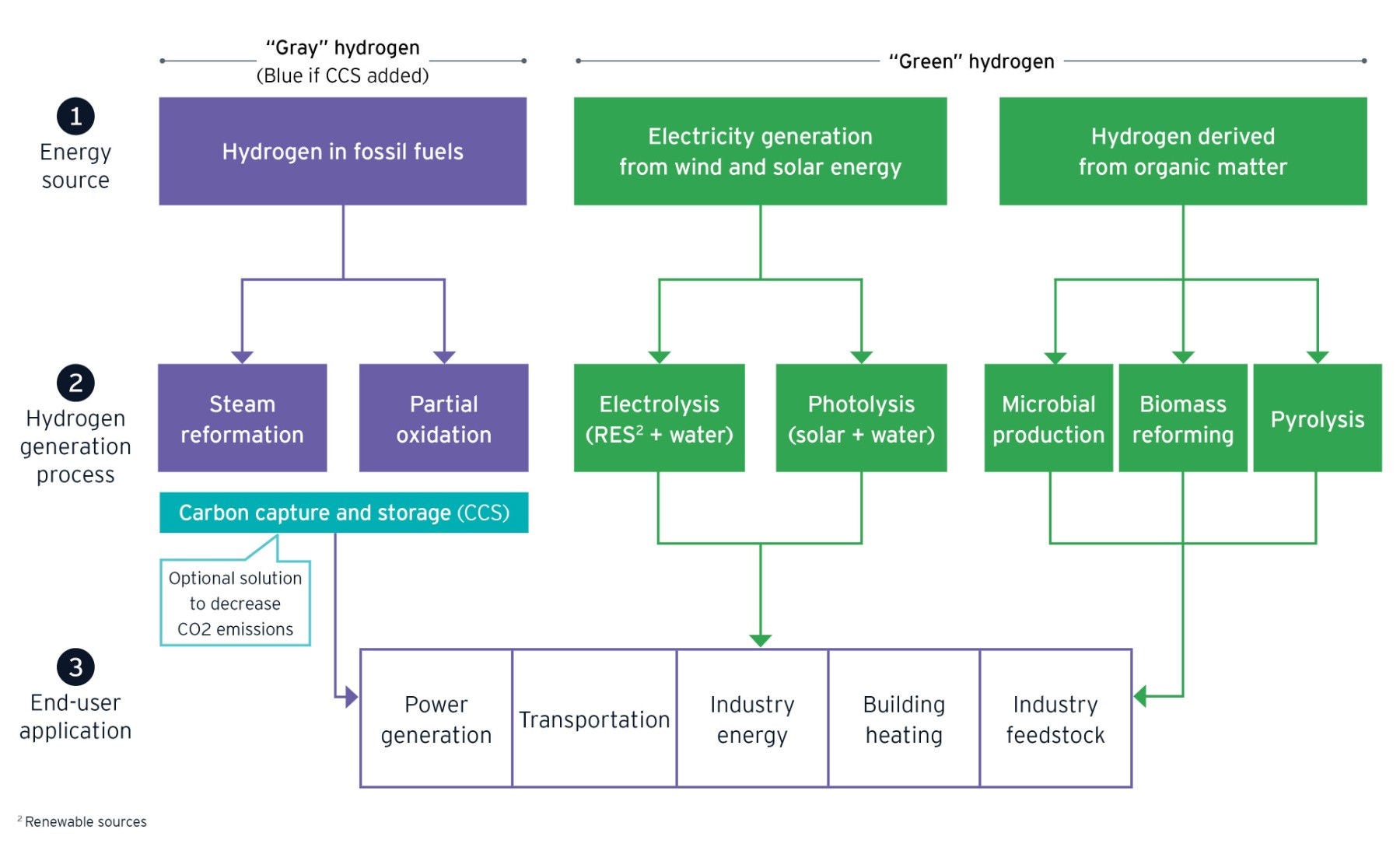

Although green hydrogen costs have not yet reached parity with gray and blue hydrogen, for an increasing number of organizations, there is enough of an incentive to climb aboard the green hydrogen train now.

Some have already begun integrating green hydrogen into their strategic agenda. For those looking to get started, leaders will want to seek the answers to the following questions:

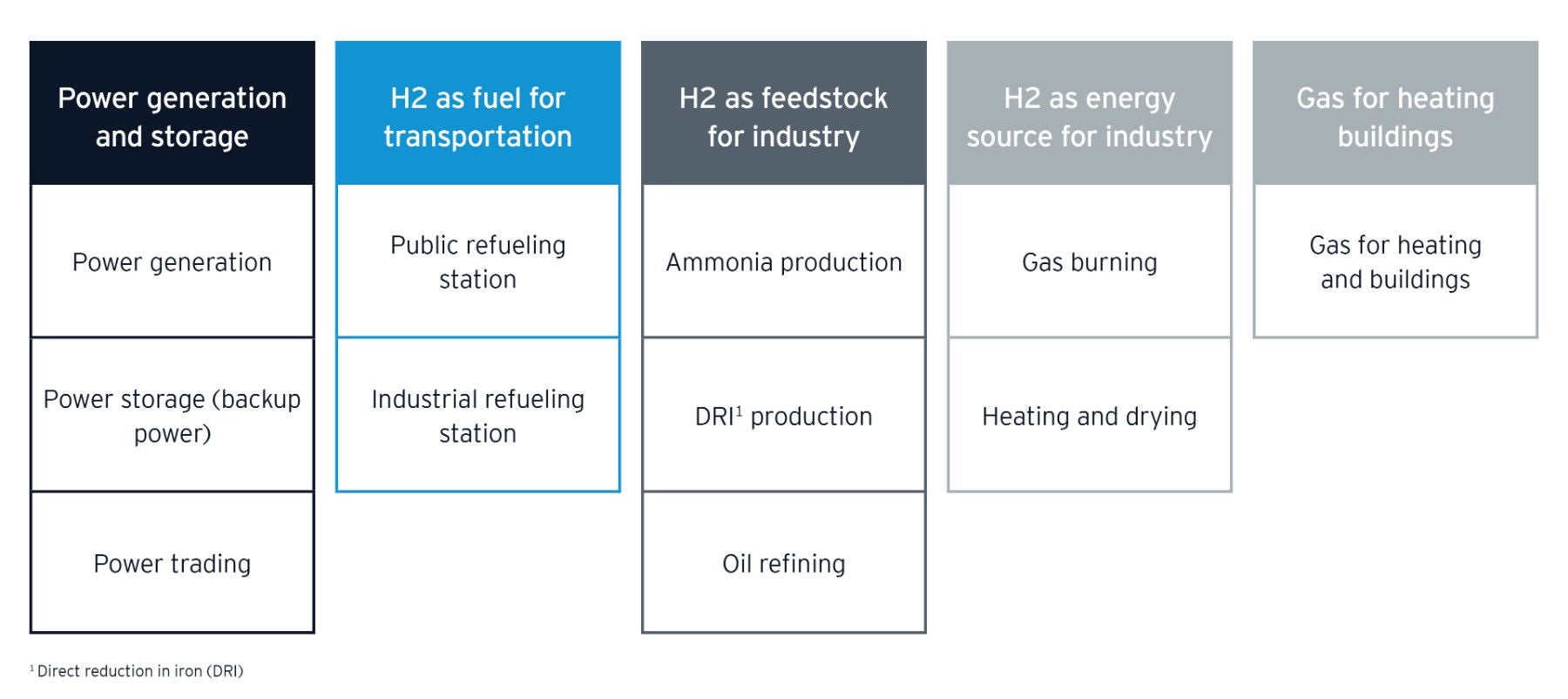

- What is our green hydrogen value proposition?

- Do we have a solution ready, or do we have to implement large-scale changes to seize existing opportunities?

- Are there new market opportunities that require new support or infrastructure? Are there new business ideas or business models that we need to consider?