Chapter 1

Indian internet start-ups come of age

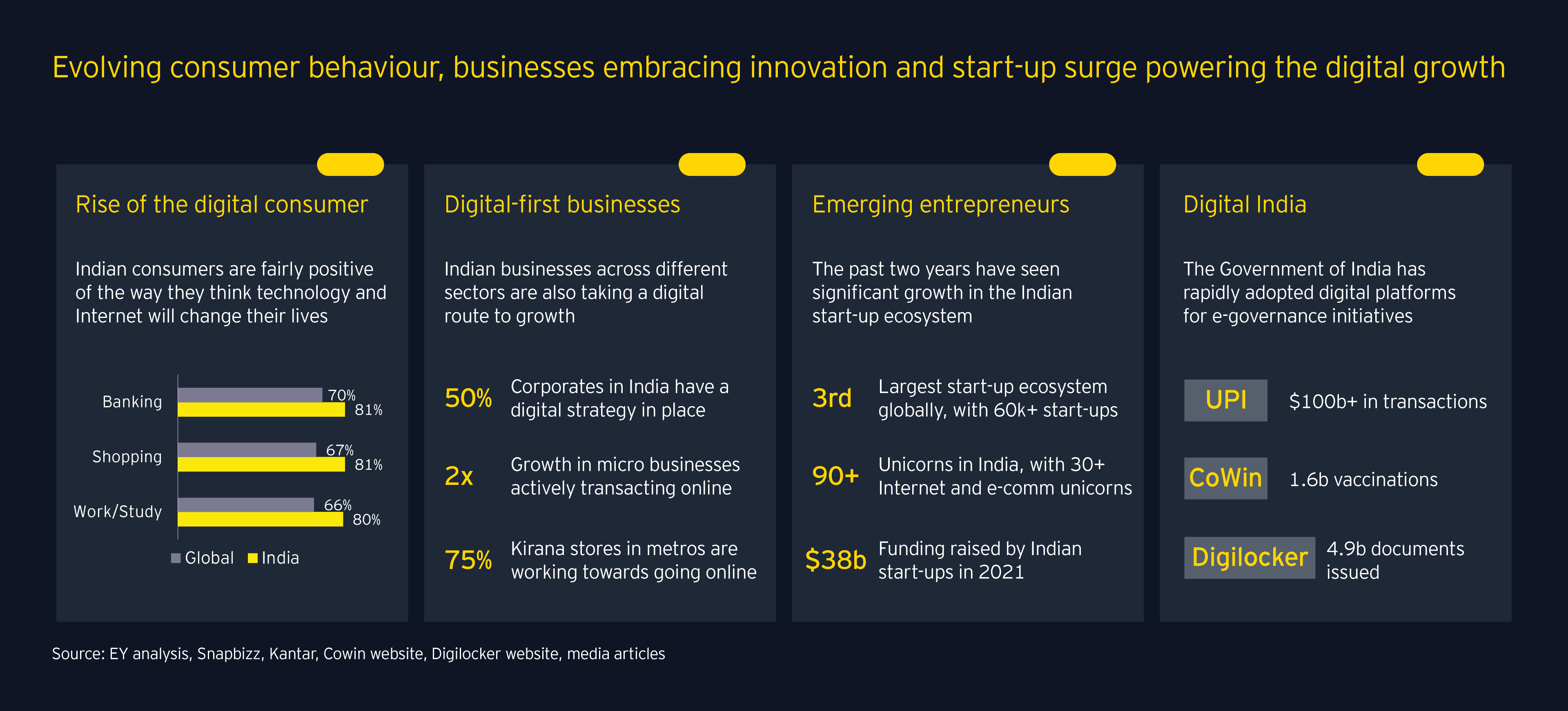

The year 2021 was the year of start-ups in India, with increased capital deployment in start-ups across different growth stages.

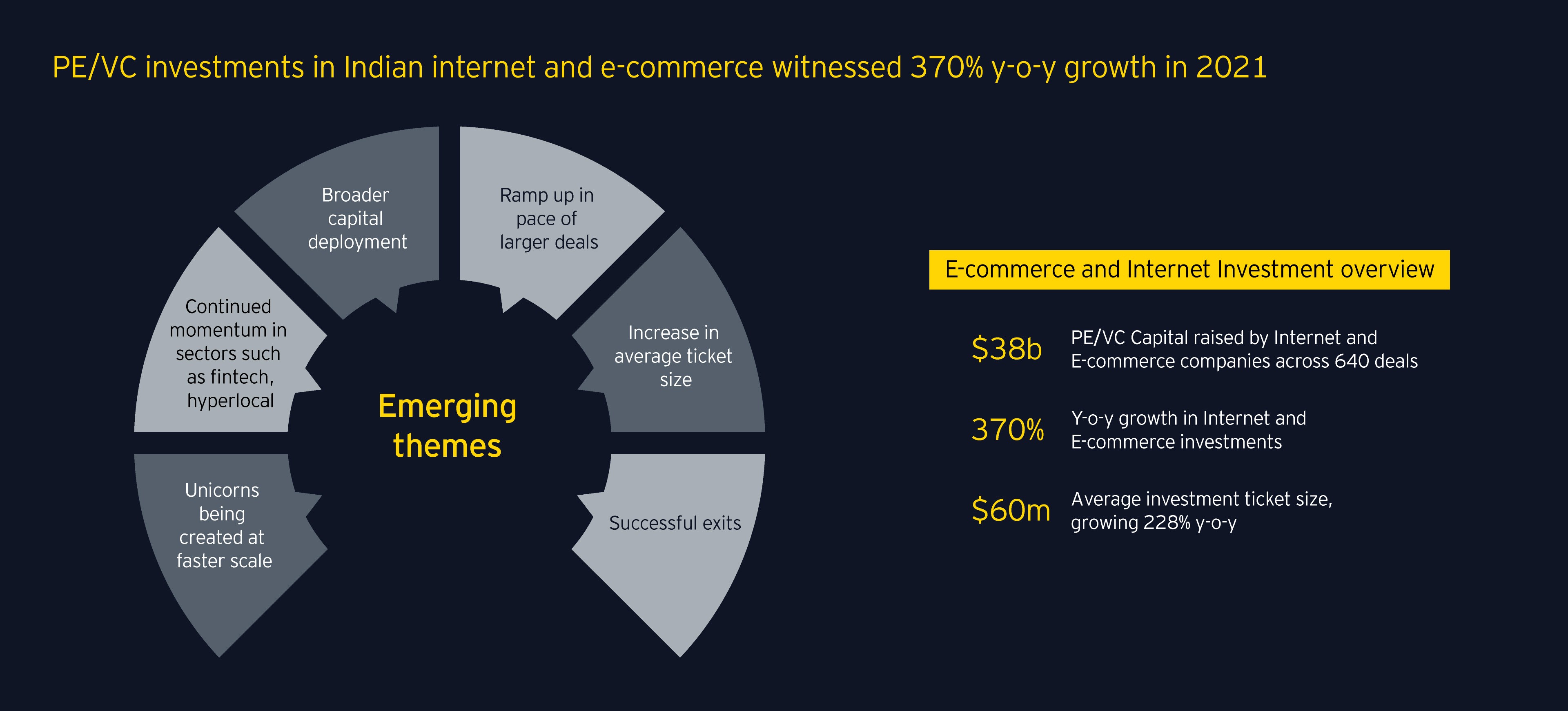

Consumer internet and e-commerce companies raised US$38 billion in 2021, increasing from US$8 billion in 2020, driven by large-size investments across fintech, hyperlocal and e-commerce sectors as the Indian start-up ecosystem continues to mature. Rise in late-stage investments also resulted in creating Indian tech unicorns, giving rise to 30+ unicorns across fintech, B2C and B2B e-commerce and payments.

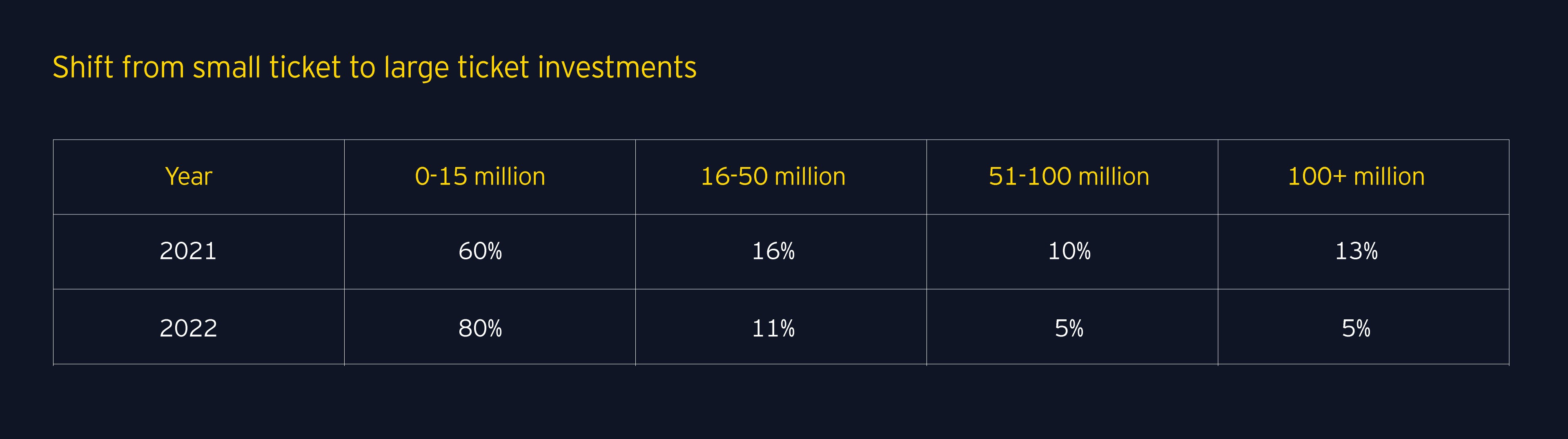

While small ticket investments in the Indian ecommerce and Internet sector continue to account for over 60% of total PE/VC investments, there has been a notable increase in large ticket investments, with growth in late-stage funding.

The payments and wallets segment saw the largest share of 100m+ deals in 2021, with payment providers aggressively looking to expand in contactless payments. BNPL has also become a hot segment as the reach of e-commerce and payments continues to expand. The deployment of capital has broadened in 2021, with 100m+ funding growing its share in total internet and e-commerce investments from 5% in 2020 to 13% in 2021. This has also resulted in an increase in the average ticket size, signaling Segway into the next phase of maturity in the India’s internet start-up ecosystem.

Chapter 2

Sectoral view: story of unique opportunities

We look at EdTech, fintech, gaming, B2C e-commerce, B2B e-commerce, logistics tech, online classifieds and services, agritech, hyperlocal, healthtech, social commerce, travel and hospitality, mobility, payments and wallets.

- Edtech helped democratize access to high-quality education and facilitate student engagement - As schools and colleges reopen with the normalization of the pandemic situation, there is expected to be a lower demand for online education services. However, market is expected to witness a growing trend over the coming years driven by use of AI and machine learning to provide enhanced offerings such as accurate progress tracking, personalized assessment, and career counselling. The test preparation segment is estimated to expand at a robust pace driven by a shift in preference, while the language and casual learning segment is projected to expand at a steady rate, owing to improved revenue generation from advertisements. Today, Private equity and venture capitalists are realizing the huge potential in Indian EdTech sector, as also the firms are looking for M&As to enhance product portfolio and drive geographical expansion.

- Indian FinTech industry continues to outpace the world with rising adoption - With one of the world's fastest-growing economies, India has also emerged as the third largest fintech ecosystem in the world. Paperless lending, mobile banking, WealthTech, InsurTech, buy now pay later and other fintech concepts are already being adopted in India. Indian government’s focus on creating a cashless economy and RBI’s adoption of blockchain to launch a digital currency is also supporting the fintech industry. In 2021, the industry witnessed ~10x increase in PE/ VC investments. India also accounted for four out of top 10 fintech deals in the Asia-Pacific region in 2021. Digital payments and lending tech are the most funded fintech sub-segments.

- Agritech start-ups are redefining farming by leveraging modern technologies - In the last three years, funding has grown nearly three times and is expected to reach US$10 billion by 2030. Yet the potential of the agritech sector in India has barely been tapped. Current penetration of agritech in India is less than 1% of overall Indian agritech potential. Post-harvest platform solutions connecting different parts of the value chains embedded with next-gen technologies are expected to be the future growth engines. The output market linkage and precision farming are expected to contribute close to 68% to total agritech market by 2025. The sector would witness greater tech-driven innovation and deployment across value chains in the coming year. Huge market potential in agrarian India is a key investment driver while the entry of traditional players into agritech is leading to M&As.

- Hyperlocal solution in a click - The hyperlocal delivery sector witnessed steady growth after facing some obstacles during the start of the pandemic. The online grocery market observed 70% growth in 2021 while online food delivery witnessed 19% growth in 2021. Factors such as urbanization, tech-savvy consumers and changing consumer behaviour with more shift towards convenience fuelled by the pandemic are driving the growth of hyperlocal sector. Initiatives such as ‘no contact delivery’ and ‘online payments’ further made it more convenient for customers to use hyperlocal platforms. The online grocery market is expected to grow at CAGR of 29% during 2021-26 to reach US$1,311 billion by 2026 while online food delivery market is forecasted to grow at CAGR of 30% during the same period to reach US$1,515 billion by 2026.

- Gaming competition in the digital era India has emerged as one of the fastest-growing gaming markets in the world driven by ~450 million gamers, 20% paying user conversion rate, and a world leading new time paying users rate at 50%. Start-ups leveraged emerging use cases, such as in-app purchases, real money gaming, virtual gifting, tipping, and subscriptions to further drive this growth. 2021 saw the emergence of India’s second gaming unicorn as the sector witnessed increased PE/ VC investments. Overall, the Indian gaming industry is expected to grow 3x by 2027 as the country transitions from a net importer of global gaming titles to a global exporter of content and intellectual property. Further, it is expected that the paid gamers would reach ~240 million by 2026, from 96 million in 2021.

- Social commerce interaction to transaction - In India, social commerce shoppers, which account for 53% of total online shoppers, are expected to reach 228 million at the end of 2022, a 45% increase from the current consumer base, as consumers are exploring new ways of shopping for products online through social media apps.

- Currently, 55% of the social commerce customer base is from tier 2 and 3 towns, which contributed close to 80% of the gross merchandise value. Increased internet penetration, growing impulse purchases and accelerated adoption from smaller metros and towns are driving the growth for social commerce. To take advantage of this growing opportunity, social commerce players are offering convenient and hassle-free process of product discovery for consumers in their local language with the help of engagement platforms.

- Currently, 55% of the social commerce customer base is from tier 2 and 3 towns, which contributed close to 80% of the gross merchandise value. Increased internet penetration, growing impulse purchases and accelerated adoption from smaller metros and towns are driving the growth for social commerce. To take advantage of this growing opportunity, social commerce players are offering convenient and hassle-free process of product discovery for consumers in their local language with the help of engagement platforms.

- Travel and hospitality transforming through innovation - The travel and hospitality market in India is expected to show a sharp recovery in 2022 and beyond with easing of pandemic restrictions and ongoing successful vaccination drive. The Indian travel market is forecasted to grow at CAGR of 7.5% during 2020-27 while online travel market is expected to grow at CAGR of 12.6% during 2021-27. The increasing investors’ interest in the space can be observed as funding reached to pre-pandemic levels in 2021.

- Mobility gearing up for EV - The pandemic adversely impacted the mobility market, resulting in a decrease in daily ridership mainly due to lockdown curbs. This forced firms in the mobility space to embrace innovative solutions and diversify into adjacent segments. Firms expanded into B2C and C2C customer logistics to generate revenue during the pandemic. The shared mobility market in India is expected to grow at a CAGR of 25% during period 2021-27.87 The growth will be driven by ride-hailing and micro-mobility. The used car market is forecasted to grow at 12-14% during period 2025-26 to reach a size over 70 lakh vehicles from 38 lakh in 2020-21.88 The growth will be driven by increasing digitization, first-time buyers, changing demographics and aspirations, and convenience of payment options.

- Payment and wallet contactless to cashless - The value of digital payment in India is forecasted to grow three-fold to reach US$1t by 2026, primarily driven by increasing online purchases and digital adoption in the country. By 2026, close to 44% of payments will be accepted through payment gateways and aggregators, 34% through QR codes while 22% through point of sales machines.

Chapter 3

Path to growth: consolidation and collaboration

The e-commerce and internet space continue to witness consolidation as businesses leverage collaborations to drive growth.

Convergence and consolidation in the sector are reinforced by the need to innovate, expand, diversify, and differentiate. Consolidation appears to be the theme running across different e-commerce sectors as industry players continue to drive Inorganic growth through partnerships, acquisitions and alliances. The key drivers for increasing M&A activity include acquisition of technology capabilities, expansion into new markets and geographies and diversification of portfolio. In 2021, the industry saw increased M&A deals as businesses returned to growth and strategic investments and collaborations came back onto their agenda.

India is becoming a unicorn hub, led by e-commerce and internet start-ups. The Indian start-up ecosystem saw 46 unicorns in 2021, more than doubling the total number of unicorns to 90. The e-commerce and consumer Internet sector was a major contributor to the unicorn space, led by the B2C and B2B e-commerce, fintech and edtech segments. Internet-based businesses have seen an exponential growth in the past 18-24 months, acquiring many first-time customers as well as witnessing increased activity from existing customers, as consumption models evolved, and consumers went digital as a result of the COVID-19 pandemic. And these trends do not seem to be short-lived. Three months into 2022, and we already have nine unicorns in the country, out of which four are e-commerce and internet companies.

Chapter 4

2021: The year of unicorns and IPOs

46 Unicorns | $38b in Investments | 600+ PE Investments | 90+ deals greater than $100m | 370% YoY growth in investments | 150+ M&A deals | 9 IPOs

India is becoming a unicorn hub, led by e-commerce and internet start-ups. The Indian start-up ecosystem saw 46 unicorns in 2021, more than doubling the total number of unicorns to 90. The e-commerce and consumer Internet sector was a major contributor to the unicorn space, led by the B2C and B2B e-commerce, fintech and edtech segments. Internet-based businesses have seen an exponential growth in the past 18-24 months, acquiring many first-time customers as well as witnessing increased activity from existing customers, as consumption models evolved, and consumers went digital as a result of the COVID-19 pandemic. And these trends do not seem to be short-lived. Two months into 2022, and we already have nine unicorns in the country, out of which four are e-commerce and internet companies.

Related articles

Summary

India is poised to be among the leading e-commerce and consumer internet markets globally in the next few years, both by being a leading consumer of internet-based products and services, as well as the leading producer of companies catering to these demands and competing at a global level.