In order to build a holistic consensus, we reached out to industry-wide stakeholders, whose views were sought over countless interactions through a structured questionnaire, coupled with secondary analysis and global primary case studies through EY proprietary research. Future opportunities and the way forward have been duly ratified through industry and stakeholders’ roundtables. Key considerations to adopt as a call to action aimed at industry, academia and government have been outlined for actions going forward.

The opportunities that have emerged have been classified into four sections in this report: Innovation and R&D, Healthcare Delivery, Manufacturing & Supply Chain, and Market Access.

On the domestic front, the ambition translates into a growth rate of 10-11% over the coming decade. Below-average social health indicators and a low proportion of total healthcare spend as a proportion of GDP indicate an opportunity to improve healthcare delivery in the country.

With estimates that the Indian pharma industry supplies over 40% of the generics in the biggest pharma market – the US and about 25% of the prescription drugs in the UK, along with catering to over 60% of the global vaccine demand, India is one of the leading suppliers of pharmaceuticals in the world. While the global formulations trade value is about US$652 billion (2019), India’s share of exports in the global trade was only about 2.5%. With increased pricing pressure on the global generics trade as well as increased competition in India’s established export corridors, the current portfolio of products is expected to further extend this divide. The global pharmaceutical trade is expected to reach a size of US$1-1.3 trillion by 2030, the ambition is to garner a global share of 6-7% by value to attain a size of ~US$73 billion.

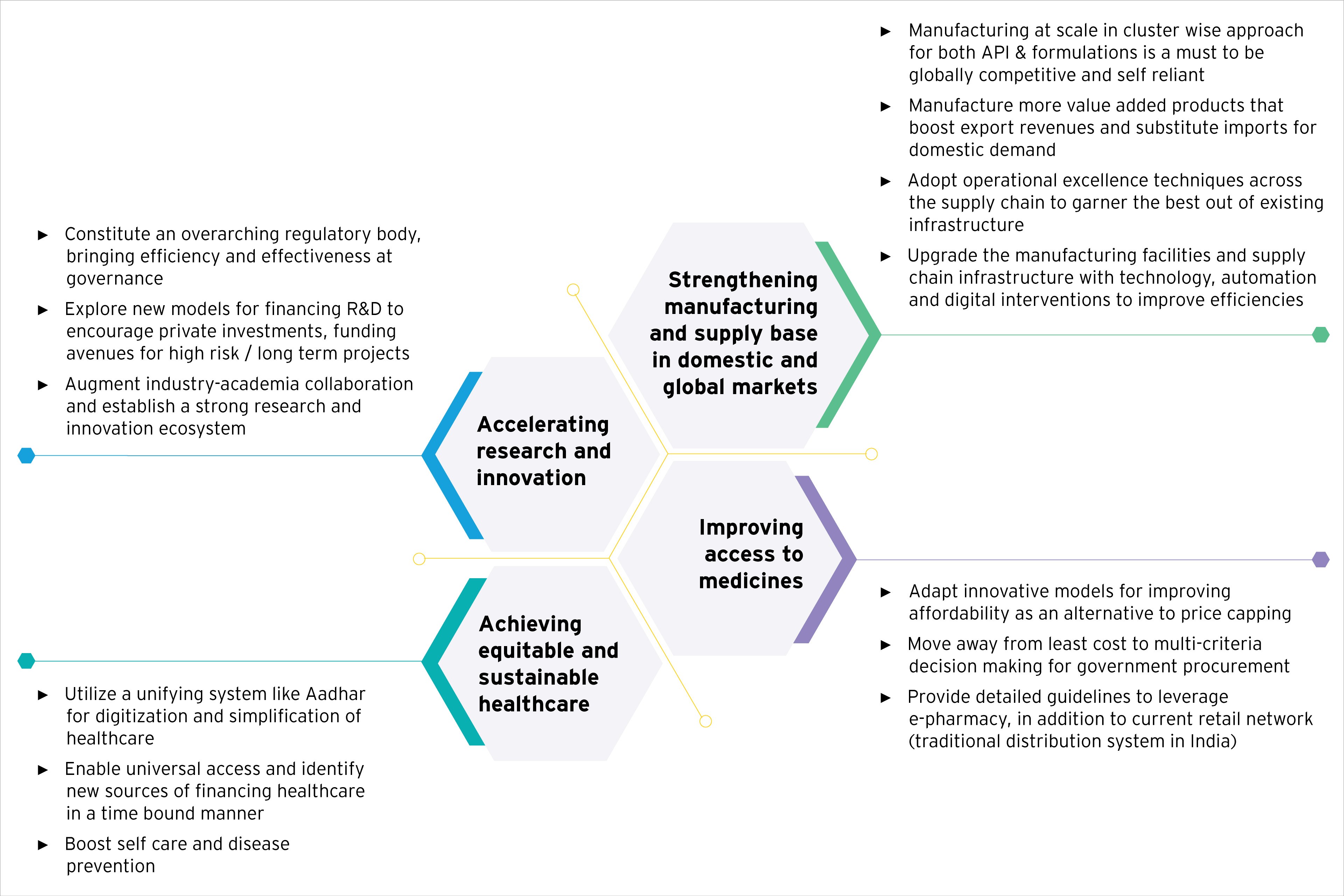

Accelerating research and innovation

- One of the key action areas that resonated across all interactions was the need to move up the value chain to achieve the ambition and consider way forward to discuss the sets of action needed to be put into place to move up India’s share of trade in value.

- To meet this objective, this section deliberates on set of actions to help the industry move towards this objective including setting up an overarching regulatory body and a Central body to streamline research infrastructure and financing from all government bodies, exploring new models for financing R&D to increase private investments and also make available funds for high risk / long term projects, measures to improve industry-academia collaboration and establish a strong innovation ecosystem, the role of industry to leverage technology for improving productivity and efficiency in research to name a few.

Achieving equitable and sustainable healthcare

- The increased acceptability of digital technologies has the potential to improve healthcare delivery. This section explores the progress towards achievement of universal healthcare access, establishing efficient processes such as the potential use of Aadhar card to identify as well as simplify the delivery based on healthcare coverage category. The next steps to creating, maintaining and leveraging healthcare data to identify and prioritize focus areas for healthcare have also been discussed in depth.

- Considerations for enabling teleconsulting, focus on preventive healthcare have also been dealt with, in detail, and the role of the industry, government, healthcare sector and insurers carved out.

Strengthening manufacturing and supply base in domestic and global markets

- The focus of manufacturing & supply chain initiatives would be to develop capabilities in APIs and enable manufacture of complex generics, bio-similars, gene & cell therapies etc.

- Ease of doing business is the most important enabler to set up world class manufacturing facilities

- Attractiveness of manufacturing sector would also need to be enhanced in order to attract the best talent in India and abroad

- Given the growth ambitions, it is vital to encourage and setup of Pharmaceutical machine manufacturing facilities in India that would result in lower fixed costs, savings in forex and reduction in time to set up additional facilities

- Strong and all round focus on excellence and compliance is a must to facilitate a “Made in India” phrase that is synonymous with high quality

- Government would need to bolster the logistics infrastructure for connecting the key pharma hubs in the country in order to facilitate quick and cost efficient movement of goods (including facilities for cold chain)

Improving access to medicines

- This is the last section that explores the key opportunities that need to be realized in order to improve the market access of the drugs in the country.

- This section revolves around various global best practices in drug pricing and procurement models, contextualized for developing geographies.

- Deliberations on digital marketing of pharmaceutical products in India.

Future Considerations and way forward