The underlying intent of the BRSR can be said to be seamless integration and alignment of the various regulatory frameworks and compliance requirements in terms of environmental, social and governance parameters to be followed by companies operating within India, for the purpose of responsible conduct of business and transparent disclosure of their non-financial parameters and sustainability goals of the company.

Through BRSR reporting, SEBI has defined ESG disclosures in a standardized manner for the listed companies based on which the BRSR guidelines were issued. The BRSR format acts as one standard for all in India for ESG related disclosures and it will be intertwined with the financial performance of the companies as well, as the BRSR report will be published alongside their annual report as an integral part. This will be a standardized alignment of financial and non-financial disclosures of a company to truly represent its business operations in a transparent form.

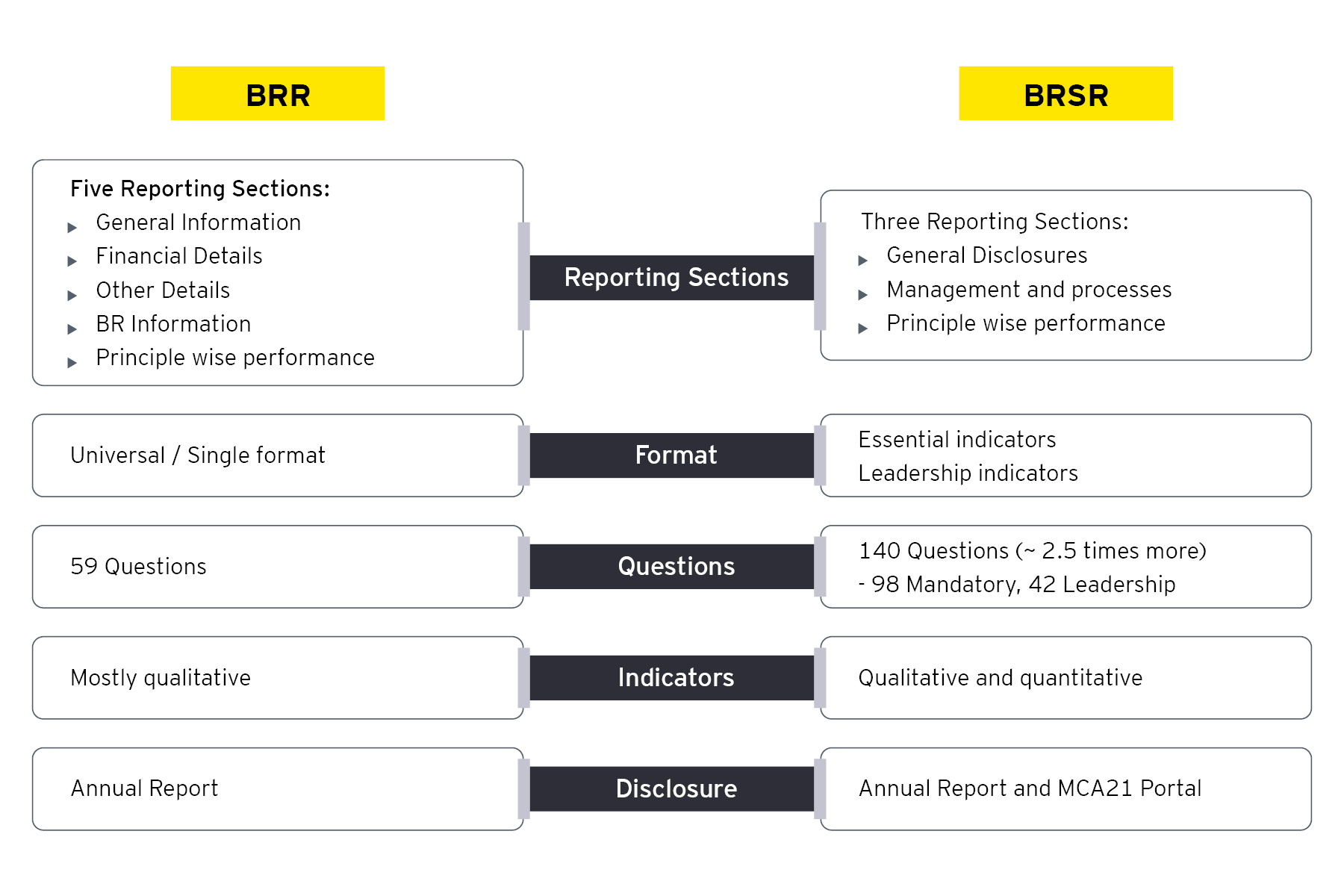

The BRSR report format will consist of three sections:

- General disclosures: The objective of this section is to obtain basic information about the company – size, location, products, number of employees, CSR activities, etc.

- Management disclosures: In this section, the company is required to disclose information on policies and processes relating to the NGRBC Principles concerning leadership, governance, and stakeholder engagement. Wherever relevant, companies have been asked to provide links to their websites where these policies are available.

- Principle-wise disclosures: Responses to this section indicate how a company is performing in respect of nine Principles and Core Element of the NGRBCs. This section requires companies to demonstrate their intent and commitment to responsible business conduct through actions and outcomes.

The questions have been divided into two types:

- Essential indicators (mandatory)

- Leadership indicators (voluntary)

With the BRSR reporting, companies require to highlight sustainability-related challenges faced by them and further delve in their ESG related targets, goals, and achievements while also mapping the probable risks and opportunities they will potentially face in their ESG journey.

BRSR will act as an effective mode of communicating a company’s non-financial disclosures and should be seen as the next step in ESG reporting going forward. Publishing a BRSR report should be seen as a mandatory compliance exercise as per SEBI’s vision as to what it intends BRSR’s purpose to be.