EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Insights

Asking the better questions that unlock new answers to the working world's most complex issues.

Services

EY helps clients create long-term value for all stakeholders. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate.

Industries

Discover how EY insights and services are helping to reframe the future of your industry.

See more

Case studies

Strategy and Transactions

How a cosmetics giant’s transformation strategy is unlocking value

13 Sept 2023Nobuko Kobayashi

About us

At EY, our purpose is building a better working world. The insights and services we provide help to create long-term value for clients, people and society, and to build trust in the capital markets.

See more

Spotlight

Press release

EY announces launch of artificial intelligence platform EY.ai following US$1.4b investment

13 Sept 2023Rachel Lloyd

Press release

EY reports record global revenue results of just under US$50b

13 Sept 2023Rachel Lloyd

Press release

Doris Hsu from Taiwan named EY World Entrepreneur Of The Year™ 2023

09 Jun 2023Lauren Mosery

Recent Searches

Trending

-

2025 Global IPO market key highlights and 2026 outlook

The EY Global IPO Trends covers news and insights on the global IPO market for 2025 and an outlook for 2026. Learn more.

17 Dec 2025 IPO -

How can the moments that threaten your transformation define its success?

Leaders that put humans at the center to navigate turning points are 12 times more likely to significantly improve transformation performance. Learn More.

15 Apr 2024 Consulting -

EY.ai - a unifying platform

EY.ai, a platform that unifies human capabilities and artificial intelligence to help you confidently adopt AI. Learn more.

16 Nov 2023 AI

TaxLegi 31.05.2021

-

Οn 21 March 2018, the European Union (EU) Commission proposed the adoption of new rules on the imposition of Digital Service Tax (DST) to tax digital business activities in a fairer and more growth-friendly way within EU.

The proposal aims to identify and tax the new ways by which profits are generated in the digital world and more specifically the users’ role in creating value for businesses engaging in such digital activities.

The need for a DST implementation was a result of identifying a disconnect between where value is created and where taxes are paid. In addressing the challenges and gaps of current taxation systems, the EU Commission issued legislative proposals in two areas.

1. Corporate tax rules reform

Profits generated in a territory, even without the businesses’ physical presence there, to be taxed in the EU Member State within which companies engage in such digital activities.

Where to Tax:

A digital platform will be deemed to have a taxable 'digital presence' or a virtual permanent establishment in a Member State if it satisfies any of the following criteria:

- Revenues exceeding €7 million annually in a Member State;

- Users exceeding 100,000 in a Member State within a taxable year;

- Online business contracts for digital services exceeding 3000 in a taxable year.

The new rules are set to change how profits are allocated to Member States in a way which better reflects how companies can create value online (e.g. depending on where the user is based at the time of consumption).

What to Tax:

Profit attribution will take into account the market values of:

- Profits from user data

- Services connecting users (online marketplaces, ‘sharing economy’ platforms)

- Other digital services (subscription to streaming services)

2. Application of Interim Tax on certain revenues

A second proposal affecting indirect taxation is the application of interim tax on certain revenues arising from digital activities, currently escaping from current/traditional tax frameworks.

DST will apply on revenues created from activities where users are a vital part of value creation and which are the hardest to capture under current tax rules, such as revenues:

- From selling online advertising space;

- From digital intermediary activities which allow users to interact with other users and which can facilitate the sale of goods and services between them and

- Created from the sale of data generated from user-provided information.

Tax revenues would be collected by the Member States where the users are located and would only apply to entities with total annual worldwide revenues of €750 million out of which €50 million are EU-generated.

The proposed tax rate for revenues arising from such activities is 3%.

Certain EU Member States such as France, Italy, Spain, Austria and Poland have already implemented the above proposals and it is expected that other EU countries such as Cyprus, Slovenia, Czech Republic, Latvia and Norway will follow in the near future.

Although initial consultation regarding the adoption of DST in Cyprus has been initiated since 29 August 2019 it has yet to be implemented, since an international consensus-based solution is aimed without having unilateral measures.

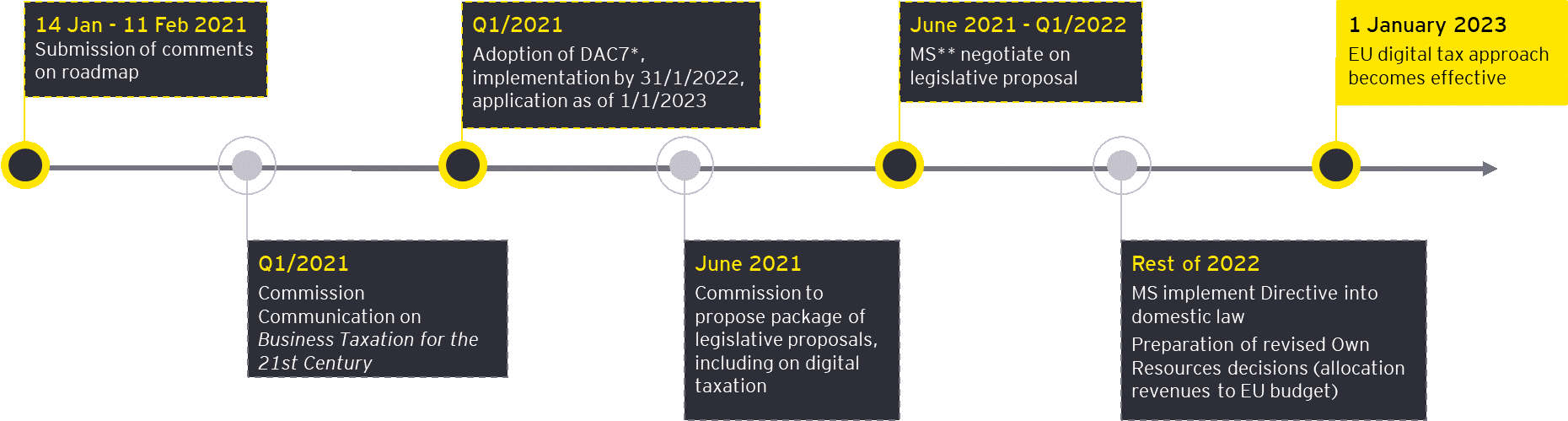

Since then, the European Commission has further opened a four-week feedback period running from 14 January 2021 to 11 February 2021 on its inception impact assessment/roadmap (per below) for the introduction of a digital tax to address the issue of fair taxation of the digital economy. Responses will be taken into account in the further development and fine tuning of the initiative.

There is no fixed timescale for further action after this feedback period and the next steps are likely to be driven by what progress can be made.

As such digital businesses will need to put in place appropriate identification mechanisms of potential tax obligations in Member States which already adopted DST, and where potential obligations may arise.

The introduction of DST goes hand in hand with other indirect tax changes in VAT for which developments are expected to be implemented in the summer of 2021. Such are the simplification rules in the e-services/commerce, through the introduction of One Stop Shop.

Pantelis Charalambides - Senior, Indirect Taxes

-

The Tax Department through an announcement issued on the 28th of April 2021, would like to remind tax payers that the deadline for the payment of the Special Defence Contribution (“SDC”) and General Healthcare System Contributions (“GHS”) with regards to Deemed Dividend Distribution arising on the 2018 profits, is the 30th of April 2021.

Further to the above, it is noted in the announcement that the Tax Department will not impose any interest/ penalties in case the above-mentioned payments are made by 31st of May 2021.

Our team remains at your disposal for more information and support.

Michalis Karatzis - Manager, Direct Tax

-

Introduction

Further to our previously issued Tax Alert in relation to tax forms T.D. 602 and T.D. 603 , we would like to inform you that through an announcement issued on 4 May 2021, the Tax Department provides further details regarding the new forms for SDC and GHS withheld on interest and dividend payments.

The below forms are accessible through the Taxisnet portal and through the account of each Taxpayer as follows:

1. Form T.D.602 – SDC and GHS withheld on interest paid.

2. Form T.D.603 – SDC and GHS withheld on dividends paid.

➢ Who has the obligation to submit such forms?

Any taxpayer who has or had the obligation to withhold SDC and GHS contributions, on interest/dividends declared from 1 January 2019 onwards, is obliged to electronically submit forms T.D.602 and T.D.603.

Should the taxpayer wish, they may grant access to their authorised representative / tax consultant, enabling them to complete and submit the said forms to the Tax Department on their behalf.

➢ What is the deadline for these forms to be submitted?

- Forms relating to the period January 2019 until December 2021 shall need to be electronically submitted by 31 January 2022.

- Forms relating to the month January 2022 and onwards shall need to be electronically submitted by the end of the month following the month in which the withholding was made (i.e. the deadline is the same as the due date of the payment of SDC and GHS contribution withheld).

➢ When should the payment of withheld SDC and GHS be made?

As noted above, the payment of SDC and GHS is due by the end of the month following the month in which the SDC and GHS contribution were withheld.

It should be noted that in case the payments have already been made, these should be reflected automatically in the forms T.D.602 and T.D.603. In case the SDC and GHS contribution is due after the electronic submission of the forms T.D.602 and T.D.603, the relevant liability should be automatically created and reflected in the tax portal system. The payment of the relevant liability can be made via online banking from a Cypriot bank account, or JCC Smart application/website or wire transfer from a foreign bank account.

Additional information:

- The taxpayer has the right to submit multiple forms for the same tax year. The submission of an additional form does not overwrite the prior submitted tax return but rather represents a supplementary declaration (e.g. in case a company made 3 separate dividend declarations during 2020 for different months, then 3 separate T.D.603 forms shall need to be submitted via Taxisnet).

- Forms T.D.602 and T.D.603 can accept negative amounts in relation to prior payments, for which there are grounds for correction, provided that the statute of limitation of 6 years has not elapsed from the withholding date.

- The penalty for failure to submit the relevant forms within the due date will amount to EUR 100 for each form that ought to have been submitted. In addition, in case of delay in payment of SDC and GHS contribution due, a penalty equal to EUR 100 and a flat 5% penalty on the amount due is imposed. Interest is also imposed based on the official rate set by the Minister of Finance calculated based on completed months (the official rate as of 1.1.2020 being 1,75%).

How can we help you?

EY Cyprus can assist taxpayers with the completion and electronic submission of forms T.D.602 and T.D.603 to the Tax Department together with any additional calculations that may be connected with these forms.

EY Cyprus remains at your disposal for any information and/or clarifications required.

Despo Kyrmitsi - Assistant Manager, Direct Tax

-

On 11 May 2021 the Settlement of Overdue Social Contribution (Amending) Law (N.2) (N.102(I)/2021) was published in the official Gazette of the Republic.

The purpose of the amending law is to amend Article 2 of the law so that the overdue contributions subject to regulation include, in addition to the contributions payable in accordance with the Social Insurance Law, the Annual Leave with Remuneration Law, the Termination of Employment Law, the Social Cohesion Fund Law, the fee which is payable in accordance with Article 20 of the Human Resources Development Law, and the contributions payable in accordance with the General Healthcare System Law.

Furthermore, article 5 of the law is now entitled; “Submission of an application to regulate a liability” and provides the following:

1) Individuals and companies, who wish to regulate their overdue social contributions, may submit an application, in the form which the Minister will define through a notification which will be published in the official Gazette of the Republic, within four months from the date of such publication.

2) Individuals and companies who have an overdue social contribution which is not regulated on the date, which is specified by the Minister through notification, are entitled to submit an application in order to regulate their overdue social contributions.

The Law explicitly provides that the following cases may not be subject to a new regulation:

a) Individuals or companies with overdue social contributions which were regulated and subsequently cancelled, and for which an objection is pending with the Minister or for which the period to submit an objection has not lapsed.

b) Individuals or companies, who receive Minimum Guaranteed Income or Public Aid, and for which overdue social contributions were under regulation on the date of publication of the Minister’s notification. Irrespective of the provisions of paragraph a) above, the overdue social contributions for periods of contributions which were under regulation are permitted to be included in a new regulation.

c) The regulation is applied with respect to social contributions which were overdue on the date preceding the date specified by the Minister through notification.

EY Cyprus is at your disposal for any information or clarifications you may require.

Herodotos Hadjipavlou - Assistant Manager, Direct Tax

-

By the end of 2021, it is expected that the transition of multiple Interbank Lending Rates (‘IBORs’), including the London Interbank Offer Rate (‘LIBOR’), will take place. These IBORs are expected to be replaced, to an extent, by Alternative Reference Rates (‘ARRs’). There are multiple implications in the financial systems that may arise as a result of these transitions. The potential impacts on the Transfer Pricing practice will be examined below.

Taking into account the timeframe for the transition from the IBORs to the ARRs, it is important to identify and analyze the impact of the transition to risk-free rates (‘RFRs’) to lenders and borrowers alike.

Overview

In the United Kingdom (‘UK’), the Bank of England has been working to ensure a transition from LIBOR to the Sterling Overnight Index Average (‘SONIA’), a rate produced by the Bank of England. SONIA reflects the average of the interest rates that banks pay to borrow sterling overnight from other financial institutions and other institutional investors.

Moreover, in the Euro area, there is a drive to replace both the EURO LIBOR and Euro Interbank Offered Rate (‘EURIBOR’) by the Euro short-term rate (‘€STR’), which is calculated on the wholesale euro unsecured overnight borrowing costs of euro area banks.

In addition, in the US, the Alternative Reference Rates Committee (ARRC), convened by the US Federal Reserve, has published its Recommended Best Practices for Completing the Transition from LIBOR. The Secured Overnight Financing Rate (‘SOFR’) is the recommended ARR for replacing the USD LIBOR. SOFR represents a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities.

General differences

There are a number of differences between IBORs and ARRs. The first main difference between them is that IBORs represent the rate at which banks believe they are able to lend to and from one another in the interbank market over a specified time period, whereas ARRs typically refer to overnight transactions. Another main difference is that IBORs typically include an element of risk in the form of a credit spread, where RFRs are effectively nearly risk-free rates.

General Transfer Pricing considerations

Immediate focus should be given to intragroup financing transactions considering that IBORs have often been used as underlying rates for intragroup financing arrangements. Considering that for tax purposes transactions entered between related parties (including financial instruments) should be concluded on arm’s length terms, such arm’s length price may have been specified by reference to IBORs (e.g. LIBOR plus a margin).

Following the replacement of the IBORs by ARRs, the terms of both intra-group financing arrangements may need to be reassessed and such terms are expected to be on at arm’s length as at the reassessment date.

Based on the above, taxpayers should determine whether a financial instrument that is amended as a result of the benchmark reform constitutes a variation or rescission of the original financial instrument. This should also be considered in the light of fallback provisions if applicable in the initial loan/facility agreement. By way of example, the discontinuation of an IBOR referenced in a loan facility and its replacement by an agreed alternative benchmark may result in changes to the amount payable under the facility. It is unclear how the increase in the loan amount will be treated for tax purposes.

In addition, the appropriate ARR should be selected for each financial instrument (i.e. in line with guidance from relevant associations, tax authorities etc.). Another implication that should be considered is the potential adoption of timing differences between jurisdictions as well as differing views on the acceptability of each ARR. Such deviations may result to a mismatch of acceptable rates and/or their treatment from a tax perspective in each jurisdiction.

Depending on the circumstances, the transfer pricing documentation of such financial instruments may need to be updated in order to reflect the change from IBORs to ARRs and/or new documentation should be prepared in order to support the financial agreements to be entered into from an arm’s length perspective.

More specifically, considering the Transfer Pricing Circular issued by the Cypriot tax authorities applicable as of 1 July 2017, where for example, a third-party financing institution is involved in the provision of variable interest rate financing (with an IBOR used as the floater) to a Cypriot financing entity that uses the loaned funds to grant variable interest rate financing (with that same IBOR used as the floater) to related parties, the intragroup use of IBOR may need to be investigated. The financing institution may amend the respective ARR based on a fallback provision included in the existing agreement, effectively exposing the group’s financing vehicle to additional risks due to the floater rate mismatch.

The impact of the transition is not restricted to typical lending transactions, but it has a wider impact. For example, currency derivatives will also be affected (the ISDA Benchmarks Supplement may be incorporated in derivatives transactions).

Finally, consideration should be given in cases where a taxpayer has obtained advanced pricing agreements (‘APA’) or rulings regarding specific intragroup transactions, as the applicability and/or validity of an APA or ruling may be challenged due to the discontinuation of the relevant IBOR or lack of acceptability of the underlying IBOR.

Takeaway points

There still remains a high degree of uncertainty around LIBOR transition. The transition could have a number of impacts on market participants. These impacts include possible changes to contractual documentation, adaption of operational processes/IT systems, changes to the value of products or the possibility of products no longer serving the purpose for which they were intended. Interesting parties should contact their professional advisors on the possible implications of the changes such as financial, legal, accountancy or tax consequences.

Charalambos Palaontas - Director, Transfer Pricing

Timotheos Ioannou - Senior, Transfer Pricing Services

-

Introduction

Further to our prior Tax Newsletters issued in relation to the Procedure for Settlement of Overdue Taxes Law (L.4(I)/2017) (“Law”), we would like to inform you that on 29 April 2021 law 79(I)/2021 (“Amending Law”) was published in the Official Gazette of the Republic, which in effect provides for the settlement of overdue taxes relating to the tax years 2016 – 2019 (both years inclusive) under certain conditions.

Specifically, the Law has been amended to capture periods up until the 31 December 2019, provided that the taxpayer falls under any of the following categories:

- Companies and self-employed persons subject to Value Added Tax (“VAT”), which present a decrease in their turnover for the year 2020 compared to 2019, by at least twenty five percent (25%), due to the restrictive measures taken to address the effects of the COVID-19 pandemic and;

- Companies and self-employed persons who are exempt from the obligation to register for VAT purposes (Approved Private Tutoring, Conservatories / Music Schools and Schools of Dance), which present a decrease in their turnover for the year 2020 compared to 2019, by at least twenty-five percent (25%), due to the restrictive measures taken to address the effects of the COVID-19 pandemic.

Furthermore, should a taxpayer decide to enter into an arrangement for the settlement of its overdue taxes relating to periods up until 31 December 2019, they will need to do so within 12 months from the date of enactment of the Amending Law (i.e. by 29 April 2022).

It should be relevant to note that unlike the provisions applicable for the settlement of overdue taxes for periods up until 2015, where the taxpayers have the right to apply for regulation within six months from the date that any future assessment is issued, the Amending Law specifically provides that no such regulation is possible for any future assessments to be issued that relate to the period 1 January 2016 until 31 December 2019.

Moreover, should a taxpayer decide to enter into an arrangement under the provisions of the Amending Law, they will need to file relevant tax returns by 31 December 2021.

Finally, even though an arrangement created by a taxpayer should automatically be cancelled in case 5 instalments are not paid, the Amending Law provides that any due instalments relating to the period from 1 March 2020 to 31 December 2020 should be ignored for this purpose.

Our team remains at your disposal for any additional information and support you may need.

Michalis Karatzis - Manager, Direct Tax