EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Insights

Asking the better questions that unlock new answers to the working world's most complex issues.

Services

EY helps clients create long-term value for all stakeholders. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate.

Industries

Discover how EY insights and services are helping to reframe the future of your industry.

See more

Case studies

Strategy and Transactions

How a cosmetics giant’s transformation strategy is unlocking value

13 сент. 2023Nobuko Kobayashi

About us

At EY, our purpose is building a better working world. The insights and services we provide help to create long-term value for clients, people and society, and to build trust in the capital markets.

See more

Top news

Press release

09 Apr 2024Michael Curtis

Press release

EY announces acceleration of client AI Business Model adoption with NVIDIA AI

20 Mar 2024Barbara Dimajo

Press release

EY announces launch of artificial intelligence platform EY.ai following US$1.4b investment

13 Sep 2023Rachel Lloyd

Recent Searches

Trending

-

2025 Global IPO market key highlights and 2026 outlook

The EY Global IPO Trends covers news and insights on the global IPO market for 2025 and an outlook for 2026. Learn more.

17 Dec 2025 IPO -

How can the moments that threaten your transformation define its success?

Leaders that put humans at the center to navigate turning points are 12 times more likely to significantly improve transformation performance. Learn More.

15 Apr 2024 Consulting -

EY.ai - a unifying platform

EY.ai, a platform that unifies human capabilities and artificial intelligence to help you confidently adopt AI. Learn more.

16 Nov 2023 AI

Indirect taxes, particularly customs duties, are often hidden within COGS and cannot be seen, but the managed amount is often larger than that of direct taxes. So it’s wise to keep an eye on it.

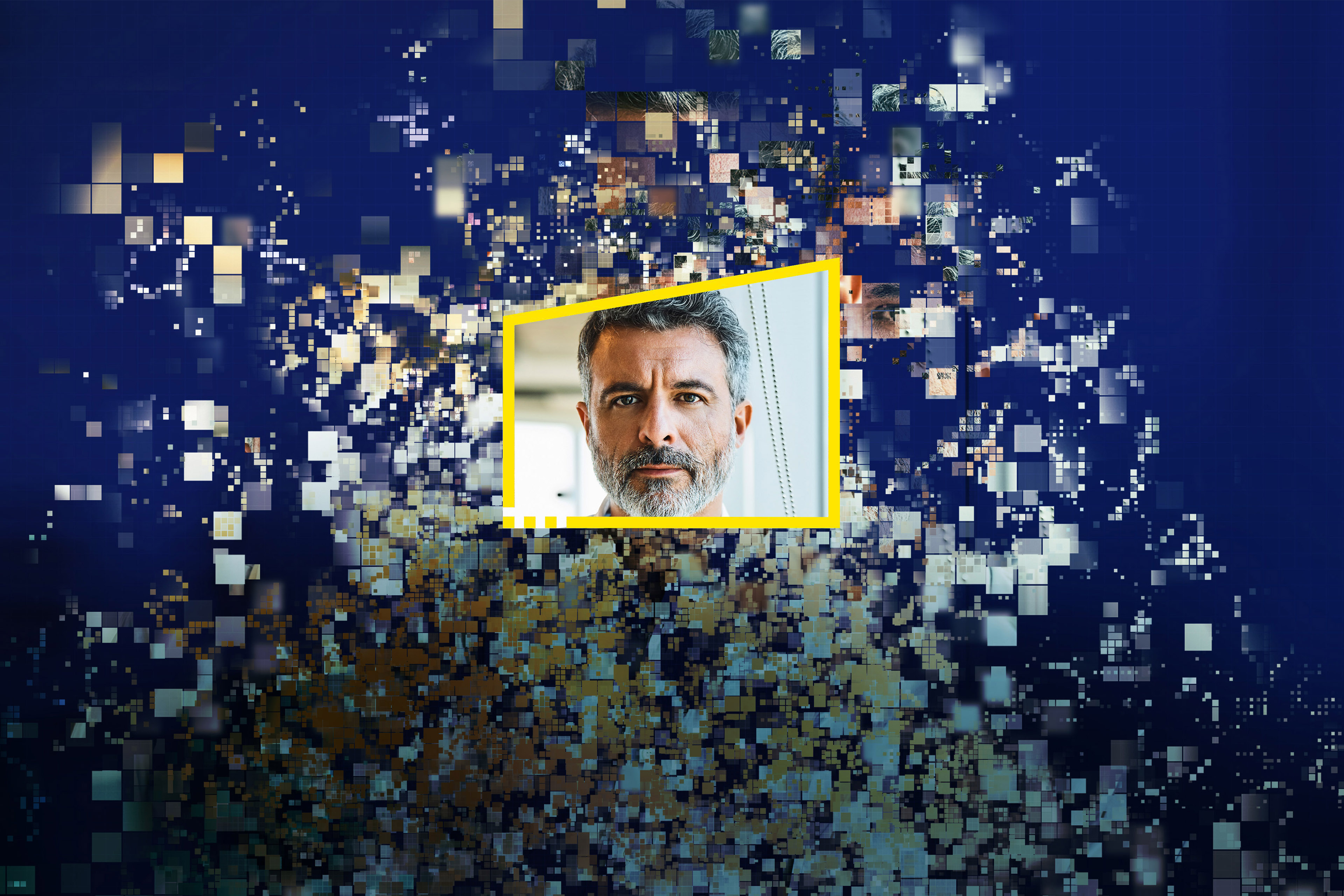

Yoichi Ohira

EY Japan Indirect Tax Leader; Partner, Ernst & Young Tax co.

Providing practical, results-oriented services that companies can immediately put into action.

As the EY Japan Indirect Tax Leader, Partner, Yoichi helps manage EY Customs and Global Trade, Consumption Tax and Outbound VAT/GST services.

Having managed global indirect tax in industry for more than a decade, he has extensive experience leading indirect tax planning projects for multinational companies, including designing and assisting in implementing supply chain strategies around free trade agreements, customs valuation planning, utilization of indirect tax relief measures and VAT/GST/JCT optimizations.

He works across sub-service lines to provide multidisciplinary services such as customs and transfer pricing harmonization, SCM improvement and due diligence/post-merger advisory.

A frequent contributor to various Japanese publications on indirect tax matters, Yoichi is also a lecturer on indirect taxation at Keio University's Law Faculty and Waseda University Graduate School of Accountancy. He earned a BA in Law from Keio University, Japan.

How Yoichi is building a better working world

In an ever more uncertain world where forces for trade protectionism and free trade are constantly colliding, Yoichi helps clients navigate through the uncertainty. He does this by increasing trade visibility through the use of analytics tools, reducing indirect tax costs in clients’ global supply chains through various planning ideas and improving access to emerging markets by providing local insights, which all helps to bring products at affordable prices to end consumers around the world.