EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

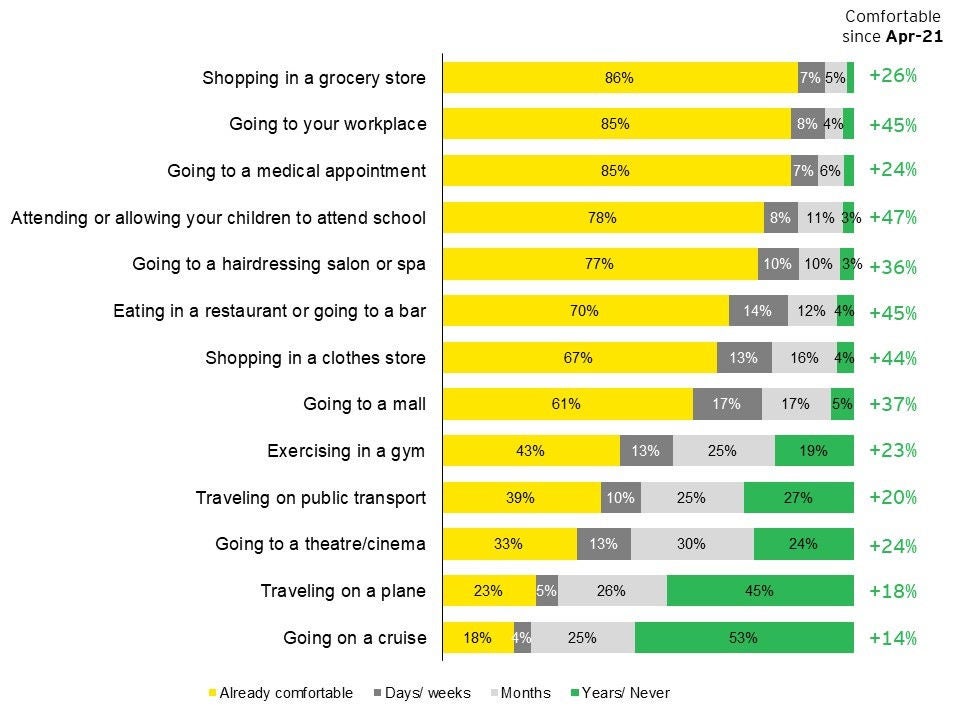

The 4th EY Future Consumer Survey tells us that people are feeling the highest levels of comfort in carrying out various activities since the start of the pandemic – an important outcome from the continued roll-out and take up of the vaccination programme locally.

While current attitudes seem to have become more optimistic, our research in July 2021 indicates several behavioural changes that may have a lasting effect. Around 57% of respondents expect to keep working from home more often, 51% will shop online, and 42% of respondents will replace international vacations with domestic travel. Spending considerations are also emerging that need to be considered carefully. 64% of respondents will focus on value for money, while 34% expect to save more than before the pandemic. 58% say that they will be cautious about their spending.

How long will it take you to feel comfortable doing the following?

Consumers indicate an evolving perception on company behaviour, with 25% of respondents saying that companies have a role to play in making positive change and 24% who expect companies to be more transparent about their environmental impact. At a global level, the EY Future Consumer Index suggests 43% of global consumers want to buy more from organisations that benefit society, even if their products or services cost more. And 64% are prepared to behave differently if it benefits society. Consumers often say they will pay more for sustainable products and services, but then don’t support that intention with action. As the world slowly emerges from the pandemic, there are signs this gap will close. That would create a major growth opportunity for consumer-facing companies. But they need to transform now to seize it. In particular, they need to create products that reflect the nuanced concerns of target consumers, and they need to make sure the business operations behind the brand meets those expectations too.

How can CEOs respond? These five strategies will help your organization give consumers the sustainable products they increasingly want, at a price they are willing to pay, while meeting their evolving expectations about how companies should behave:

Embrace sustainability as a driver of value creation

How are you changing the culture in your organization so people see sustainability as a way of growing the business, finding efficiencies and creating new value pools – not just a cost? Globally, 54% of consumers have reduced or stopped altogether purchasing from organizations they believe acted inappropriately on environmental or social issues. This isn’t just a turn away from brands that are part of the problem; it’s a turn towards those that are an active part of the solution:

- Position your purpose-led brands for growth. Sustainability is a differentiating factor that drives growth. Even if most consumers are unwilling to pay more for sustainable brands, they are still more likely to buy them than alternatives.

- Invest in sustainable practices that drive efficiency. Products that produce less waste or fewer emissions, and last for longer can drive down costs, making sustainability more affordable for the consumers.

- Create value, don’t just avoid harm. The sustainability agenda is focused on reducing negative impacts. But a more regenerative mindset actively creates value. This is about designing new products, services and business models that can profitably serve people and the planet as part of a circular economy.

Take a holistic perspective, but act on what matters to your business

How are you balancing the need to track your performance on sustainability issues against the need to deliver a broader vision? Individual ethical, social and governance metrics and targets need to be met, but it’s their collective impact that drives change. And consumers expect you to make a difference on issues that are beyond the traditional remit of a business. For example, globally, 38% say ending poverty should be a priority for their country, the world as well as for businesses.

- Think beyond single-issue sustainability. Sustainability isn’t just about the climate and the natural world. In different markets consumers prioritize diversity, inclusion, inequality, labour practices, health and safety and modern slavery differently. All these issues are important, but companies perform better when they focus on what matters to their specific business activities.

- Consider the interdependency of issues. Carbon has been the focus of many companies over the last two decades but carbon is linked heavily to other priorities such as waste, water intensity, plastic pollution and biodiversity.

- Build expertise but avoid siloes. Sustainability is a complex and involving issue. Your response needs to be led by people with deep expertise in this rapidly evolving area. But make sustainability part of your company culture, not a standalone business function, and embed it into decision-making so everyone is working towards a common goal.

Be authentic and be prepared to prove it

How are you making your organization more transparent, so people can see what’s behind your products and how you really do business? This is an opportunity to lead the market and build trust among the 80% of global consumers who expect brands to be transparent about their environmental impact. It’s important to use the most appropriate data to demonstrate progress and to leverage technology to provide the transparency and traceability consumers increasingly demand.

- Set ambitious, measurable and credible targets. Companies will be punished for vague commitments they can’t evidence and for underdelivering against targets that could never realistically be achieved.

- Use non-financial KPIs. Measure progress using the most appropriate, clearly defined metrics that are aligned to your incentives.

- Be open and honest with all your stakeholders. People will be more forgiving of a company that openly tries to address shortcomings than one that brushes over them with high-profile, low-impact initiatives.

Drive positive impact across the value chain

How are you getting more visibility into the behaviour of your suppliers and partners and their impact on sustainability issues? Companies set global targets but often must rely on local, piecemeal execution. Many are exposed to financial, regulatory and reputational risks from upstream and downstream impacts that they cannot always see or control. Yet 68% of global consumers say businesses must ensure all their suppliers meet high standards of social and environmental practices.

- Scale successful initiatives across the business. Leaders need to ensure that high-profile achievements in one function are scaled widely.

- Look beyond your immediate activities. Companies are judged not just on their own activities but on the impact their products and partners have throughout the product life cycle. Technology-enabled transparency can measure, improve and support more sustainable activities.

- Collaborate for systemic solutions. Many companies face challenges that can best be resolved by working together and sharing responsibility. Find opportunities to work with others – even competitors – on issues that have a global impact.

Re-design your operating model for sustainable execution, then build it fast

How are you creating the flexibility needed across all your operations to meet and shape evolving consumer expectations around sustainability? This isn’t just about reducing cost. For example, 27% of global consumers would pay more for products that ensure safe and inclusive labour conditions and fair employee pay.

All these strategies are an opportunity to rethink how you create and measure both value and impact. Your operating model needs to efficiently support not one or a few business models, but a plurality of new strategies for staying relevant to the consumer. Tomorrow’s operating model should incorporate these five design elements:

- Dynamic ecosystems that foster profitable agility

- A listening organization built on data and analytics for real-time decision making

- Talent flexibility that reimagines how people do their work

- An innovation platform that fosters ideas that can scale

- An enduring purpose that drives all decisions and activities

Methodology

The 4th EY Future Consumer Survey Malta was carried out in July 2021 across a stratified random sample of 1,038 participants. The survey is conducted periodically to capture changes in consumption and consumer behaviour.

Gilbert Guillaumier is an Associate Partner at EY Malta within the Strategy and Transactions team.