EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

EY Better Credit: credit-decisioning and customer management services

What EY can do for you

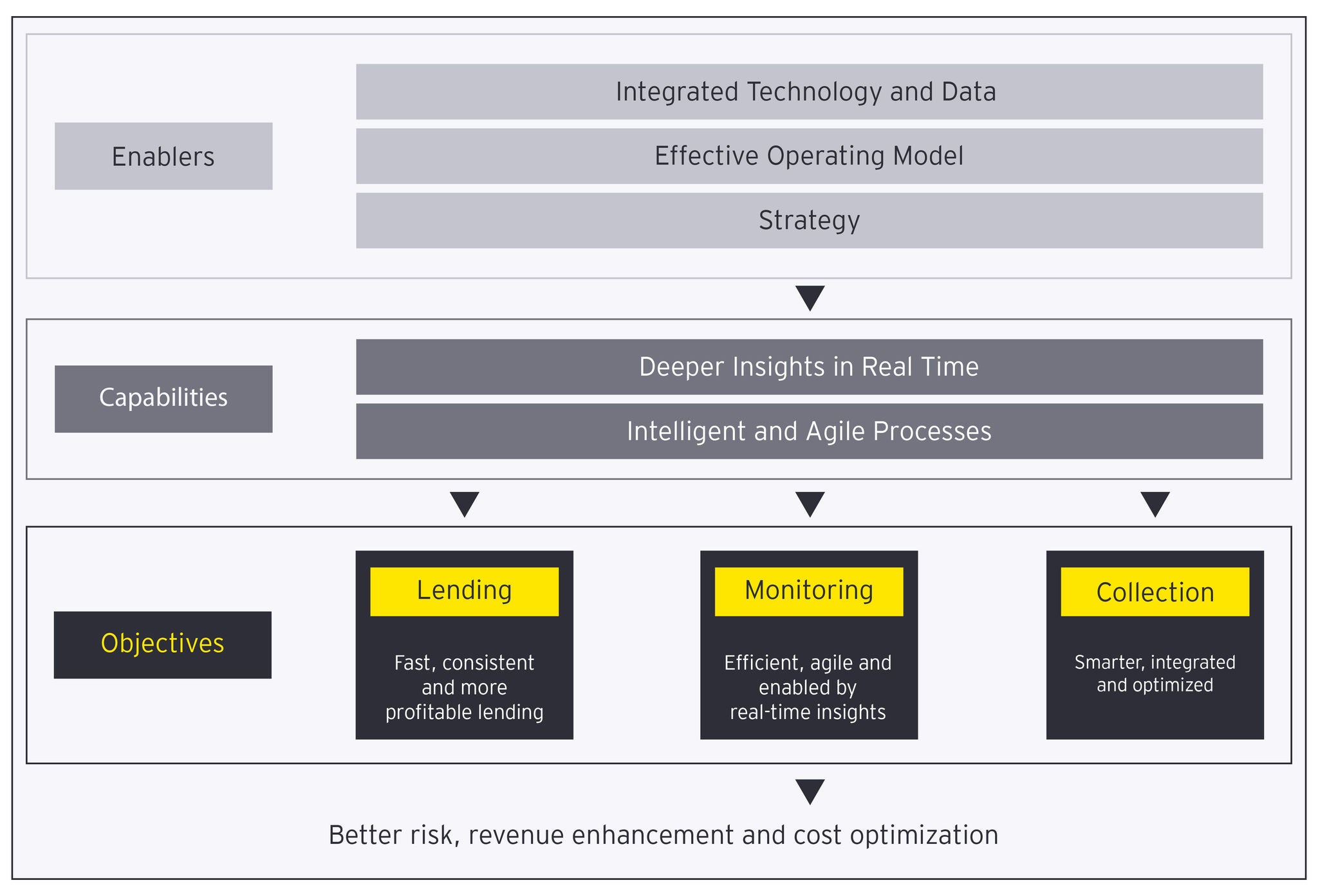

The EY organization collaborates with banks and other lenders to provide more insightful, efficient and profitable lending by developing and enhancing capabilities across the credit lifecycle, including:

- Broad credit risk frameworks, strategies, appetite and policies

- Advanced decisioning capabilities

- Operating models and credit process automation and digitization

- Real-time credit insights and monitoring (including early warning systems)

- Improved collections strategies and analytics

Better credit solution

We support banks that lend to SMEs to help accelerate transformation journeys by leveraging our specific knowledge of credit transformation, extensive delivery experience and flexible delivery models, including on-shore and lower-cost delivery hubs. EY offerings include:

Transformation strategy, vision setting and design

EY teams can develop credit decisioning visions, target state designs and roadmaps, incorporating third-party strategies.

Business capability delivery

EY teams offer various delivery models to assist clients in developing and implementing business capabilities across the credit lifecycle, such as:

- Broad credit risk frameworks, strategies, appetites, methodologies and policies

- Advanced decisioning frameworks and better lending strategies, decision model development, use of non-traditional data and innovative approaches to improving the quality and consistency of manual decisions

- Digitization, intelligent processes, automation solutions and operating models

- Credit monitoring frameworks that help deliver near real-time credit insights, including early warning systems and instant analytics

- Help in optimization of collections strategies, analytics to support better customer outcomes and innovations in case management

Program and delivery model support

EY teams provide transformation program mobilization and design, including governance setup, business case and benefit management, and resource and location optimization.

Transforming decision frameworks is a complex task involving multiple departments. It’s critical that there is collaboration between business, risk and delivery stakeholders to help enable the delivery of positive business outcomes. An agile approach, multi-skilled delivery pods and effective planning and governance can help manage costs and provide an early view of outcomes. A robust and well represented design authority helps navigate trade-offs and compromises while helping ensure alignment to the transformation vision. The EY Better Credit solution can support banks who lend to SMEs with credit-decisioning and customer management across the broad credit lifecycle.

The team

Our latest thinking

How a global FinTech captured growth in the SME segment

A global Fintech captured growth in an opportunistic SME segment with a differentiated, holistic strategy. Learn more in this case study.

How SME lenders can build next-generation credit decisioning

Discover the key factors and design principles for a framework that improves speed, quality, and customer experience.

How a new technology platform can help banks unlock financing for SMEs

The Cashbot platform offers banks an online invoice finance solution for SME clients.

Why digital lending is the future for banks and SMEs

Banks can serve and understand small businesses better through a modern digital credit process that is data-led and can deliver funds quickly.