EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Greek businesses are currently faced with a fragmented consumer base.

EY’s Future Consumer Index Greece 2023 confirms that the basic trends recorded in the past two years, in the Greek, as well as in the index’s various global iterations, are being consolidated, and, in many cases, intensifying. In a permacrisis environment of prolonged instability and uncertainty, consumers come under pressure from different directions and react in different ways. Inflation, economic slowdown, international conflicts, anxiety about physical and mental health, concerns about climate change, as well as the need to decompress and seek new experiences, are shaping new consumer behaviors and values.

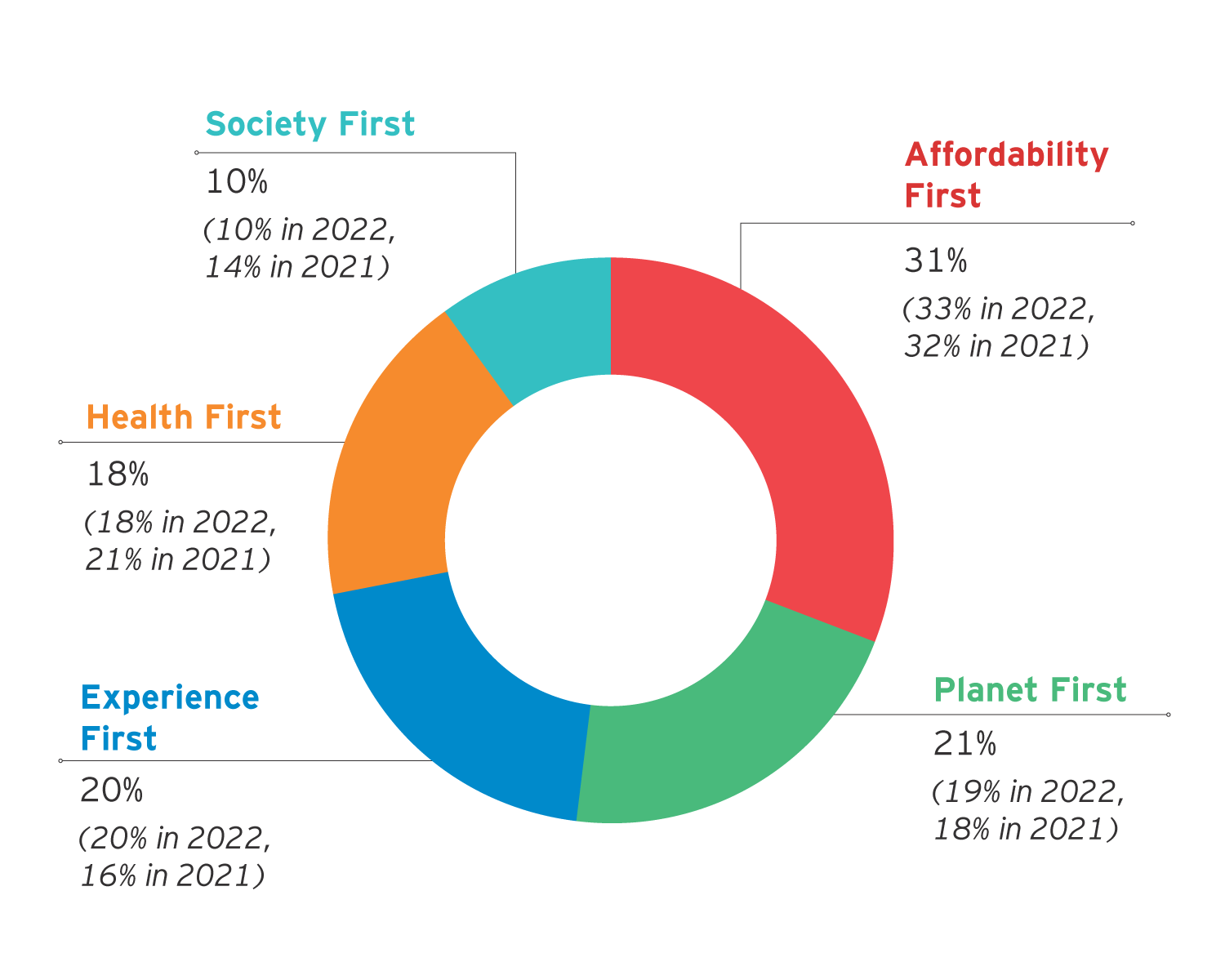

These concerns are clearly reflected in the five consumer groups monitored by the Greek, as well as the global survey: One in three consumers (31%) is trying to "get by" through sensible financial management, focusing on the price and affordability of products (Affordability First). Consumers prioritizing the environment and the planet (Planet First – 21%) have emerged this year, for the first time, as the second most numerous group, while, if one takes into account those who are concerned about the social impact of their choices (Society First – 10%), their total share equals that of the dominant group, who primarily worry about their finances. Consumers who are mainly looking for experiences (Experience First – 20%) are another strong minority, as are those who are still concerned about their health (Health First – 18%).

Cost of living and rising prices remain dominant concerns, driving purchasing decisions

The combined pressure of economic slowdown and inflation on the purchasing power and the psychology of consumers, is clearly reflected in the survey’s findings. The answers by Greek consumers are in line with those of consumers worldwide, as recorded in EY’s global Future Consumer Index, but give a more optimistic picture compared to Italy and Spain. 56% of consumers in Greece (vs. 58% globally, 57% in Europe, 71% in Italy and 73% in Spain) say they are very concerned about the increased cost of living, and 40% (vs. 47% globally, 40% in Europe, 63% in Italy and 61% in Spain) about the economy in general. At the same time, two in three (69%) expect the problem of the increased cost of living to intensify in the coming months, while two in five (38%) believe that their finances will deteriorate in the next year.

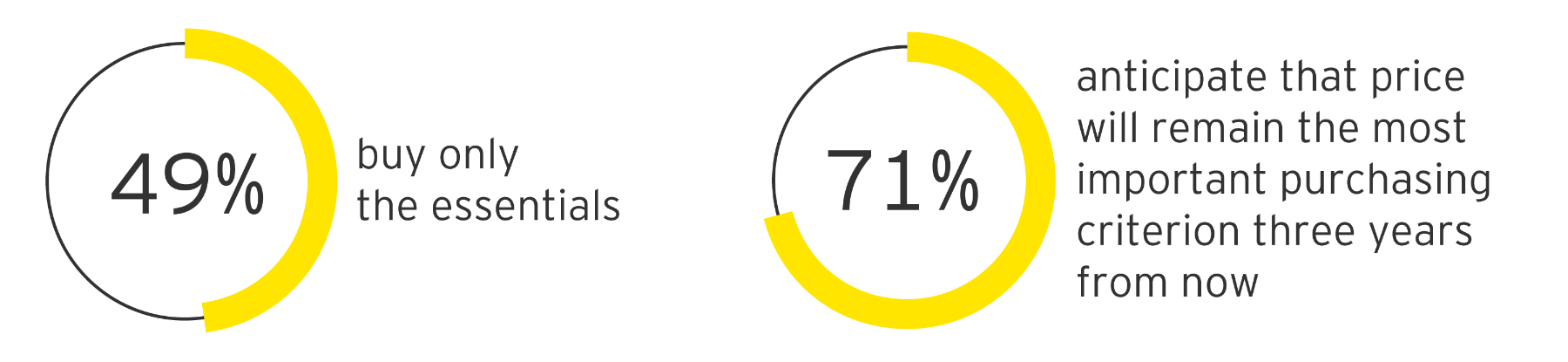

One in two (49%) say they only buy essentials, one in five (19%) struggle to meet basic costs such as food, healthcare and housing, and one in ten (12%) say they rely on government support and benefits to make ends meet. Price remains today, by far, the most important purchasing criterion for all product categories, while 71% of respondents estimate that it will remain the most important criterion three years from now.

Faced with increased prices, and depending on the type of product, many consumers choose to buy less, or switch to cheaper alternatives or, to a lesser extent, may stop buying certain products. However, a significant share say they have not changed the way they buy products, particularly for essentials such as food and household items.

As in the rest of the world, under the influence of financial constraints, the traumatic experience of the pandemic, as well as concerns about the environment, a significant share of consumers seem to be adopting a more restrained and responsible consumer behavior. One in two (51%) report that their values and the way they look at life have changed in the last year. 85% say they make an effort to not waste food, and 59% are more likely to repair something rather than replace it, while 44% say they feel less pressure to keep up with the latest fashion trends. Three in four (76%) say they will be more aware and cautious about their spending in the future, and two in three (68%) say they will be more focused on value for money in the future.

Food, travel and technology

Three spending categories appear to be resisting consumers’ current frugal mindset. Food – fresh and frozen – is the first in this group of three, where almost three out of four consumers report that their household spend will not change (58% and 53%, respectively), or that it will even increase (16% and 18%).

Consumers are also in a mood for travel and tourism, with two out of three (67%) reporting that they are planning a vacation / holiday for the next six months. This percentage is even higher (84%) among young people aged 18-29, half of whom (48%) plan to travel abroad. It is worth noting that two out of three will spend about the same (36%), or more (27%) than they usually spend.

Finally, three out of four respondents (74%) say they intend to buy technology products or electrical appliances in the next year, confirming that technology is now an integral part of consumers' lives.

In the last two categories, the resilience of consumption can be attributed to an attempt by consumers to relax and decompress post-pandemic, as well as to a strong tendency to seek new fulfilling experiences.

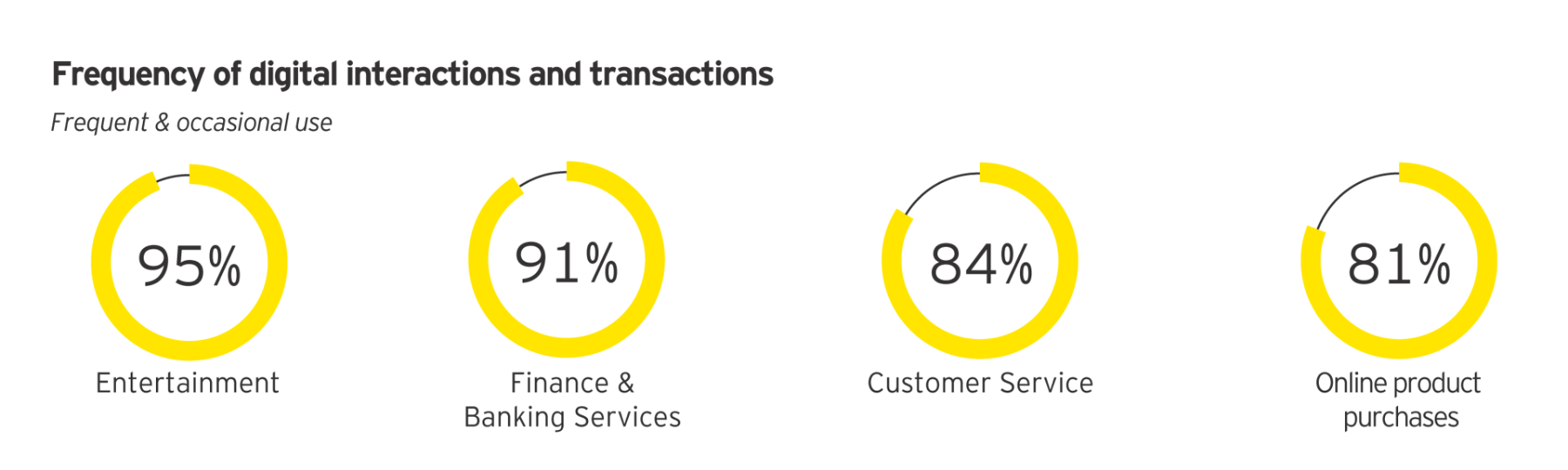

The use of online services is increasing, centered on the household

At the same time, the penetration of the use of online services, interactions and transactions in consumers’ daily lives is increasing. 95% of respondents report that they have used the internet for entertainment and 91% for financial or banking services, often or sometimes, in the last three months. A significant share of consumers has also used online customer service (84%) or shopped online (81%), while over half went online to plan their vacations, or for professional and personal services.

Online shopping has now established itself as a key shopping channel for a significant share of consumers, across all age groups, as they are more familiar with online tools, and businesses have overcome the initial adaptation problems created by the pandemic. Slow delivery / shipping is now a problem for just one in five consumers, down from one in two in 2021, while the main obstacle today appears to be expensive delivery / shipping (43%) and, to a lesser extent, the difficulty of changing products.

The increasing penetration of online shopping is also linked to consumers’ intention to put their household at the center of their daily lives in the future, spending more time at home (29%), cooking more at home (39%) and focusing their entertainment on their home (28%). Therefore, the home tends to become a hub, around which more and more activities will revolve in the future.

However, although one in two consumers have a positive attitude toward online shopping, a significant minority (27%) remains less positive. The challenge here for businesses is to develop multichannel models so that consumers can enjoy the benefits of both physical stores and online searches and purchases, combined, particularly from where they choose to interact with brands. At the same time, it should be noted that cost and search for discount opportunities are, at this stage, the main driving force behind the development of e-commerce, combined, always, with convenience and greater experiences.

Brand loyalty is decreasing as consumers turn to private label products, except for food

The financial pressure created by high inflation and the need to seek cheaper alternatives has had a negative impact on consumer brand loyalty. One in two (53%) say brands are a less important factor in all purchasing decisions today, while only one in ten (11%) cite a product’s brand as one of the most important purchasing criteria three years from now. Only 16% are willing to pay more for brands they trust.

One in two consumers (51%) have changed the brands they buy, with most of them (38%) turning to private label products, aligning their buying habits with the international practice. Willingness to buy private label products is particularly strong for home and household care products (55%), in line with the survey’s global sample, apart from fresh (35%) and packaged (30%) food, where Greek consumers appear more reluctant to give up branded products.

Consumers are concerned about physical and mental health…

Three years after the outbreak of the pandemic, health issues are still a concern for consumers, but to a lesser extent (61%) than the cost of living (73%) and personal finances (64%). For many categories, particularly food and personal care products, a product being healthy and good for the consumer remains the second most important purchasing criterion after price, with one in four (26%) saying they would pay more for products that promote health and wellness.

At the same time, after three years of continuous restraints and changes in everyday life, mental health emerges for many as a key concern, especially for women and younger generations. 38% of respondents in Greece are concerned about their mental health, well above the global sample and close to the 39% who say they worry about their physical health. 19% of consumers estimate that their mental health will deteriorate in the coming months, compared to 13% who believe the same about their physical health, while 68% report that they will be more aware and cautious about their mental health and 73% about their physical health.

...and seeking experiences

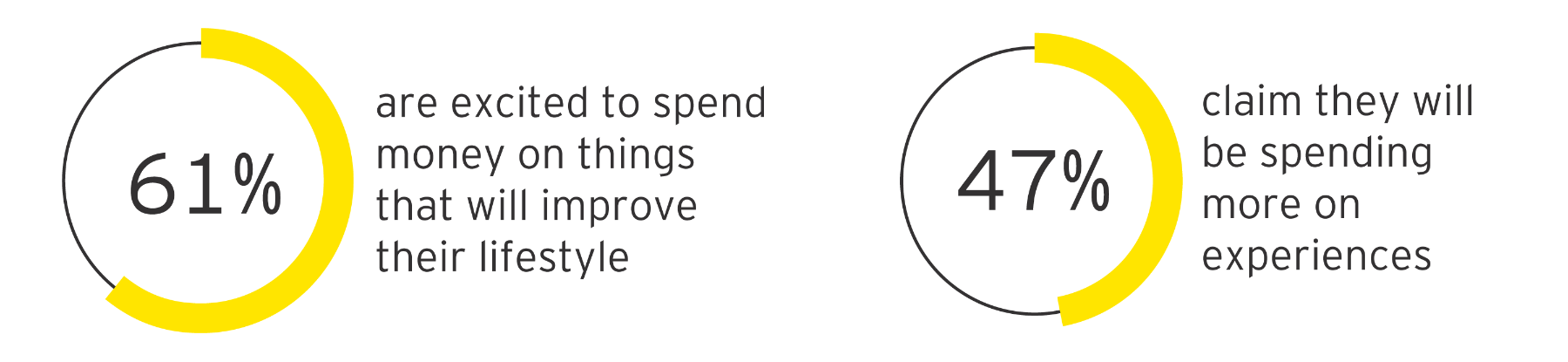

Despite the economic uncertainty, or perhaps because of it, many consumers feel a need to release their stress and are looking for experiences, focusing on themselves and on the present. 61% report that they are excited to spend money on things that will improve their lifestyle, and 58% that they will live more for the moment, without making long-term plans. 47% say they will spend more on experiences and 44% are excited to spend money on things they haven’t been able to do before. Quality of service (29%) is seen as the third most important purchasing criterion three years from now, and second among those under 39.

A focus on sustainable development, but always with economic constraints in mind

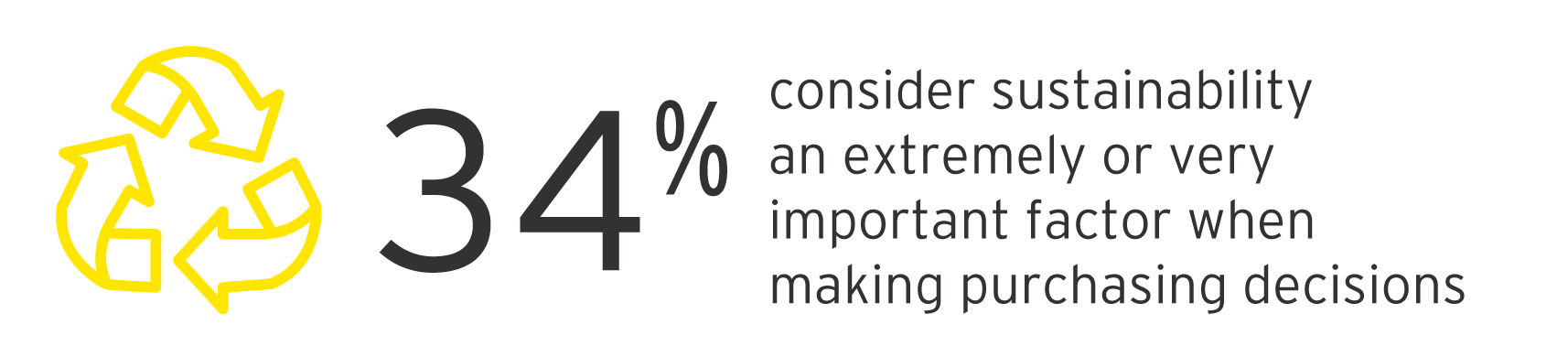

The equation for businesses becomes even more complex when considering consumers' concerns about the social and, especially, environmental impact of their purchasing choices.

One in three consumers (34%) state that sustainable development is extremely or very important when making purchasing decisions. However, when consumers are asked to list their purchasing criteria, issues such as sustainable packaging, ethical sourcing or production, and a product being organic or good for the environment, are ranked among the least important, for a number of product categories.

At the same time, a sizeable share of consumers state that they are adopting practices and behaviors in an effort to make their lifestyles more sustainable. However, they appear to be focusing on practices that will also help them save money, raising some questions about the actual motives.

Interestingly, as in last year's survey, more than two in five intend to reduce (37%) or stop (7%) purchasing sustainable products in the next year, compared to just 15% who will increase or start purchasing such products. High price (72%) and low quality (50%) are seen as the main deterrents. However, consumers also cite several reasons that highlight a strong mistrust in businesses and their claims regarding sustainable products, such as lack of information availability or transparency, deceptive marketing or misleading information about the product, and lack of trust in the company, the store or the brand.

Therefore, in order to appeal to this segment of consumers who prioritize the environment and society, companies must ensure that their prices are affordable and, at the same time, reassure consumers about the quality of their products, as well as the reliability of the claims concerning their sustainable characteristics.

Download the EY Future Consumer Index Greece 2023 Survey, in Greek

Summary

The economic slowdown and inflation are restraining consumption and intensifying pessimism for the future, while concerns raised by the traumatic experience of the pandemic remain. Many consumers are becoming aware of the environmental and social impact of their purchasing choices, but seem reluctant to spend more in this direction, while others seek relief through new experiences. The shift to online shopping is intensifying, while brand loyalty is faltering. In order to support their products in this complex environment, Greek businesses should support consumers, decipher their many and varied concerns and expectations, and implement targeted strategies that will allow them to grow and stand out.