EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Limited, each of which is a separate legal entity. Ernst & Young Limited is a Swiss company with registered seats in Switzerland providing services to clients in Switzerland.

As central bank digital currency (CBDC) moves up the global agenda, we explore the why, what and how of digital currency projects.

In brief

- What has triggered interest in CBDC?

- How does CBDC differ from cryptocurrencies, and where’s the overlap?

- How could CBDC work in practice?

When Joe Biden signed an executive order to explore digital currency operated by the US central bank, he catapulted the topic of regulated digital currencies onto the world stage. While the scale of interest is new, central bank digital currency has been the subject of economic and technology research for several years – well before the President’s public interest in a possible digital dollar. Implementing a national or even transnational digital currency is a complex undertaking due to the associated technical challenges. Besides issues such as counterfeit protection, (un)traceability and prevention of money laundering or double spending, the current discussion is strongly influenced by the socio-economic effects of technical design decisions. Whether designed as a retail or wholesale solution, CBDC need to consider all these aspects in order to build trust with their users.

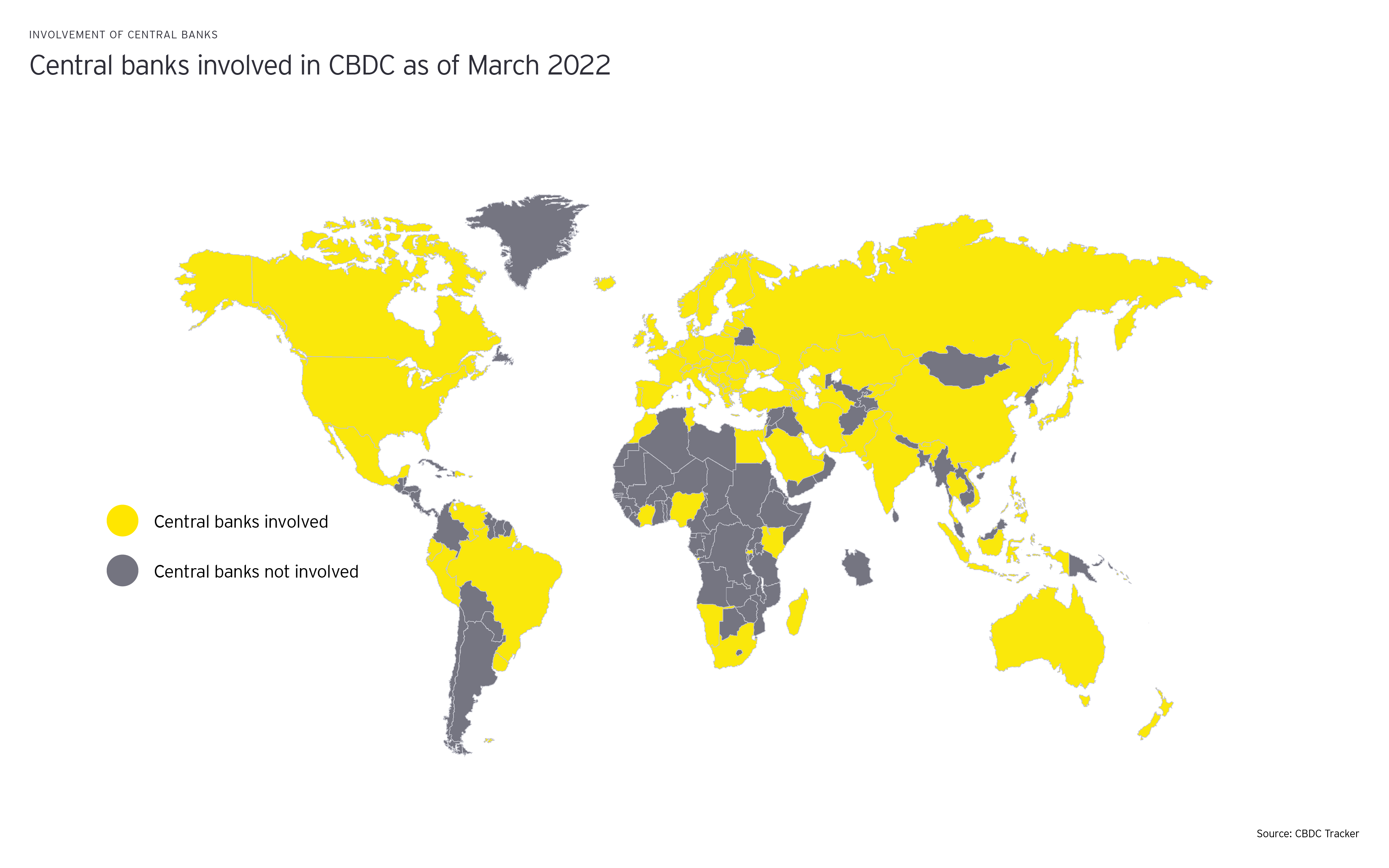

A large number of central banks around the world are already working on the implementation of a CBDC setup, conducting research on the subject or have commissioned assessments. Such projects are under way at the central banks of the US, EU, Switzerland, Sweden, India, Ukraine, Bahamas, China and Nigeria, to name just a few.

In this article, we explore three key questions around CBDC:

- What has triggered interest in CBDC?

- How do CBDC differ from cryptocurrencies, and where’s the overlap?

- How could CBDC work in practice?

Along the way, we share information, use cases and technical considerations to help you understand the intricacies of this emerging topic.

Question 1

What has triggered interest in CBDC?

CBDC is moving up the global agenda as the need for regulation grows.

The financial sector has faced growing regulatory challenges in recent years. Triggered by the financial and economic crisis, the need for stronger regulation became clear. Bitcoin has been the counter design to the existing payment system since 2009, driven by the same reasons but with the aim of excluding, rather than supporting, the traditional players of this sector. The idea of breaking away from the existing financial service providers and creating a payment system without central intermediaries is based on a mistrust caused by the financial crisis.

However, the decentralized structure of the underlying blockchain technology also makes it difficult to regulate cryptocurrencies such as Bitcoin. Initially little used and barely registering on the regulatory radar, Bitcoin and other cryptocurrencies are increasingly finding themselves the focus of regulatory authorities as use becomes more widespread.

Recognizing the need for digital currencies, most of the world’s central banks have commissioned research and projects on CBDCs in recent years. This is based on the desire to establish a regulated and controllable digital currency – and part of the push back against the uncontrolled cryptocurrency sphere.

Question 2

How do CBDC differ from cryptocurrencies, and where’s the overlap?

CBDC is often associated with cryptocurrencies, but the two concepts are highly different.

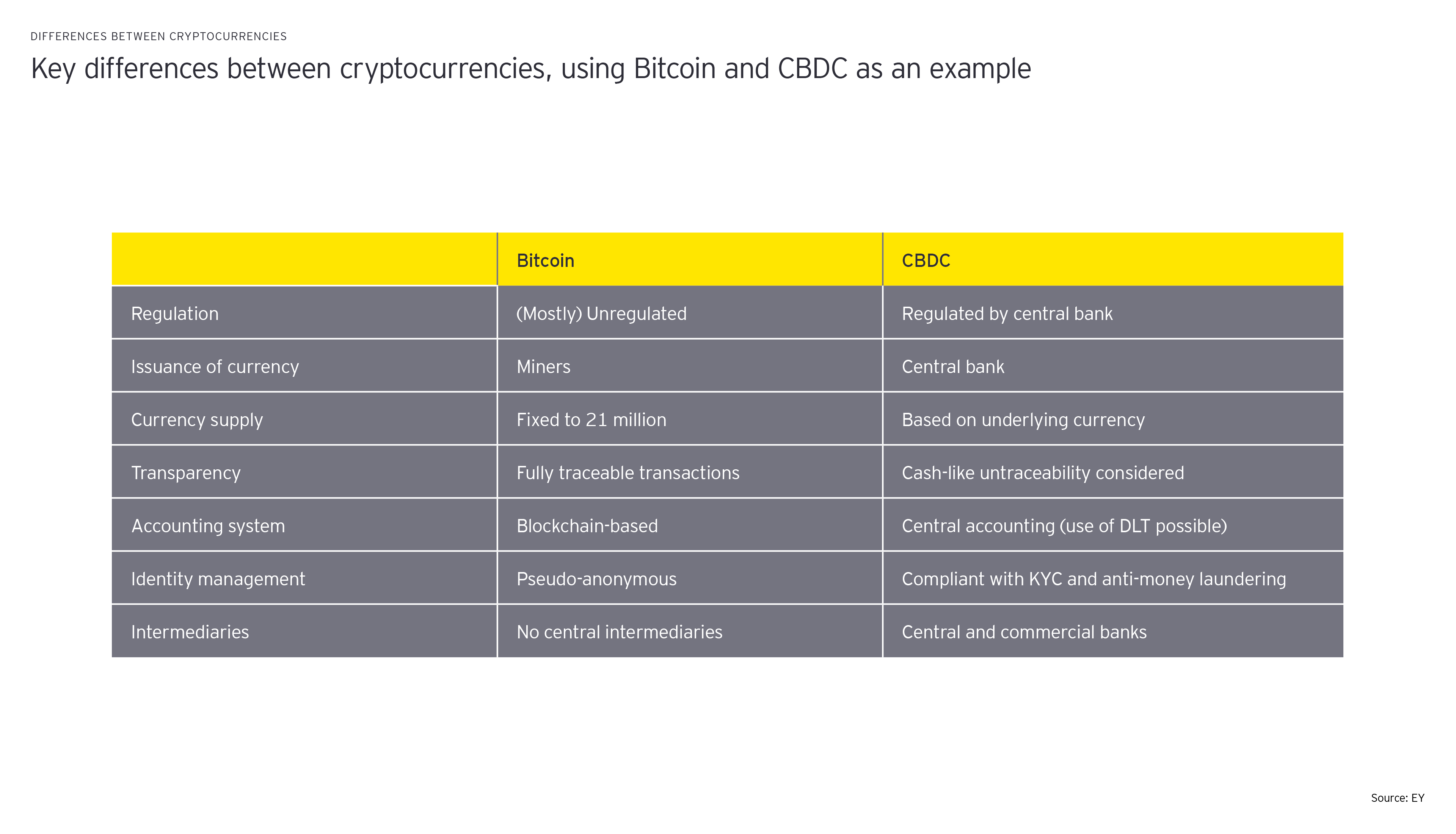

Blockchain technology is often one of the first things many people think of in connection with CBDC. The table below sets out the key differences between cryptocurrencies, using Bitcoin as an example, and CBDC:

Although the use of blockchain technology can provide some transparency benefits, it also goes hand in hand with scalability and efficiency hurdles. So while there is a potential role for blockchain in CBDC, there are fundamental differences between the two concepts. The following case study examines the use of Blockchain in retail CBDC to illustrate this point.

As the case study above shows the use of Blockchain in CBDC needs to be evaluated carefully. Regardless of the choice of infrastructure, the technical issues of counterfeiting, double spending and traceability need to be addressed.

Exploring how to tackle these issues will be an important part of the studies currently under way at central banks around the world. In a public consolidation, the European Central Bank found out that public (private citizens) and professionals (including banks, payment service providers, merchants and tech companies) would value privacy (43%) and security (18%) the most out of potential CBDC aspects. While these are valid concerns, it’s important to consider that anonymous CBDC would make it possible to abuse the relevant regulations and be used for criminal purposes. This is associated with compliance issues and the risk of reputational damage.

Question 3

How could CBDC work in practice?

Both retail and wholesale use cases are conceivable for CBDC

CBDC could be used for two different use cases: retail and wholesale. In both cases, it can be assumed that CBDC is issued by the central bank.

Retail, today, refers to the use of coins and banknotes by end customers for purchases e.g., in shops, restaurants, at the hairdresser's or at gas stations. These are usually held by customers in an account with their preferred bank. The retail case provides for end customers to use CBDC as a digital representation of the existing coins and notes of a currency. They would be used for daily use in shops, restaurants, at the hairdresser's or at the petrol station. For off-chain, cash-like CBDC, customers withdraw these digital units from their bank account and store them in a digital wallet until they are issued again, just like normal banknotes.

Wholesale uses existing reserves at the central bank and is only available for commercial banks. The wholesale case would provide commercial banks with a digital representation of existing reserves at the central bank. These would be used in real-time gross settlement payments system and thus by core banking systems to perform bank settlement and clearing.

Digital currencies can be structured either on an account or token basis. Token-based digital units are exchanged directly and correspond to digital representations of banknotes and coins. The main difficulty lies in verifying the authenticity of the individual tokens. This is mainly used in retail. Account-based balances are held on accounts and are mainly used in wholesale. The difficulty lies mainly in the verification of the account owner.

When we talk about CBDC, we should not confuse it with a simple electronic accounting method. Although the monetary units that we hold in our bank accounts today are not stored one-to-one as coins or banknotes in the vaults of the banks but are also a kind of digital representation of our assets, they are still only accounting deposits. When paying by online banking or credit card, there is only an accounting reduction of our balance and an accounting increase of the balance of the counterparty. Settlement is then done between the banks. The situation is different when we pay with cash. When we withdraw cash from our bank account, the accounting balance is first reduced, and we receive cash in exchange. This then actually changes hands as a physical unit when we pay with it. We can think of it in a similar way in the case of off-chain CBDC. If we withdraw digital central bank money from our bank account, we receive these digital units in a digital wallet and transfer them to the seller when we buy them. Here, the units actually change hands, not just in accounting terms. It’s important to keep in mind that is mainly true for a token-based retail CBDC and might differ in a wholesale account-based solution.

A final consideration in how CBDC could work in practice is how it would be treated from a regulatory perspective. As a digital representation of existing currencies, CBDC must also be compliant with existing regulations such as:

- Know your customer (KYC) – the obligation of a bank to identify its customers before opening an account and to establish that customers are really who they claim to be.

- Anti-money laundering – rules, obligations, and guidance to prevent the financing of criminal activities or terrorism or, in general, to disguise the source of income.

Although the current CBDC projects are still in their infancy, the high level of interest shows the potential impact on the payment landscape and the way we as a society think about money. Fundamental design decisions need to be made and the impact on security and privacy will have major socio-economic implications. These implications will define how CBDC and digital currencies in general will be accepted in society and thus have far-reaching implications for other digital payment methods.

Summary

As central banks around the world turn their attention to central bank digital currencies, we explore the background, feasibility and technical implementation of CBDC solutions. Structured around three key questions, this article explains the main features of CBDC and clears up some common misconceptions about overlap between this new central bank-backed payment system and cryptocurrencies.

Related article

How will you seize real opportunities in tomorrow’s virtual world?

As the corporate world embraces the metaverse, it’s time to explore the potential for players in all sectors.

The CIO Imperative: Is your technology moving fast enough to realize your ambitions?

Data centricity can be an insight engine that unlocks operational, customer and market data value, according to EY’s 2022 Tech Horizon survey. Read more