Interplay between IPO and ESOP

ESOPs come with the opportunity for an employee to be part of an organization’s growth story. Many organizations which are on their IPO journey use ESOPs to align the interest of employees with the shareholders for sustained growth of the company. There are also companies which implement cash settled stock incentive plans (like Stock Appreciation Rights) in their earlier years but go in for ESOPs before an IPO.

Typically, employees of unlisted companies may not have much liquidity to cash out on their stock options. The expectation is that the employees who show greater commitment and continue with the company would eventually reap the benefits, potentially upon a future IPO. This trend is changing as many successful companies are providing for interim buyback allowing employees to realise the market value of their stock, without having to wait for an IPO.

A lot of unlisted companies align their exercise period with their IPO so that employees can exercise their options on IPO and reap benefit of immediate liquidity. Therefore, from employees’ standpoint, an IPO is a huge milestone as their vested ESOPs may be exercisable (in case exercise is linked to the IPO) and shares are encashable at the market price, which is likely to be much more than the exercise price paid by the employee. This, in a way, helps employees from a liquidity standpoint to meet their income tax obligation as tax liability on the benefit arises at the time of allotment/transfer of shares on exercise of the stock option.

Some companies also link vesting itself to IPO - linking vesting to IPO pushes higher levels of performance of senior employees in leadership team in ensuring that the company makes it to an IPO. Also, some companies do not want to commit shares to employees unless there is a clear exit by way of an IPO for them.

ESOP Trust pre-IPO

Many unlisted companies use an ESOP Trust to provide exit to the employees prior to the IPO. Due to the non-marketability of shares, an ESOP trust helps in buying back shares of the company from an employee. However, administering an ESOP Trust comes with the complex requirements of funding to be made by the company, valuation of shares to be transferred and other requirements relating to transfer of shares. ESOP Trust also entails annual compliance such as audit and tax filings.

Further, while there is no doubt on the salary perquisite taxability in the hands of the employee on transfer of shares to employee, in case of unlisted companies, the trust structure has a risk of notional capital gains taxation in the hands of the trust on transfer of shares by the trust to the employees, if the exercise price is less than a normative value fixed by income tax rules. While there may be some legal arguments to defend such notional taxation for the ESOP Trust, pending any specific relaxation in law given to ESOP Trust, taking a non-taxable position may be risky. Furthermore, any expenditure incurred by the company by way of contribution to such Trust or write-off of loans granted to the ESOP Trust may not be allowed as deduction in the hands of the company.

IPO related restrictions not applicable to ESOPs

Securities and Exchange Board of India (Issue of Capital and Disclosure Requirements) Regulations, 2018 (‘SEBI ICDR Regulations’), which regulates IPOs, prohibits a company from undertaking an IPO if there are any outstanding rights entitling any person with an option to receive equity shares in the issuer company. However, the condition expressly excludes outstanding ESOPs, therefore, outstanding ESOPs are not a hurdle for undertaking an IPO.

Similarly, as per SEBI ICDR Regulations, the entire pre-issue capital held by persons other than promoters shall be locked-in for a stipulated period of 6 months (12 months in certain cases) from the date of allotment in IPO. However, the said lock-in condition does not apply to shares allotted pre-IPO under an ESOP Plan, provided adequate disclosures are made by the issuer company. Therefore, shares allotted under an ESOP Plan are freely tradeable post the listing of shares in the IPO. However, the equity shares allotted to the employees under an ESOP Plan will be subject to provisions of lock-in as specified in Securities and Exchange Board of India (Share Based Employee Benefits and Sweat Equity) Regulations, 2021 (‘SEBI SBEBSE Regulations, 2021’).

ESOP governance pre and post IPO

While the primary legislation governing ESOP is the Companies Act, 2013 both for listed and unlisted companies - unlisted companies are also subject to Rule 12 of the Companies (Share Capital and Debentures) Rules, 2014 and listed companies, to SEBI SBEBSE Regulations, 2021.

As per the SEBI SBEBSE Regulations, 2021, no company is permitted to make any fresh grant which involves allotment or transfer of shares to its employees under any schemes formulated prior to its IPO and prior to the listing of its equity shares ('pre-IPO scheme‘) unless such pre-IPO scheme is in conformity with the said SEBI SBEBSE Regulations, 2021. Further, the pre-IPO schemes are required to be ratified by the shareholders of the company post the IPO. Accordingly, the companies need to review their ESOP Plans and make necessary amendments to ensure that the ESOPs are in accordance with the SEBI SBEBSE Regulations, 2021.

Further, the ratification by the shareholders may be done any time prior to grant of new options or shares under such pre-IPO scheme.

The shares arising after the IPO out of ESOPs granted under any scheme prior to its IPO to the employees are required to be listed immediately upon exercise in all the recognised stock exchanges where the shares of the company are listed subject to compliance with the applicable regulations.

How does taxability of ESOP change for the employee, post IPO?

The Income-tax Act, 1961 (the IT Act) provides for taxation of ESOPs as a perquisite at the time of exercise, subject to the valuation of the perquisite as prescribed in the Income-tax Rules, 1962 (the IT Rules). As per the IT rules, the taxable value of the ESOP on exercise is the Fair Market Value (FMV) of the share on the date of allotment / transfer of shares, reduced by the exercise price paid by the employee. The IT Rules provide for separate mechanism for determining the FMV for shares listed on a recognized stock exchange in India and for shares not listed on a recognized stock exchange in India. An unlisted company has to obtain a valuation certificate from a Category 1 Merchant Banker registered with SEBI as of a date not earlier than 180 days prior to date of exercise. However, once the company is listed, it can rely on its market price (average of opening and closing) on the relevant date for the purpose of perquisite valuation.

In respect of employees of specific start-up companies (subject to conditions), there is a relaxation of timing for the payment of taxes on ESOP with effect from financial year 2020-21.

The second stage when ESOPs are taxed are when the shares allotted to the employee are sold by the employee. At the time of sale of shares issued under ESOP, the difference between sale price and FMV of the shares as on the date of exercise (i.e. FMV used for calculation of taxable perquisite at the time of exercise) is taxable as capital gain for the employee.

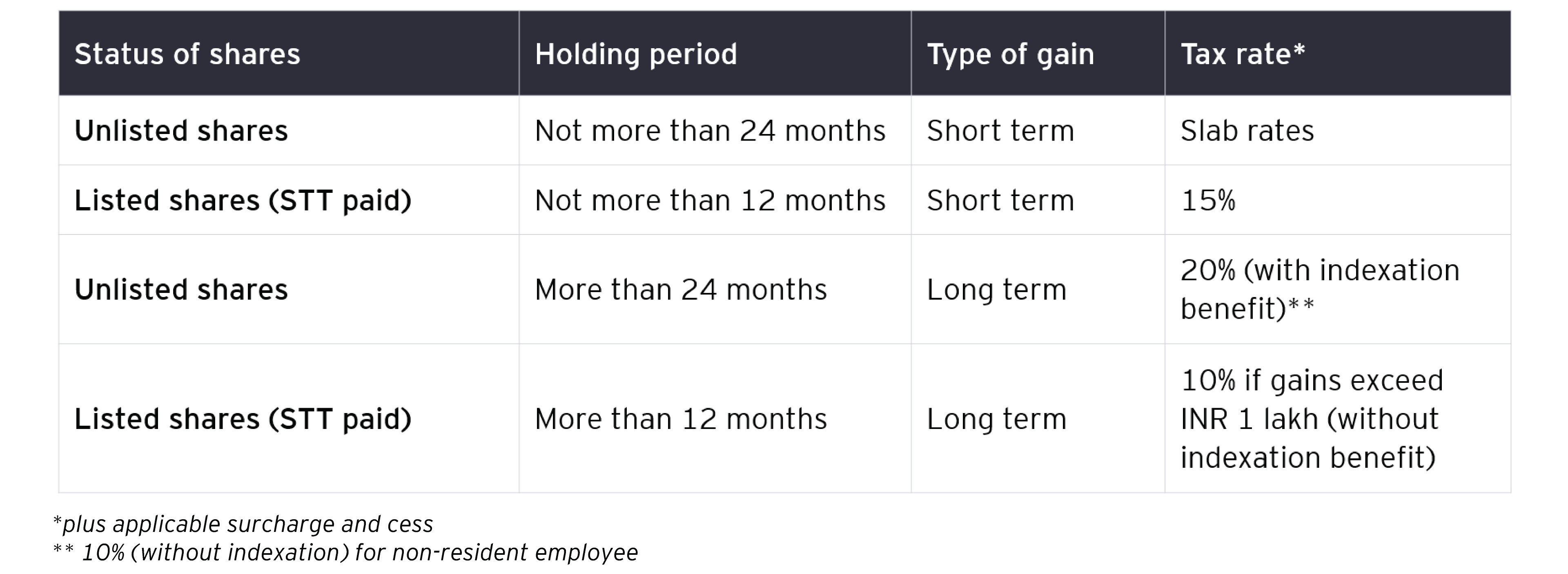

The capital gain is categorized as long term/ short term depending on period of holding of the shares by the employees. As tabulated below, in the event of sale of shares by the employee, the holding period as well as tax rate for long term capital gain is much lesser for a listed share as compared to an unlisted share for a resident employee.