EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

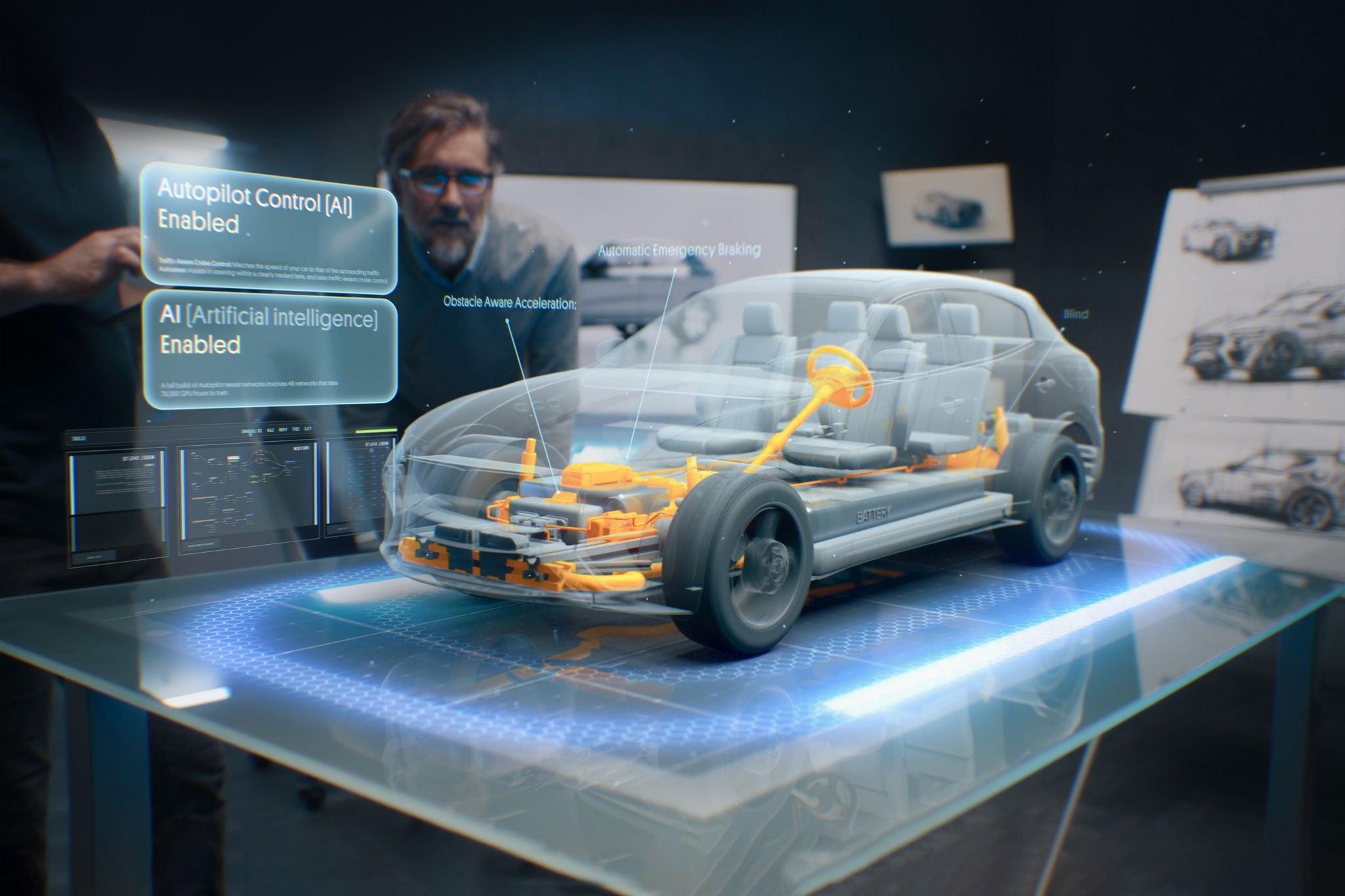

The rise of EVs, AVs, telematics and changing customer needs will shrink the market and invite new competition, forcing carriers to adapt.

In brief

- Rapidly evolving mobility trends, telematics and customer expectations are changing the auto insurance business, challenging legacy business models.

- By 2035, these forces will shrink the market by 31%, invite new competition and change how insurance is distributed, underwritten and serviced.

- Carriers that act now to build B2B distribution partnerships, maximize the benefits of telematics and improve customer experiences will be poised to grow.

The auto insurance industry as we know it is being upended by rapid advances in vehicle data and technologies. According to an EY-Parthenon analysis, the growing popularity of electric vehicles (EVs), autonomous vehicles (AVs) and shared-mobility platforms, combined with a coming proliferation of telematics data on driver behaviors, will shrink the overall personal line (PL) insurance market 31% by 2035.

Those forces, along with changing customer expectations, will alter the way auto insurance is distributed, priced, underwritten and experienced by customers, threatening the profitability of incumbent carriers’ business models. They also will open the door to competition from noncarriers, including auto OEMs, eager to leverage vehicle telematics data and their access to car-buying customers to capture new revenue streams.

Many carriers are not prepared for this. They lack the ability to incorporate mobility trends, EV- and AV-based risk, repairability and safety projections, and telematics data into their underwriting engines, and can be bogged down by legacy distribution networks and policy administration systems.

Our analysis, detailed below, highlights key trends that are shaping the industry’s future and predicts how those forces will change the terms of the competition going forward. It also suggests actions, such as embracing embedded finance and B2B partnerships, that carriers can pursue to bolster resilience and future competitiveness. This is a game incumbent carriers can win, provided they start preparing now.

Key trends driving change in auto insurance

Evolving mobility trends, vehicle technologies and customer expectations will alter the dynamics of the global auto insurance market, forcing legacy carriers to adapt quickly or lose relevance.

- EV sales will outstrip sales of vehicles with internal combustion engines (ICEs), reducing the share of ICE vehicle premiums in the PL market by 20%.

- As the EV ecosystem matures, economies of scale will drive down EV repair and replacement costs, driving EV premiums below those of ICE vehicles and reducing the size of the overall market by about 7%.

- Level 3 and 4 AVs, which can drive themselves under limited conditions, will be commercialized, boosting automobile safety and reducing accident rates by 2% and personal auto loss ratios and Direct Premiums Written (DPWs) by 9%.

- The growing popularity of ridesharing, e-bikes and other shared- and micro-mobility platforms will shrink PL premiums another 8%, while commercial line (CL) premiums rise 18%.

Beyond these mobility trends, the market will be influenced by two other significant changes in the operating environment: the growth of telematics and rapidly changing customer expectations.

- Telematics will emerge as a widely used tool to segment customers, price and underwrite policies, incentivize customer behaviors and seamlessly manage the claims process. In a recent EY-Parthenon survey, 60% of consumers said they would use telematics solutions from carriers in exchange for discounted premiums.

- Customers, accustomed to easy ecosystem experiences and customer journeys elsewhere, will expect the same from insurers, making the ability to provide seamless sales and claims experiences table stakes in the battle for growth. In a recent EY-Parthenon consumer survey, 40% of respondents said they would prefer buying auto insurance at the point of sale versus from traditional agents. Those figures will rise as consumer expectations evolve.

Our predictions: how these trends will alter the auto insurance marketplace

These trends are beyond the scope of any carrier to control but will demand strategic responses. They will alter the dynamics of the auto insurance market in profound ways, opening the door to nontraditional competitors and changing the way policies are distributed, serviced and experienced by customers.

Legacy insurers will struggle to find growth in a declining revenue environment. They also will have opportunities to take out expenses and better meet customer needs in areas like distribution and claims processing by embracing ecosystems and simpler operating models and by automating key functions, such as underwriting, rate analysis and filing and reporting.

It would not be surprising to see consolidation accelerate, as some smaller and midsize insurers struggle to maintain market share and profitability. Incumbent carriers, InsurTech firms and other mobility ecosystem participants could capitalize on the disruption with strategic investments to add scale, capabilities or market share.

In a world where innovators are rewarded, carriers will need to embrace new ways of doing business to compete — something that could conflict with the nature of a highly regulated business. Our predictions for how the auto insurance market will change by 2035 include:

Auto OEMs and dealers will be the agencies of the future

Control of vehicle telematics data and access to customers already engaged in an emotional purchase process will position auto OEMs and other players in the mobility ecosystem to distribute insurance — either through wholly owned subsidiaries or via distribution partnerships with established carriers. Already, several auto OEMs embed insurance in car purchases, and we are presently working with tire manufacturers, ridesharing companies and other players in the mobility ecosystem eager to monetize insurance as a channel.

For carriers, the emergence of nontraditional distribution channels presents obvious competitive challenges. At the same time, new ecosystem-based distribution models will offer a chance to significantly cut costs by reducing commissions and marketing costs tied to traditional insurance agents. Forward-thinking insurers also will be able to leverage superior underwriting skills to forge profitable relationships with nontraditional players, but they will need good partnership skills to thrive.

Ecosystems will be critical to delivering seamless experiences

Customers’ expectations for product and service experiences that are as seamless, personalized and engaging as what they get from leading retailers or ridesharing companies will push carriers to overhaul the front-end experience. Embedding insurance into customers’ ecosystem journeys and using telematics data from auto OEM partners and other noncarriers to customize offerings will be critical to driving greater value, customer loyalty and growth.

The claims process will become invisible to the customer

With emerging technologies, the claims process no longer will require customers’ active involvement. Behind the scenes, telematics, cameras and sensor data will detect the severity of an accident and be able to provide a preliminary estimate, body shop recommendations and even arrange for transportation from a crash site. Effective ecosystems that allow carriers to interact seamlessly with auto OEMs, dealers, repair networks and other partners will enhance the claims experience for the customer and dramatically reduce carrier loss ratios.

Carriers will modernize legacy systems to leverage real-time data

Carriers will leverage new technologies and systems to analyze large volumes of telematics and other customer data and personalize pricing decisions based on individual driving habits and other risk factors, providing an important point of differentiation. Better systems also will help carriers anticipate new risks, such as hacking of automated vehicles, which current underwriting practices aren’t equipped to handle.

What insurers can do now to prepare for a disrupted future

Going forward, legacy auto insurers will need to hone their strategic focus, business models, technologies, data capabilities, and organizational competencies to compete in a market impacted by these emerging changes. Key actions they can take today to prepare for what’s to come include:

Get a head start on B2B partnerships

Proactively develop partnerships with auto OEMs and other players in the mobility ecosystem, such as repair networks, ridesharing companies and EV battery research labs, to refine understanding of EV liability profiles and risks and embed insurance closer to the point of sale. Embracing a partnership strategy that is informed by market needs and building a structured framework for identifying, selecting and onboarding partners can position carriers to realize greater value from ecosystems.

Decouple the front and back ends

Separating customer-facing operations from product definitions, rate filings, reserving and other back-end functions can help mitigate compliance concerns over how customer information is used, making it easier to innovate. Compartmentalizing to avoid regulatory tension can help carriers embed insurance more easily into customers’ digital journeys, personalize pricing through telematics and advanced analytics and automate claims reporting — all keys to future success.

Invest in data capabilities to realize full value from telematics

Beyond risk-selection, carriers will increasingly use telematics to segment customers and incentivize safe driving behaviors through discounts, bespoke gamification and rewards. Carriers that invest now in core technologies and capabilities, such as centralized data warehouses and artificial intelligence and machine learning (AI/ML) algorithms, can position themselves to make telematics data a differentiator.

Embrace embedded distribution models

Insurers can evaluate changes to their distribution strategies and begin to embrace new channel mixes that meet the evolving digital needs of consumers. Finding new ways to sell auto insurance, such as through partnerships with auto OEMs or bundling with homeowners’ insurance through a mortgage origination platform, is likely to cause political friction with in-house and independent agents, but carriers will have little choice. Those that can optimize how they connect with customers will be poised to find growth and profitability in a changing market.

Utilize the full value proposition of telematics

As telematics hit the mainstream, insurers can begin to educate themselves on how data can be used as a differentiator. Carriers can use vehicle data to understand customer risk profiles, improve claims management, encourage changes in driver behavior and even as a source of revenue as a service provider to ecosystem partners. Experimenting now can accelerate the learning curve for determining how telematics can best add value in the future.

Double down on the commercial market

As growing consumer use of shared- and micro-mobility platforms shrinks the PL business, carriers can expand their commercial auto offerings. Long considered an afterthought, in recent years commercial auto has outperformed PL auto in terms of profitability and growth. Some commercial auto carriers and distribution partners already embed telematics into high-risk, high-premiums vehicle segments, such as long-haul transportation, raising the stakes for everyone else.

Concluding thoughts

The operating landscape for auto insurance is being transformed by a variety of forces, including new driving technologies, telematics and changing customer behaviors and expectations. In an increasingly competitive environment, legacy carriers that keep pace with the evolution and embrace new business models, B2B partnerships and data-driven personalization will be better positioned for growth.

Summary

Legacy auto insurance carriers that embrace new business models and data-driven personalization will be primed for growth.

Related articles

How increased trust and transparency can unlock growth

Explore the EY Global Insurance Industry Outlook. Learn more.

Nine customer types defining the next wave of insurance

Shifting consumer needs are an invitation for insurers to innovate in pursuit of growth and to stay ahead of new competitive threats. Read more.

How to make InsurTech investments that meet today’s customer demands

Insurance companies and PE firms looking to invest in InsurTechs can watch for these emerging technological and commercial trends. See the trends.