EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Permanent life insurance and deferred income annuities with increasing income potential outperform investment-only approaches in our analysis.

In brief

- By 2030, gaps in investors’ retirement savings and needed protections are projected to exceed hundreds of trillions of dollars in the US.

- This presents an opportunity for insurance companies to better serve customers to bridge these chasms, through modified investment approaches.

Although facing challenges, the US life insurance and retirement industry has enormous potential to grow. Our analysis reveals insights on how best to capitalize on this opportunity.

EY researchers estimate that by 2030, there will be a $240 trillion retirement savings gap and a $160 trillion protection gap. Insurers are uniquely positioned to address these gaps with products that offer legacy protection, tax-deferred savings growth and guaranteed income for life.

In this article, we explore how two products can be used to meet investors’ savings and protection needs: permanent life insurance (PLI) and a deferred income annuity with increasing income potential (DIA with IIP), which represents deferred income annuities with persistency bonuses and non-guaranteed dividends. Can integrating PLI and a DIA with IIP into a retirement plan provide value beyond an investment-only strategy?

It is a complex question to answer. To judge the impact of PLI and DIAs with IIP, we analyzed five strategies, conducted across three different starting ages: 25, 35 and 45. For each strategy, our Monte Carlo analysis generated 1,000 scenarios based on randomized input from a range of factors, such as interest rates, inflation rates, equity returns and bond returns. The high-level results are shown in this summary article and elaborated upon in our full report.

Download the full report

The five strategies compared

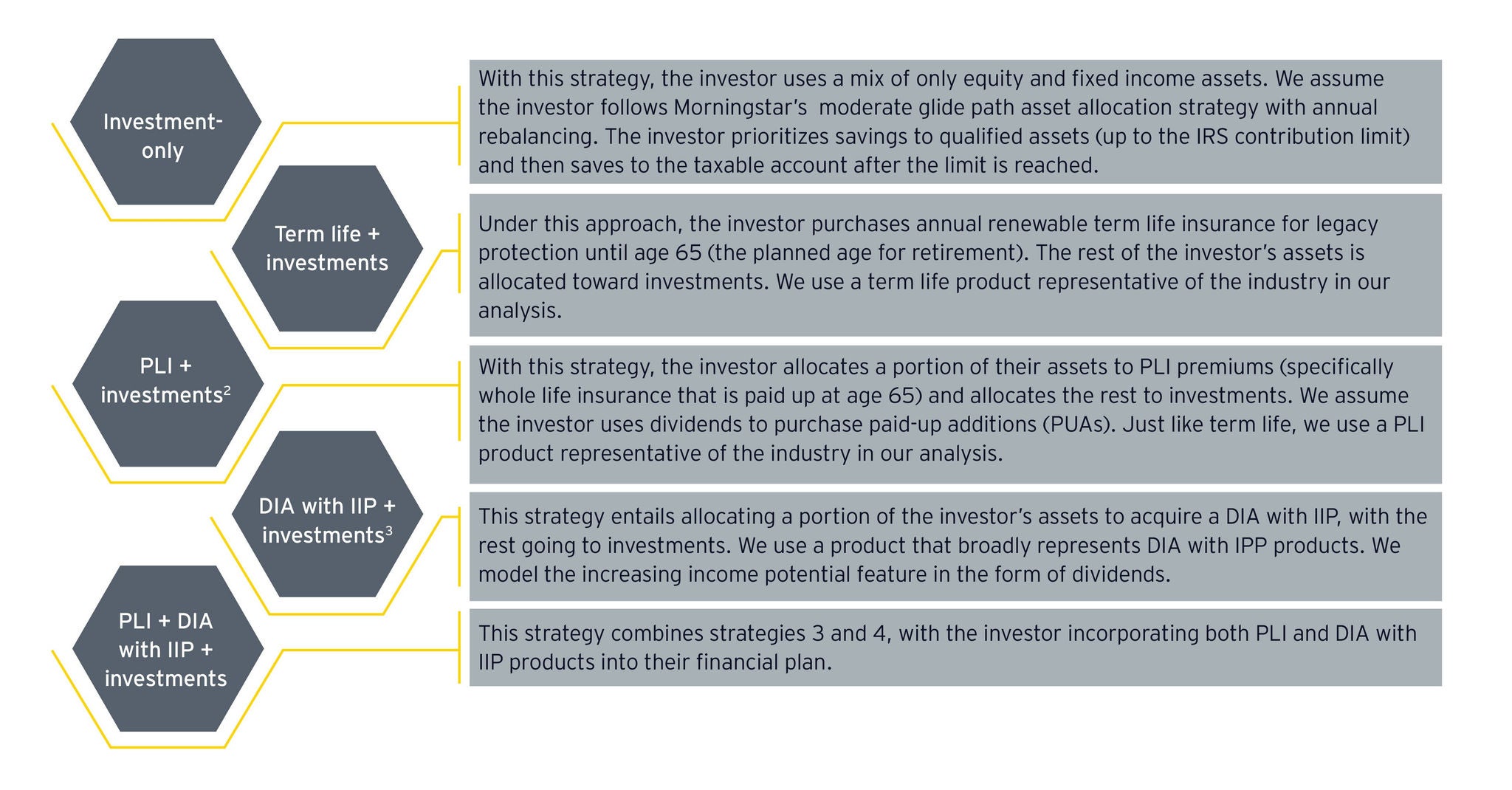

We examined a baseline of traditional investment strategies and then compared them against those that also factor in PLI and DIAs with IIP:

For strategies that include PLI and a DIA with IIP, the value of these products is included in the total financial assets and considered part of the fixed income allocation. Thus, for strategies where an investor allocates a portion of their wealth to an insurance product, the amount invested in bonds decreases compared to the investment-only strategy.

In our analysis, PLI cash value (accessed via surrenders or loans) are used to fund retirement income during periods of market volatility, allowing investors to avoid liquidating assets from their traditional investments that have fallen in value.

We divided the investor’s assets between the investments and the insurance products. Different product allocation combinations were simulated in increments of 10% of total annual savings for PLI and projected wealth at age 55 for DIA with IIP. Allocation percentages were capped at 60% for PLI and 30% for DIAs with IIP. For each allocation combination, we calculated the after tax retirement income that an investor can sustain in over 90% of the market return scenarios. We also calculated the legacy value at the end of the time horizon.

The benefit to investors

Following this methodology, strategies involving PLI and DIAs with IIP excelled overall against investment-only approaches — although the implications must be couched in a bit of nuance, depending on whether the investor is focused more on retirement income than legacy. Here are six key insights on how the strategies compare:

1. PLI + investments strategies outperform investment-only and term life + investments strategies.

PLI tends to provide superior returns over fixed income in long-run scenarios, while the term premium acts as a drag on portfolio performance. PLI loans act as a buffer against market volatility as well, improving returns since the investor does not have to sell and realize losses on investments.

2. DIA with IIP + investments strategies outperform other strategies in retirement income.

With DIAs with IIP + investments, the investor uses a portion of the balance to purchase the DIA with IIP and does not receive that balance upon death, boosting retirement income compared to other strategies. Projected legacy tends to be lower than PLI + investments but higher than the legacy from the investment-only strategy. The latter observation is a result of the DIA with IIP outperforming fixed income due to mortality credits and dividends.

3. Integrated strategies are more efficient than investment-only strategies.

For example, a strategy allocating 30% of annual savings to PLI and 30% of assets at age 55 to a DIA with IIP produced 5% higher retirement income and 19% more legacy than the investment-only strategy, because PLI and DIA with IIP both outperform fixed income.

4. For investors with a higher risk appetite, integrated strategies remain better.

We performed the same exercise described above, except that we calculated the retirement income (and legacy values) based on the amount that the investor can sustain in over 75% of the market return scenarios, reflecting the expectations of an investor with higher risk. Income and legacy do not improve as much, yet an integrated portfolio still provides benefits relative to an investment-only strategy.

5. Integrated strategies provide investors with the flexibility to focus on the financial outcomes most important to them: retirement income, legacy or a balance in between.

We found that PLI and a DIA with IIP mix well together, whether a person is focused on retirement income, legacy or a balance. Higher allocations to a DIA with IIP emphasize retirement income, while higher PLI boosts legacy protection. The right mix depends on the investor’s preferences.

6. Allocation up to 30% of annual savings to PLI and up to 30% of wealth at age 55 to DIA with IIP may be appropriate when optimizing retirement income and legacy value outcomes.

Results varied by investor starting age. But the projected retirement income and legacy values generally supported allocations of 10% to 30% to both PLI and DIAs with IIPs. An investor solely focused on maximizing legacy may still opt to allocate more to PLI, but when that allocation redirects too many assets away from equities, the reduction to retirement income can be substantial.

The results point to the value of PLI and DIAs with IIPs in a retirement plan: an integrated approach can give comfort and peace of mind to retirement investors by providing legacy protection, tax-deferred savings growth, and guaranteed income for life without sacrificing their present lifestyle. Insurers can use these products to strengthen their relationships with investors, seizing upon the possibilities in a marketplace that has proved challenging.

This article has been authored by Christopher Raham, Justin Singer, Ben Yahr, Ben Lee, and Annie E Mayer.

Summary

Investment-only approaches do not deliver as promising returns as those that are combined with PLI and DIAs with increasing income potential, an EY analysis shows, although there are distinctions to consider depending on whether more retirement income or legacy value is desired. Allocation levels should be approached with care.