Chapter 1

Consumer FinTech reaches a tipping point

Findings reveal the consumer segment is much more engaged with FinTech propositions.

Our third FinTech Adoption Index has uncovered eight key insights into the growth of FinTech among global consumers.

1. FinTech has become globally mainstream

Penetration

64%of global consumers have adopted FinTech.

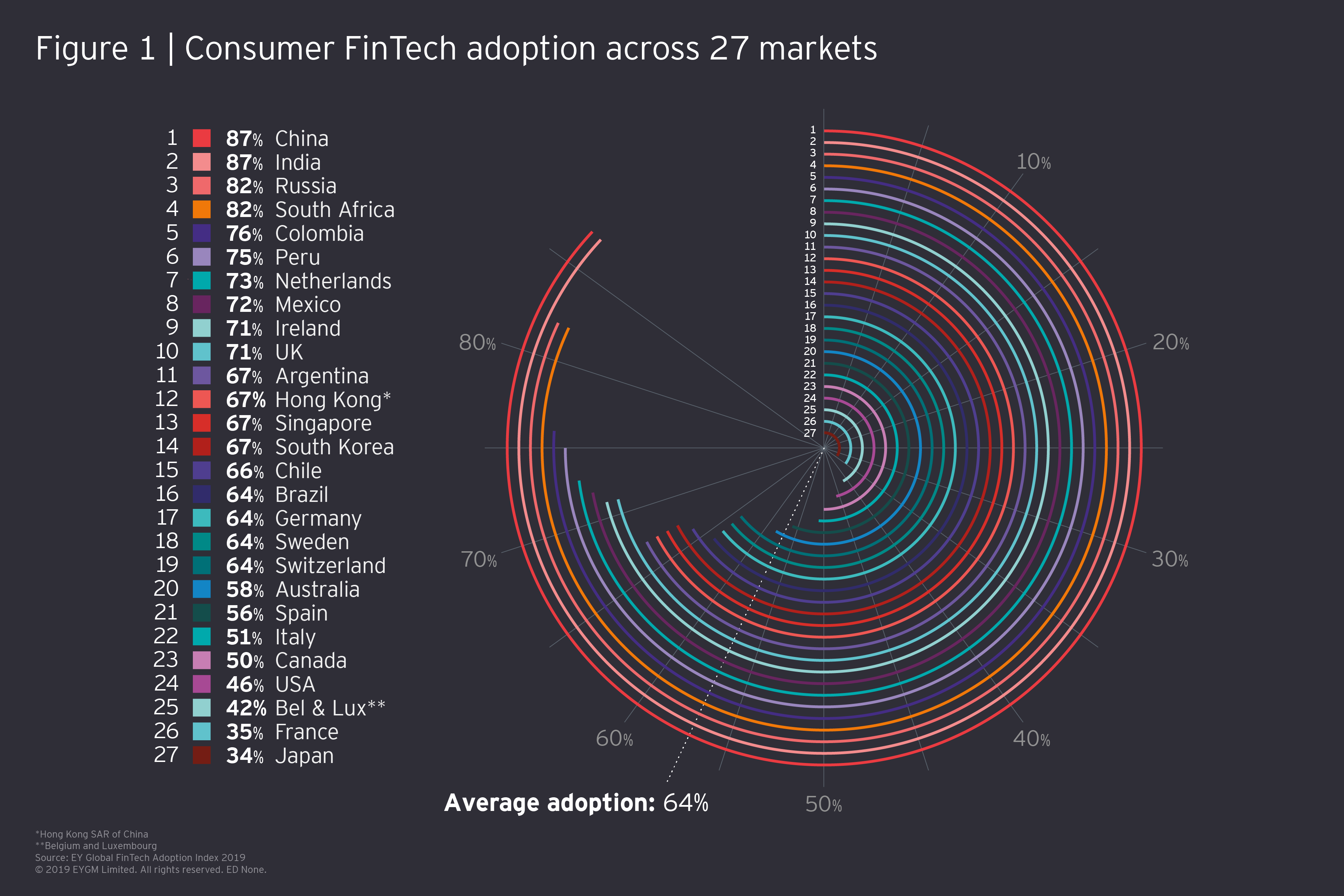

With global FinTech adoption reaching 64%, FinTech is clearly becoming mainstream in all surveyed markets (Figure 1). When compared with adoption rates across previous surveys in 2015 and 2017, this figure represents a consistent growth curve over the last five years. In the six markets surveyed in this period, adoption rates rose from 16% in 2015, to 31% in 2017, to 60% in 2019 – an increase of almost 100% every two years.

2. Consumer awareness is at an all-time high

Awareness

96%of consumers have heard of FinTech money transfer and payment services.

Only 4% of global consumers reported they were unaware of FinTech money transfer and payment services. In some markets, the figure was even lower: in both India and Russia, just 0.5% of respondents said they were unaware of such services.

Strikingly, this level of awareness was not the same across all service categories. For example, 29% of respondents were unaware of budgeting and financial planning services. Though awareness of the sector as a whole remains high.

3. FinTechs now commonly used by consumers, with China leading

Establishing FinTech

75%of consumers have used a FinTech money transfer or payments service.

With FinTech services now being commonly used by consumers globally, it’s clear that FinTechs have become recognized financial services providers. The most used services were in money transfer and payments, with around three-quarters of consumers having used a service in this category. Usage was particularly prevalent in China, with the rate at 95%. Other frequently used services included savings and investments, budgeting and financial planning, insurance, and borrowing services.

The figures indicate there is still room to grow within particular segments. For example, adoption of savings and investment services is at only 27% among women, versus 40% among men.

4. Consolidated platforms have the edge

One-stop shops

60%of consumers prefer to access services through a single platform.

It appears consumers want to get to their financial tools through a single app or online portal, with 60% of adopters indicating this was their preference. However, a tech-first approach is not always favored by consumers – when it comes to customer service only 27% of FinTech adopters globally said they would prefer to talk to their bank via social media than the more traditional channel of face-to-face exchange.

So, while FinTechs are powering and driving adoption of centralizing platforms and marketplaces through tech, they can benefit from partnerships with, and acquisitions by, banks, who in turn benefit from in-house development. And in both collaborating, a better customer experience is delivered.

5. Cost remains the most important consideration

Competitive advantage

27%of consumers say competitive rates are their top priority.

Historically, the main allure for adopters was the comparative ease of setting up a FinTech account. In 2017, for example, just 13% said that attractive rates were a priority while 30% awarded more importance to being able to easily set up an account.

According to this year’s figures, priorities have now changed. Whereas 20% say that ease of setting up an account is more important, 27% are more concerned with fees and rates – which is broadly suggestive that FinTech is now a mature market where lower costs and a frictionless customer experience are expected as standard.

6. Trust in incumbents is high

Incumbent advantage

33%would consider a new financial organization when considering a new service.

Consumers still trust their main banks or insurers: in 2019, 22% of non-adopters revealed that their decision to remain with their traditional financial provider was due to trusting it more than FinTechs.

Slow adoption may not be down to lack of trust entirely – it could simply be typical of any innovation adoption cycle. As discussed in our 2017 Index, the adoption cycle, or what is known as “Rogers’ Curve of Innovation,” spreads across five ordered groups within a population:

- Brave pioneers – individuals who seek out the newest ideas

- Early adopters – individuals who act as opinion leaders to the wider population

- Early majority – individuals who accept change more quickly than the average

- Late majority – individuals who are more skeptical than the average, but are willing to use an innovation if many have adopted it

- Laggards – individuals who are reluctant to give up traditional ways until absolutely necessary

7. Non-financial players are on the rise

Looking for alternatives

68%are willing to consider a financial proposition by a non-financial company.

Once upon a time, the FinTech market was solely occupied by incumbents and challengers. Nowadays both compete against non-financial service organizations such as retailers and technology platforms. According to the survey, 68% of consumers are willing to consider a financial services product offered by a non-financial services company.

Notably, they’re most open to retailers (45%) and telecommunication firms (44%) as service providers, and most willing to use money and transfer payment FinTech services such as digital-only banking and multimerchant eWallets. This may be down to the fact that non-financial players like retailers have not only made technological transformations, but can provide a seamless customer experience, building on prior relationships to offer holistic solutions. From a customer’s perspective, why not bank where you shop – especially if both are online?

8. FinTech adopters are more willing to share data

Data sharing

48%of adopters are willing to share bank data.

Among FinTech adopters, 48% are willing to share their bank data with other organizations in exchange for better offers. With FinTech solutions depending on the easy portability of data, providers will view such receptivity as positive.

Additionally, 46% of adopters indicated they would be happy to share data if it means accessing better deals from their service provider. 38% of adopters said they would be willing to share data with other traditional financial institutions, 31% would share with FinTech challengers, and just 23% would share with non-financial services companies. The sentiments differ somewhat from market to market. Chinese consumers, for example, are more willing to share data with FinTech challengers than they are with other financial companies.

Chapter 2

SMEs are warming to FinTech’s potential

Trends indicate the growing impact of FinTech services in the SME market.

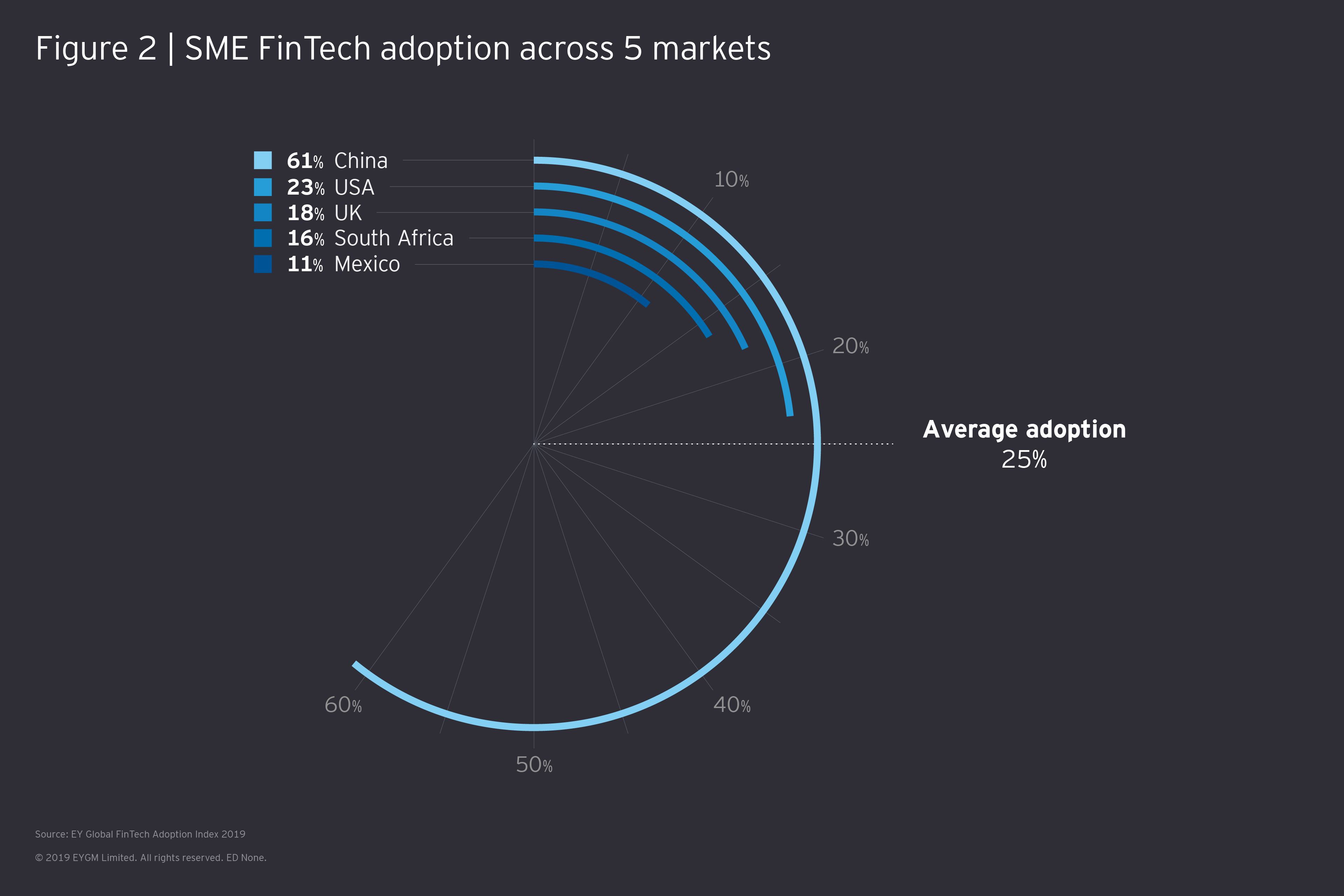

The story of the growth of FinTech services extends beyond the consumer sector. To better understand the business perspective on FinTech adoption, EY teams surveyed key decision-makers at 1,000 SMEs across five countries – China, the US, the UK, South Africa and Mexico.

SMEs starting to adopt FinTech

The survey found that SMEs have become significant users of FinTech globally, with one in four respondents saying they have used services provided by a FinTech in each of these key categories: banking and payments, financial management, financing and insurance(Figure 2).

This indicates that SMEs have been using FinTech products and services as a key part of their financial management. As with the consumer market, this trend was particularly prominent in China, where 61% of those surveyed indicated this was the case.

The top six factors driving FinTech adoption among SMEs were:

- Range of functionality and features

- 24/7 availability of services

- Ease of setup and configuration

- Rates and fees

- Compatibility with daily operations and infrastructure

- Trust in the providers team and their reputation

The most popular FinTech service to have been used was in the banking and payments category, with 56% of users saying they have done so. Again, China was a notable outlier, with 92% of Chinese SMEs indicating they have used FinTech banking and payments services.

SME FinTech preferences and priorities

Another major trend was the increasing number of SMEs joining FinTech ecosystems. These ecosystems integrate various products and services offered by challengers, financial incumbents and non-financial institutions. Unsurprisingly, those adopting FinTech ecosystem solutions were those who take a technology-first approach to problems – 93% of adopters prefer to find a tech-first solution where possible, including when facing new regulations.

Those SMEs adopting FinTech were also much more likely to consider new services carefully. For example, 98% of SME adopters said they regularly review their technology to make certain they’re using the most appropriate options. And when changing service providers, they are more likely to seek advice from multiple sources, such as business advisors, government officials, and professional and industry contacts.

Compared with consumers, SMEs were more willing to share their data with FinTech companies, over and above other third-party service providers. As many as 89% of SME adopters said they were willing to share their data with FinTech companies, versus the 70% who would with other financial service companies, and the 63% who would with non-financial services companies.

The future of FinTech

These findings show that various factors are driving the FinTech space forward – including increasing consumer and SME familiarity with FinTech products and services, attractive rates and increasing ease of portability to a new account.

But with adoption now also increasingly happening in the business market, there is a growing opportunity for FinTech firms, incumbents and non-financial organizations alike to seize the wave of FinTech disruption. With signs of rising trust in the concept of FinTech from consumers and business alike, the growth of the sector shows no sign of letting up.

For further insight into FinTech’s growing adoption and influence, take a full look at the report's (pdf) research and methodology.

The following EY members contributed to the 2019 Fintech Adoption Index: Matt Hatch, America FinTech Leader (San Francisco); Tom Bull, UK FinTech Leader and FinTech Adoption Index Leader (London); Sharon Chen, FinTech Adoption Index Lead Author (London); Doina Chiselita, FinTech Adoption Index Co-author (London).

Shrnutí

Since the first EY FinTech Adoption Index was published in 2015, adoption has gone from 16% to 33% (2017), to 64% (2019). This year’s Index found that FinTech challengers are maturing and expanding their global reach, incumbents are responding with their own credible FinTech offerings, and ecosystems are rising to connect multiple players in the industry.