2. High transition and implementation costs

In the initial transition phase to a circular model, there is lower profitability due to high up-front investments, including the establishment of new facilities to accommodate new processes and technology, training of personnel in circular economy strategies (including dealers for reverse logistics) and design costs to incorporate disassembly into the vehicle up front¹,⁴,⁵. However, these initial investments are necessary for companies to capitalize on circularity benefits (e.g., decoupling from legacy supply chains). Further, although the up-front fixed costs could be substantial, circular business models are expected to be more profitable than traditional models, with some estimates showing improved profitability by as much as 1.5 times along the value chain⁶. This shows the opportunity to absorb these costs over the long term.

3. Lack of disassembly design built into existing EVs

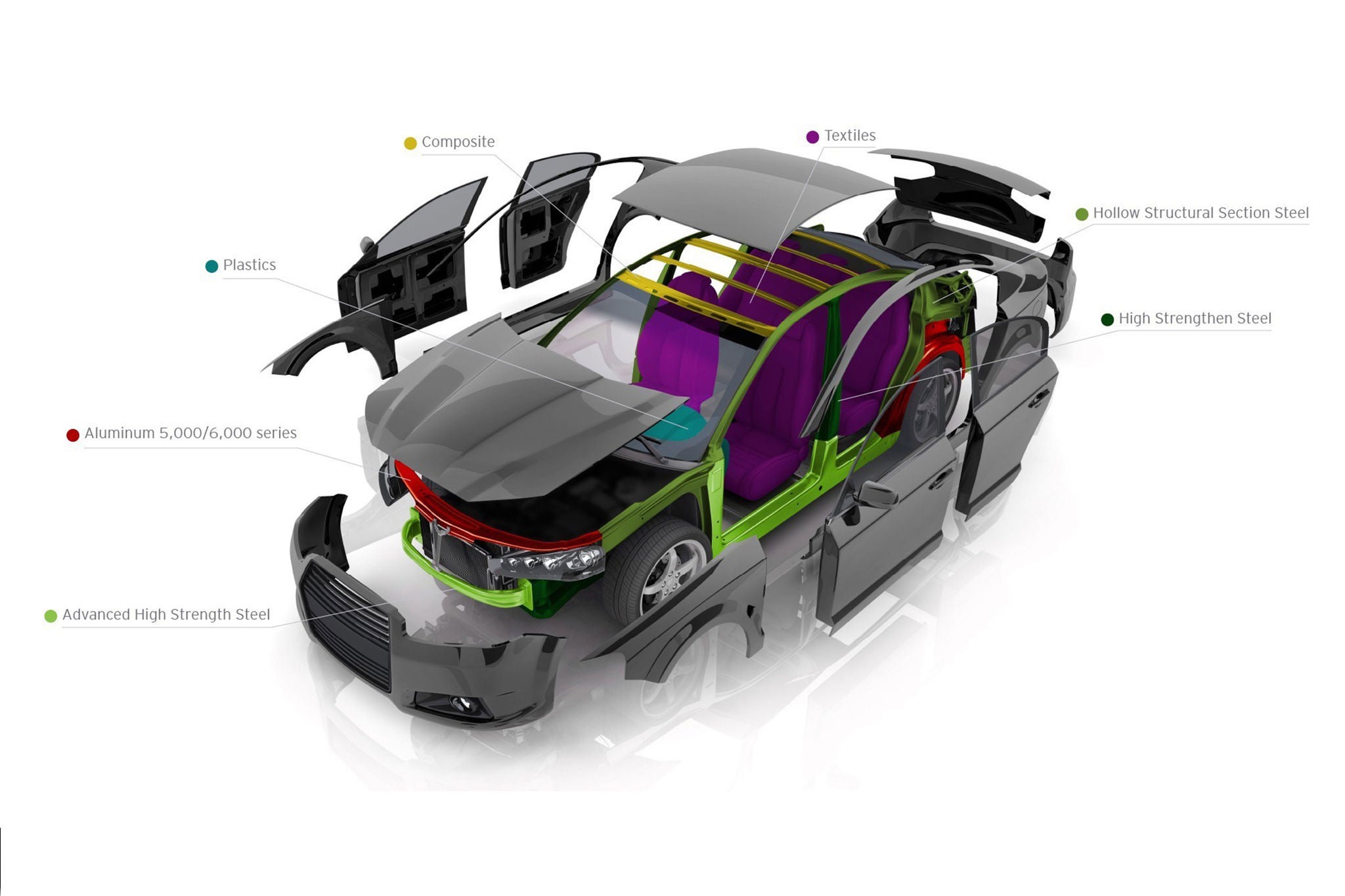

To achieve full circularity and associated profitability opportunities⁶, disassembly must be built into the design of the vehicle from the initial product design, making future vehicles more compatible with the circular economy. However, the problem remains that legacy automobiles were not designed for disassembly and circularity. As OEMs implement circular strategies, the lack of disassembly design built into legacy automobiles will become apparent.

Disassembly can be a difficult process, as strong adhesives, welding and composites are frequently used to bind various car parts together¹. As cars become more advanced (i.e., self-driving), the density of technology within the vehicle will increase. This requires OEMs that outsource production of semiconductors (for example) to either acquire the knowledge necessary to recycle these components or work more closely with suppliers to set up reverse logistics. For OEMs that build these pieces of technology in house, knowledge of how to specifically recycle these components will have to be developed¹. Despite these obstacles, the disassembly design hurdle will need to be addressed for OEMs to fully capitalize on the opportunity for circular business models to enhance profitability⁶. If disassembly design is not implemented, OEMs will have more difficulty extracting materials from end-of-life vehicles and increased profitability will not be realized due to limited material extraction or greater disassembly costs.

4. Existing societal pressures

OEMs must grapple with the landscape of societal pressures facing the automotive industry. Societal pressures in the environmental landscape today are primarily focused on the carbon footprint of their vehicles¹. This makes implementing a circular economy model more difficult as OEMs are currently responding to this pressure by electrifying their fleets. The circularity of their products has not received comparable levels of scrutiny, which ultimately decreases OEMs’ motivation to implement circular economy strategies. However, this barrier presents an opportunity for OEMs to become a first mover in the circular economy space and push their sustainability agendas beyond current societal pressures. Furthermore, societal pressures are starting to shift toward circularity. Specifically, in the European Union, the European Commission adopted the new Circular Economy Action Plan (CEAP) in March 202010 and the European Sustainability Reporting Standards (ESRS) by way of the Corporate Sustainability Reporting Directive (CSRD) includes a section on Resource Use and Circular Economy (ESRS E5)¹¹.

Value proposition and business case for circularity

Despite the barriers to the adoption of circular economy business models in the automotive industry, there is a strong business case for why the automotive sector should prioritize reusing, refurbishing and recycling components to support a circular economy. The value of a vehicle at the beginning of the lifecycle is well established. Circularity would allow for revenue to be generated repeatedly from the same materials through continuous lifecycles. The circular business model, once implemented, can increase profitability while reducing supply chain risk and resource scarcity. These advantages make a strong business case for first movers adopting the circular model in the automotive industry. Below we describe four reasons why the automotive sector should prioritize implementing circularity into their EV business models to reap the benefits of an untapped market.

1. Increased profitability:

Circularity is expected to become more profitable in the coming years due to cost reductions resulting from circular manufacturing advantages, including⁶:

- Lower remanufacturing costs

- Less time required for refurbishment

- Less energy used and emissions created

2. Reduced supply chain risk:

Decentralizing from existing supply chains with reverse logistics loops will help OEMs build resiliency, as well as reduce dependency on individual suppliers and the risk of one stage in the manufacturing process slowing down the next stage.

3. Enhanced cost and knowledge sharing through partnerships:

OEMs do not have to take on the cost of adoption of the circular economy business model alone. Collaboration with recyclers and reverse logistics providers can reduce the cost and serve as a vital partnership in not only cost sharing but also knowledge and information sharing⁶.

4. Address resource scarcity:

Adopting a circular economy business model can help address the scarcity of various materials that make up the EV. A multinational commodity trading giant warned that deep shortages of aluminum mean the world will run out of stockpiles by early 2024⁷. Similarly, research suggests that known primary metal supplies, such as those for steel, will be exhausted within about 50 years⁸. By creating a system of circular lifecycles for the materials needed in vehicles, OEMs will be much less dependent on raw material inputs from extractive industries. A circular economy model will enable OEMs to continuously utilize and control the supply of the scarce material resources already available to them.

Reuse/recycling opportunities for the remaining 60% of the car

Supporting the opportunities for increased profitability and reduced supply chain risk, each part of the car can incorporate circularity based on its own unique properties. Our analysis identified several areas where additional value can be realized for each part of the car by incorporating a circular mindset.