EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Your time is valuable. So we’ll file for you.

EY TaxChat™ connects you with an EY Tax professional who prepares your return and files for you on your schedule, eliminating the hassle of appointments, paper documents and complicated software. Put our wealth of experience to work.

A simplified tax experience. Register now and get started.

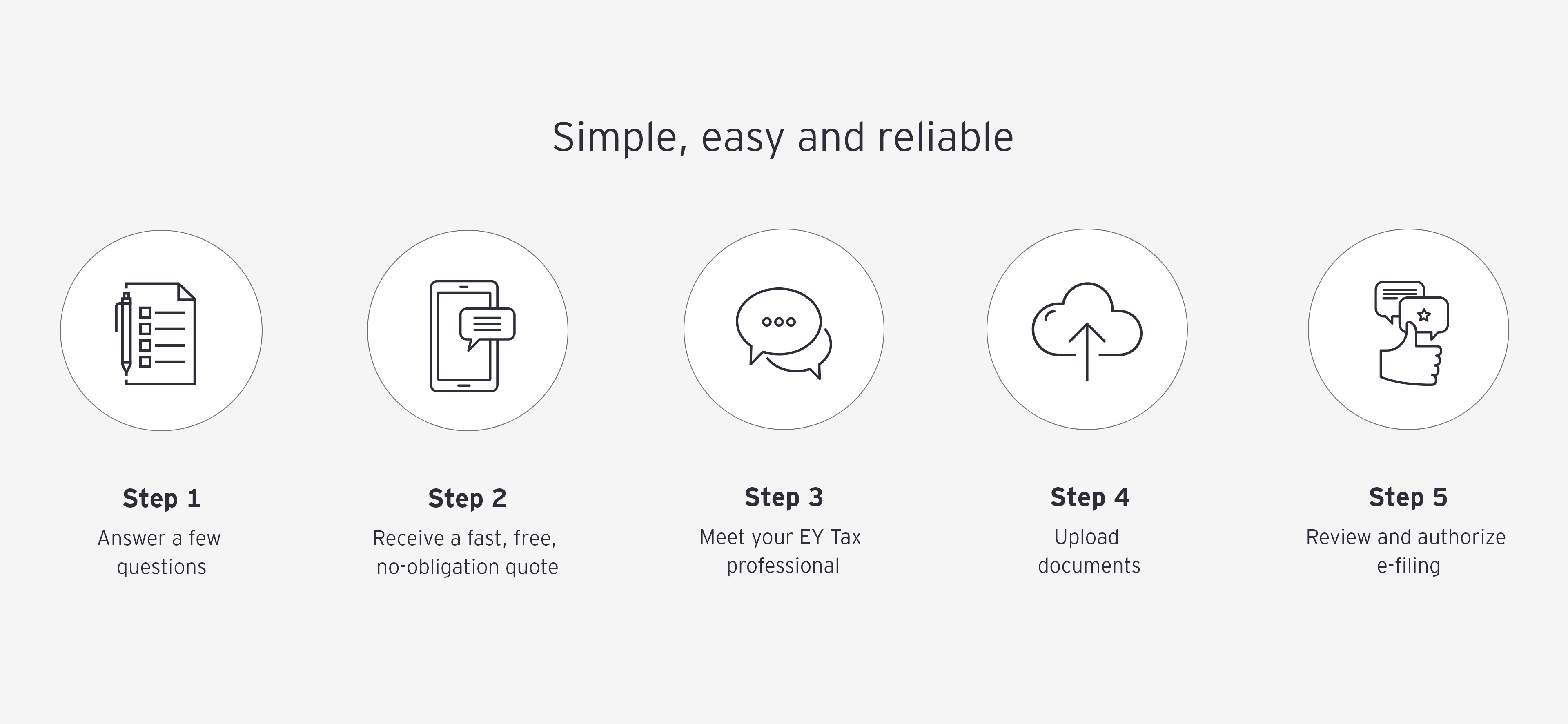

How it works

The TaxChat advantage

Our service is unmatched

|

EY TaxChat Plus |

EY TaxChat |

DIY/Software |

Traditional CPA |

|

|---|---|---|---|---|

|

Convenient |

✓ |

✓ |

✓ |

- |

|

Affordable |

✓ |

✓ |

✓ |

- |

|

Personalized advice from leading EY Tax professionals on compliance questions |

✓ |

✓ |

- |

- |

|

Chat with a human, not a bot |

✓ |

✓ |

- |

✓ |

|

Secure match to the right tax professional |

✓ |

✓ |

- |

✓ |

|

Dedicated professional who prepares and files for you |

✓ |

✓ |

- |

✓ |

|

Secure online portal: no appointments needed |

✓ |

✓ |

✓ |

- |

|

Tax Compliance Services Concierge (TSC):

TaxChat Plus is an enhancement to TaxChat that enables you to work with a Tax Services Concierge (TSC). This means that you can:

The additional fee for this service is $500 and up, depending on the complexity of your return. |

✓ |

- |

- |

- |