For the 39th year, the Cash Management practice of Ernst & Young LLP (EY US) has conducted a comprehensive survey of US treasury services businesses at top US bank holding companies. With participation by 47 banks, including 80% of the top 20 and 72% of the top 50, the Annual Cash Management Services Survey is considered the barometer for measuring the health of the treasury solutions industry.

With this year’s survey findings reflecting the treasury community’s success in mitigating the financial effects of the COVID-19 pandemic while also emerging prepared to tackle current and future economic headwinds, the phrase “the comeback is always greater than the setback” could not be more accurate in describing the industry’s resilience, initiative, and revenue growth during the last 12 months.

Top findings from this year’s survey include the following:

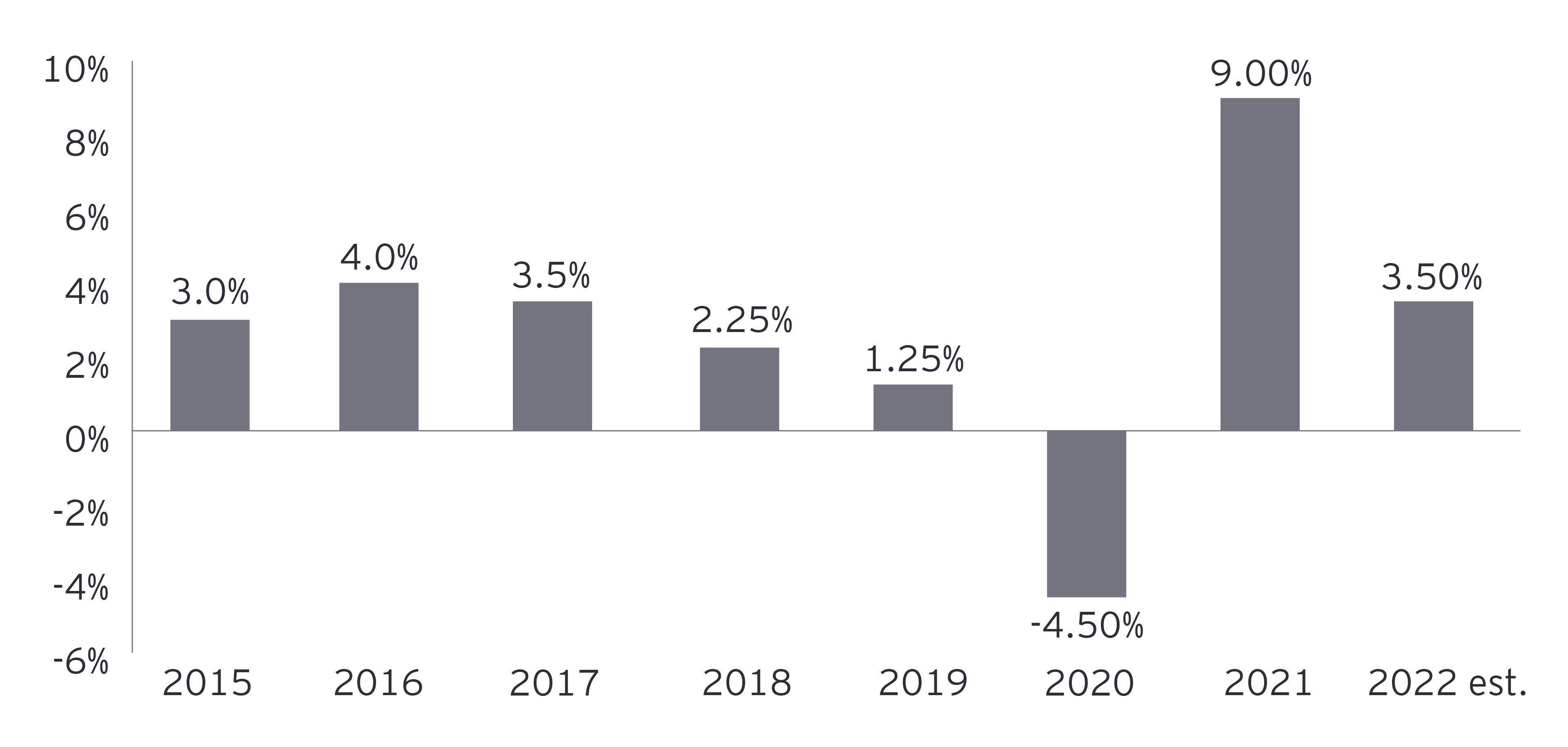

- Despite last year’s record 4.5% decline in cash management revenue, the industry has made a remarkable recovery, with a 9.0% increase, the largest in the past two decades, and has demonstrated strong fundamental growth across the product suite.

- There’s been consistent growth across peer groups, with the largest banks most adversely impacted by the pandemic-induced downturn strongly rebounding this past year.

- But government programs, inflationary factors and supply chain disruptions have had an impact:

- The benefits of government programs that provided tax credits, loans and loss mitigation to small businesses, large corporations and almost all industries during the pandemic are still working their way through the overall economy due to the timing of the assistance.

- Inflation has continued to increase at levels well above the expectations of policymakers.

- Supply chain disruptions and global geopolitical developments are increasing volatility and uncertainty for corporate treasurers and consumers alike.

- New and emerging product revenue growth is becoming a larger share of revenue.

- The future impact of increases in interest rates, inflationary costs and pricing pressures are shaping cash management strategy going forward.

- Purchasing card revenue, which suffered the second-largest percentage decline in 2020 behind retail lockbox, rebounded dramatically, representing approximately 38.0% of total recognized revenue.

- Robust growth is realized by electronic products, including wire transfer and information reporting, while the largest revenue decline in dollar terms was demand deposit accounts (DDAs), with revenue falling by US$116m and industry outflows.

Total fee-equivalent revenue is rising to record levels

Treasury’s role in managing the repercussions of the pandemic on cash, liquidity and risk has been very effective, as the 9.0% growth calculated for 2021 increased fee-equivalent revenue to approximately US$19.3b. If the respondent forecast for a 3.5% increase in 2022 is achieved, total fee-equivalent revenue for the top 100 banks will increase to about US$20b, an industry-high watermark as measured by our survey.