Most companies ultimately end up with a separate fund structure and multiyear capital commitment, as this proves most effective for them. In this article we examine corporate venture capital (CVC) funds as a key approach for companies to invest in upstart companies and other cutting-edge technologies.

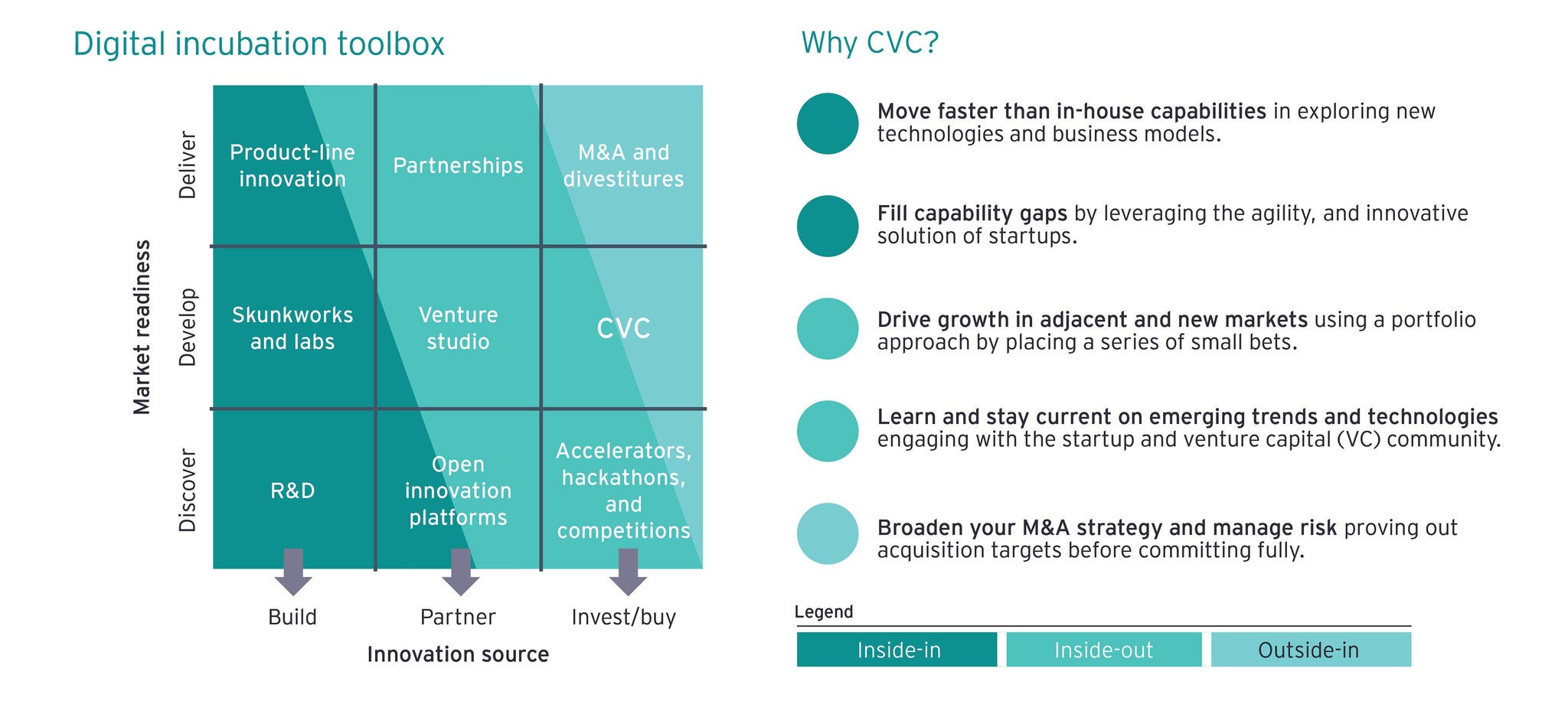

Companies with CVC funds hedge their risk while exploring opportunities through a portfolio of minority investments in startups. This helps them tap into future growth opportunities, not only during the current period of disruption, but also moving beyond into the post-pandemic world. When executed well, CVCs can become a powerful complement to other tools such as in-house R&D, partnerships, joint ventures and startup M&A to accelerate digital transformation.

In fact, now may be the perfect time for corporate venturing. While multiples have not been as impacted by the pandemic as in previous downturns, the current uncertainty means companies with available cash might be able to find some investments at a discount, especially if startups with longer-term priorities face a short-term cash crunch. Big tech companies increased their startup investments from $7.6b in 2019 to $16.7b in the first eight months of 2020, according to CB Insights.

However, CVCs may need to be selective and proactive in the origination of investments in startups to find the best value deals.

Using CVC to gain insight

CVCs provide a way for established companies to extend their ecosystem in key strategic areas, while getting early access to new technologies and capabilities. This enables them to gather insights and enhance their current business without having to incur the hefty costs of building from scratch or making a complete acquisition.

Hence, CVC deals are becoming more popular: the value of CVC-backed deals more than tripled to $57.1b in 2019 from 2014, according to CB Insights. Yet while the number of corporate venture arms has also grown, more than 80% of S&P 500 companies still do not have a dedicated CVC arm. These companies may be missing an opportunity since CVC funds have the potential to create even higher returns on investment than traditional VCs.

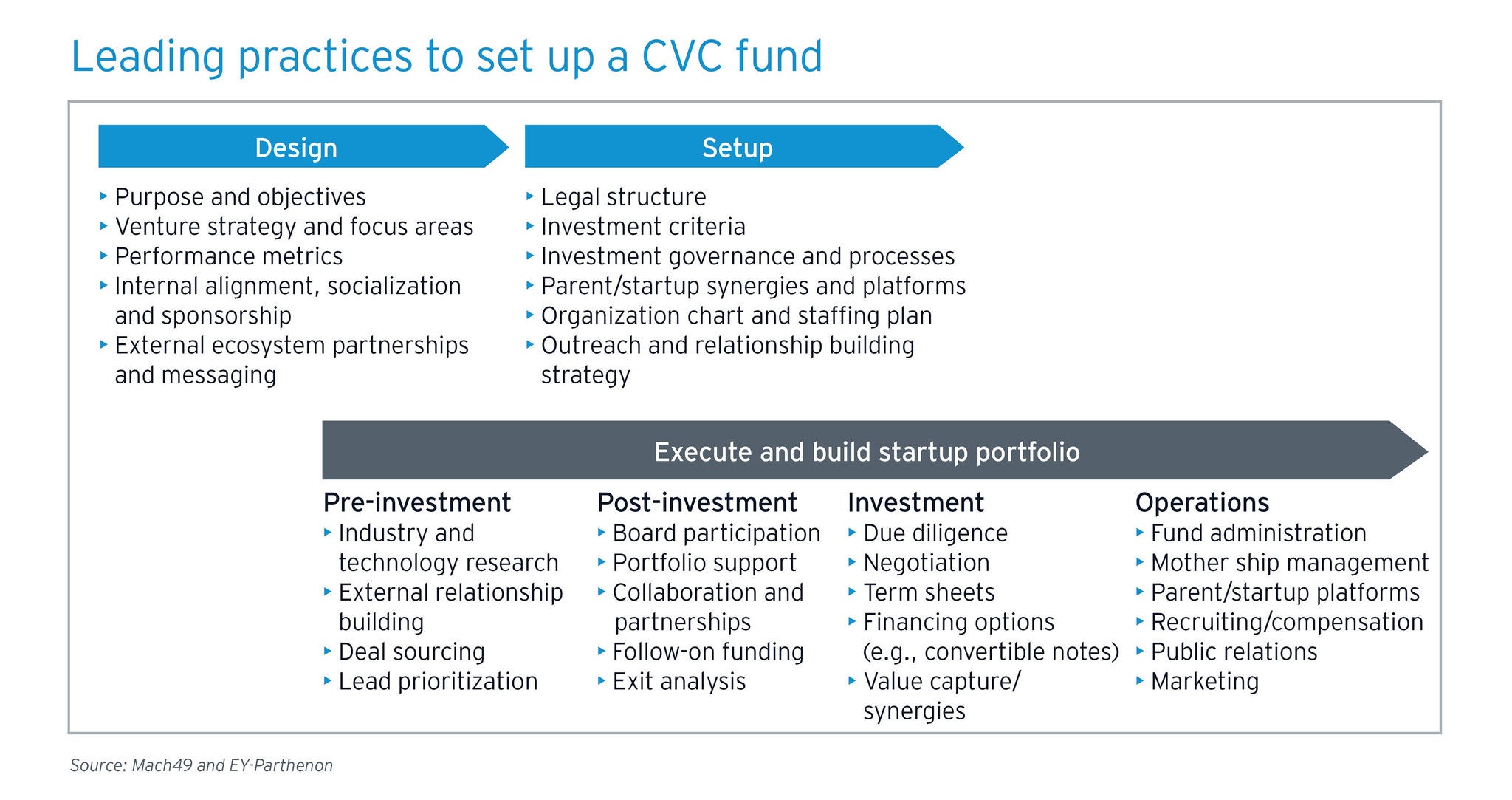

A series of key questions can help an organization determine the best way to set up and operate a CVC fund, tying it to the company’s strategic innovation agenda so it is fully supported by the board and leadership of the company.