EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

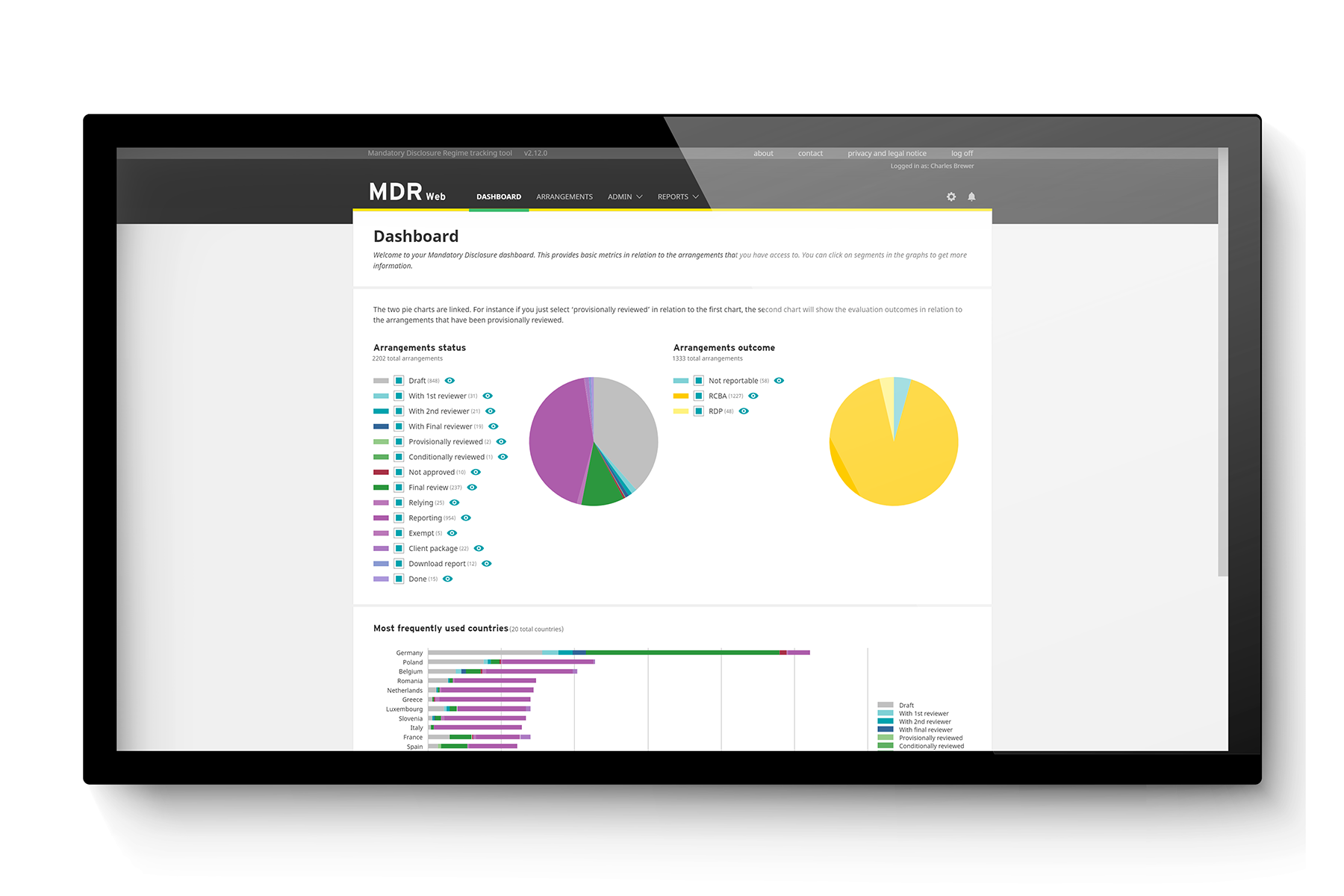

EY MDR Web: cross-border transactions and assessment platform

EY MDR Web helps you evaluate and report cross-border arrangements under Mandatory Disclosure Rules (MDR).

EY MDR Web is a cloud-based assessment and reporting platform for evaluating cross-border arrangements under the MDR for each enabled jurisdiction. The EU countries have implemented MDR – or the 6th Directive on the Administrative Cooperation between EU Member States (DAC6) – to detect what tax authorities perceive to be artificial cross-border tax matters. Extensive reporting obligations and complexities are growing as more countries around the world implement their own mandatory disclosure rules, in line with, or inspired by, the OECD Model Mandatory Disclosure Rules on CSR avoidance arrangements and opaque offshore structures.

Evaluate tax obligations

Helps identify reportable arrangements and differences between country interpretations for the submission review process.

Improve assessment and reporting

Structure your data in a format that aids report generation and reduces manual effort.

Capture reportable transactions

Access a specialized review by centrally assigned reviewers in your organization

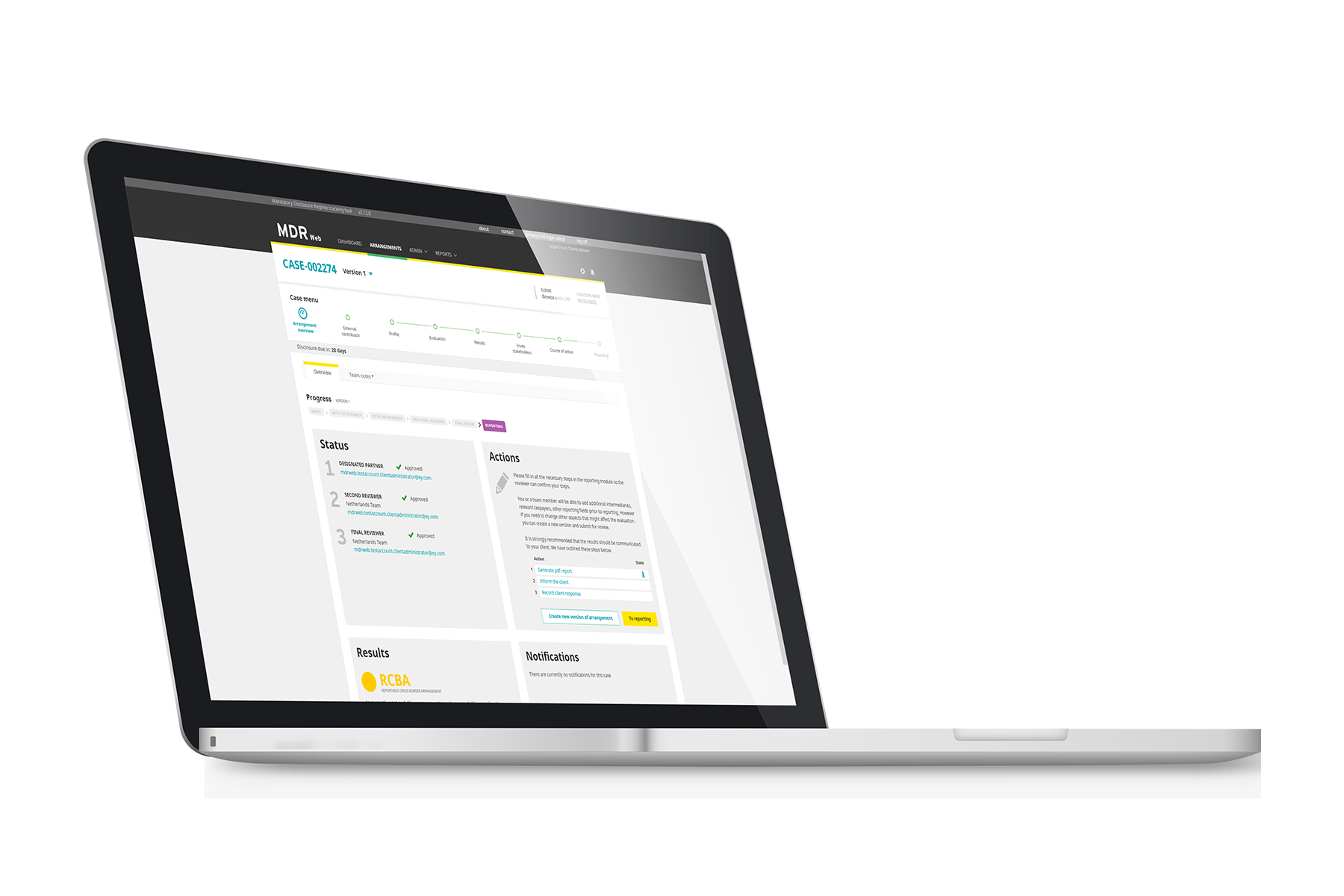

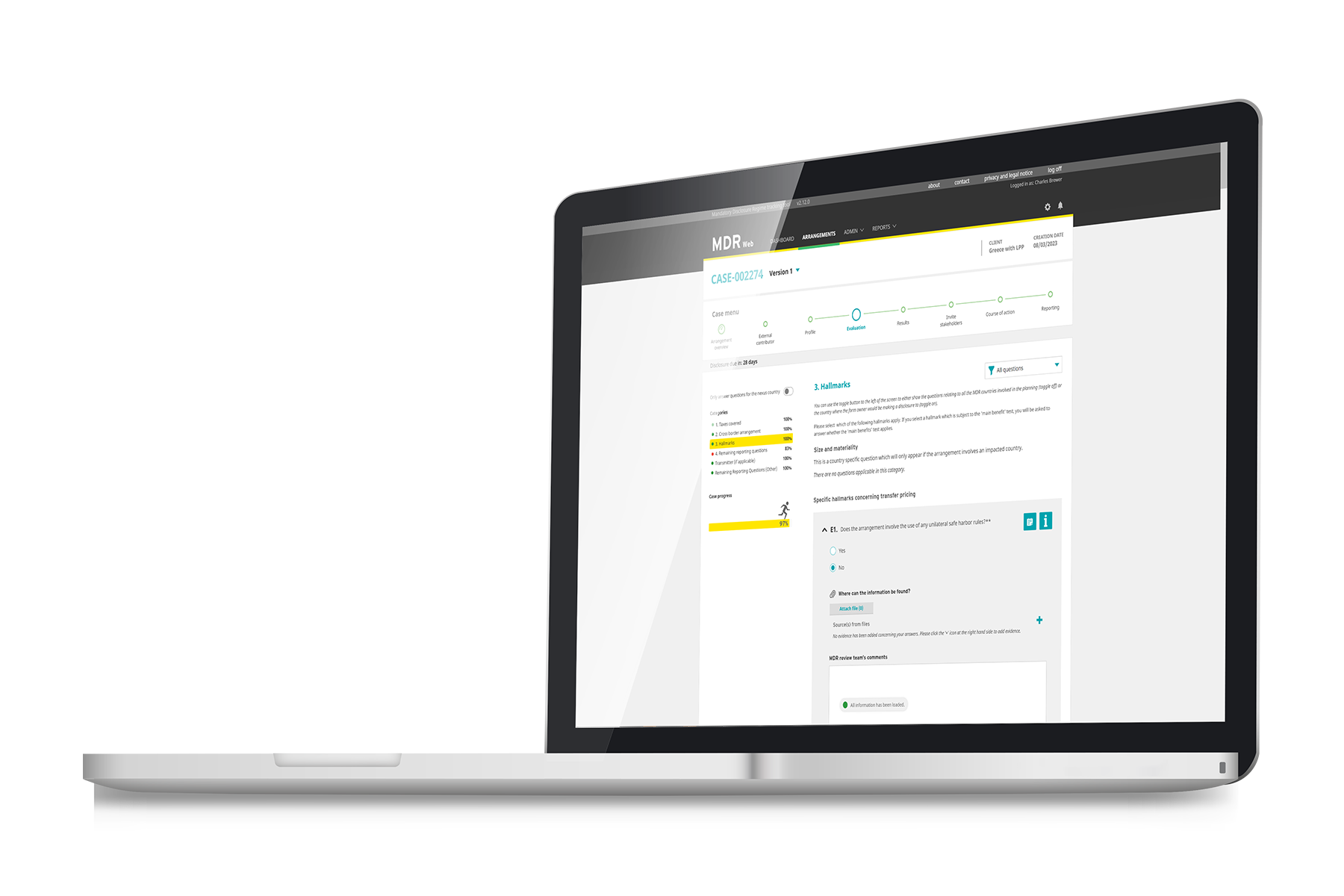

EY MDR Web provides an intuitive interface with well-defined processes and guidance at each step of the journey.

Implement an operational framework and conduct a MDR impact assessment

- Manage your organization’s MDR obligations in different countries, including EU DAC6 countries and enabled non-EU countries.

- Undergo an MDR impact assessment to understand what your business needs to address and the next steps.

- Understand the situations in which MDR obligations are applicable, along with the reporting requirements.

Define roles and responsibilities within your organization

- MDR Web enables your MDR compliance and operations, so you have complete, up-to-date MDR knowledge and can file in a timely fashion.

- Reduce the risk of penalties for incomplete or late filing.

Access a detailed approach to MDR compliance

- Named users (client and/or EY) to log arrangements. Cloud-based with integrated single sign-on.

- Disclosure workflow management process, and data input guidance (technical explanations of MDR terms) provided.

- Guided process to evaluate whether an arrangement is reportable or not.

- Essential documents can be attached and uploaded.

- Record arrangements based on legal entities to enable reporting directly from the tool.

Leverage EY knowledge and tax insight

The dedicated EY tax professionals across the globe contribute with technical MDR knowledge of each enabled country, including country-specific regulations which provide guidance on their interpretation of the EU-MDR rules. MDR Web provides guidance for both EU and enabled non-EU countries at the point when legislation and guidance are updated by the authorities.