Will is an important legal document to ensure effective estate planning and wealth distribution.

A will is a legal document specifying the wishes and intentions of a person regarding distribution of their assets and wealth after their lifetime. A person who writes a will is called a Testator.

Writing a will becomes imperative to ensuring that an estate is devolved as per the wishes of the Testator. In the absence of the same, succession of their assets will take place in accordance with applicable succession laws. The benefits on estate planning are numerous, and often ensure peace. A Will is an important part of estate planning.

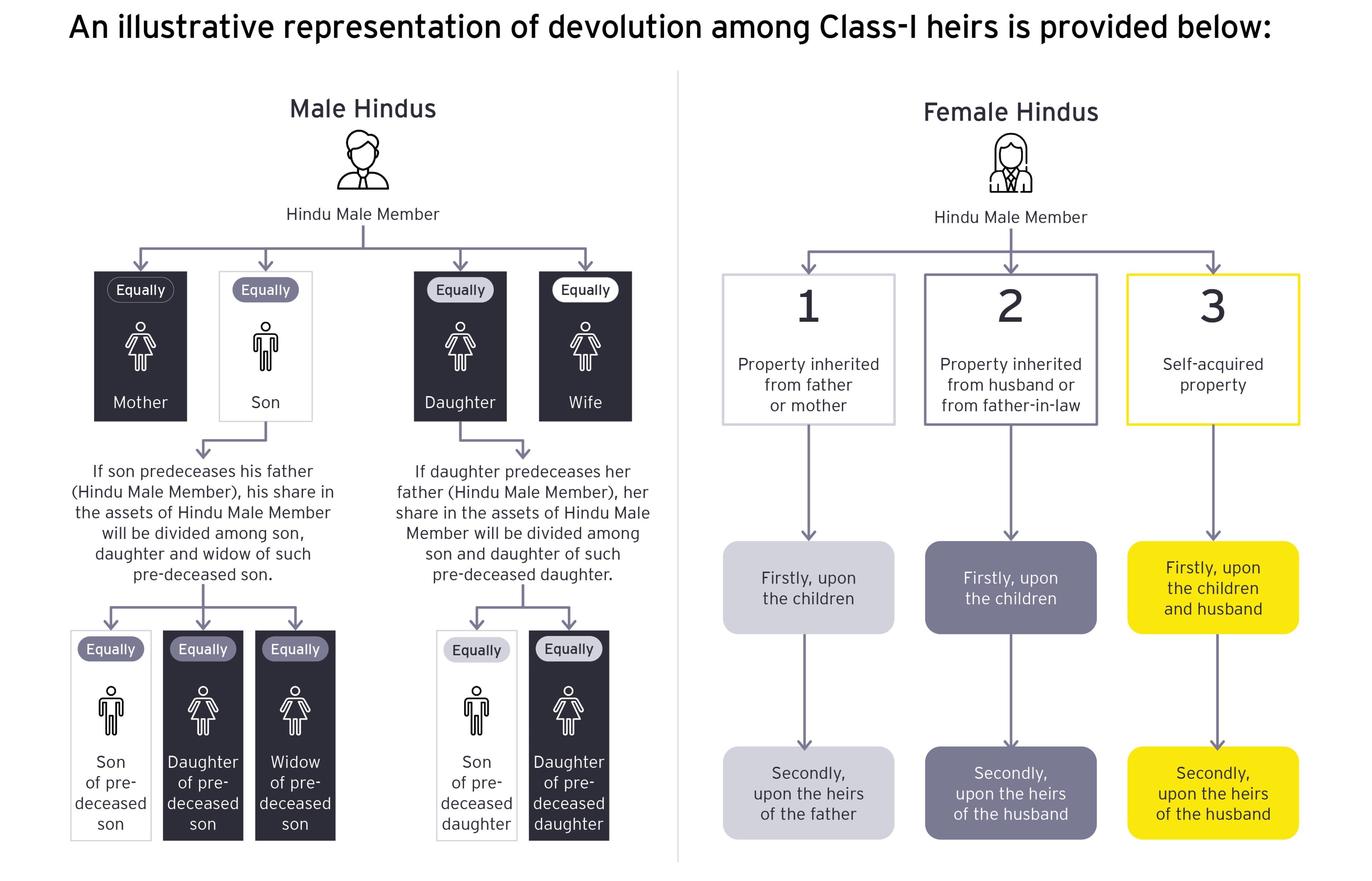

Succession for Hindus, Buddhists, Jains and Sikhs is governed by the Hindu Succession Act, 1956. In case of demise of the male member of a family without a will i.e. intestate, his assets/ estate firstly devolves upon his immediate heirs i.e. Class-I heirs. Amongst Class-I heirs, assets will be first divided equally among the widow, mother, son and daughter.

In the event, there are no Class-I heirs, the assets devolve upon other heirs, in the following order of priority:

- Class-II heirs – Examples are father, son's daughter's son, son's daughter's daughter and so on;

- Agnates – A relative whose connection is traceable exclusively through males (for example, cousin from the father's side); and

- Cognates – A relative whose connection is traceable not wholly through males (for example cousin from the mother's side).

An illustrative representation of devolution among Class-I heirs is provided below: