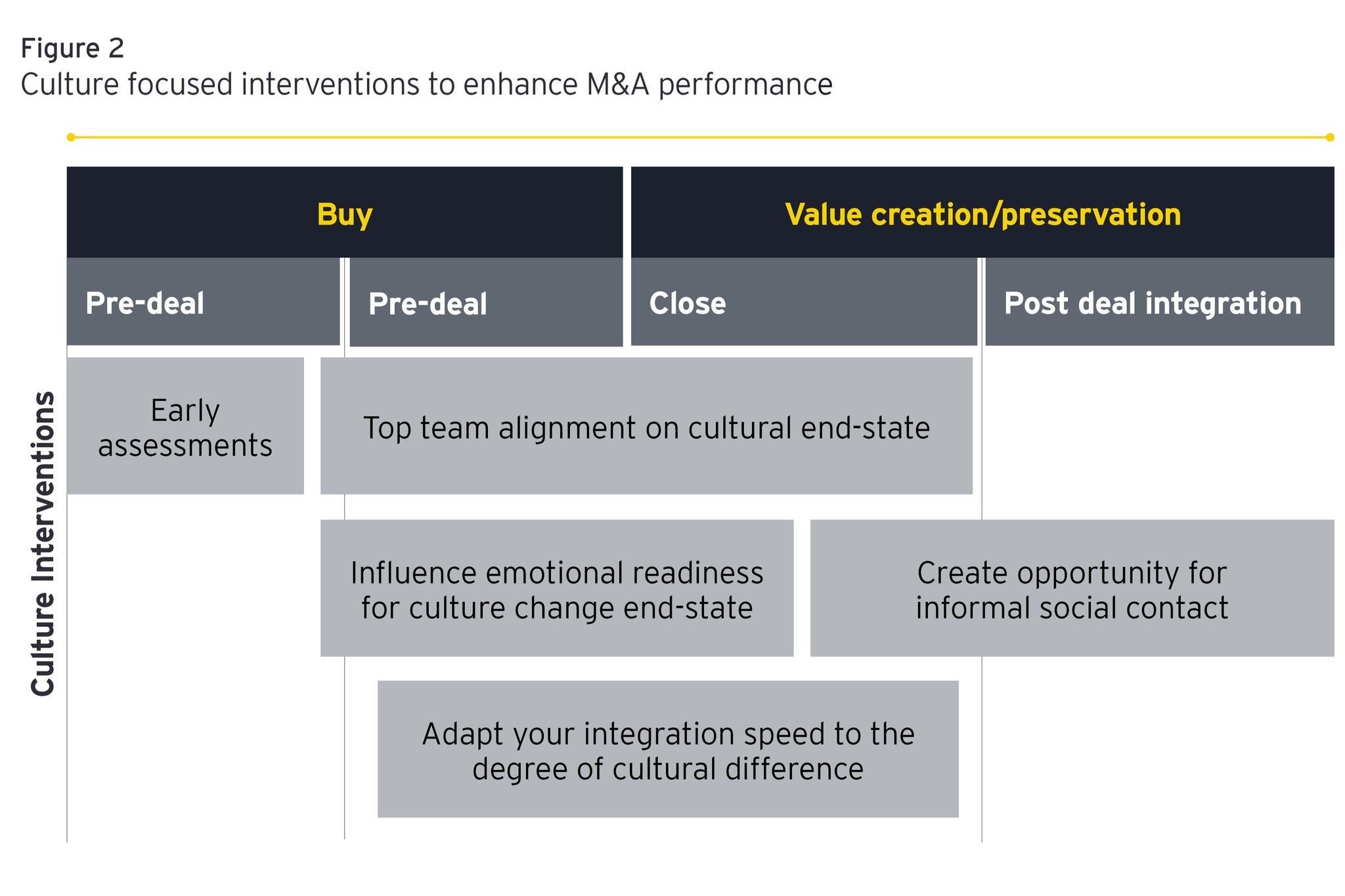

Pre-deal: Before the decision is made

It is important to conduct assessments into the culture of both organisations as early as possible. These assessments offer valuable insight into the risks that could lead to a culture clash, the opportunities that can be leveraged for cultural synergy and the timing, pace and design of subsequent cultural integration strategies.

To enhance M&A performance, make culture assessments part of your due-diligence before the transaction is agreed. At this early stage, data can be gathered by reviewing the articulated culture of each organisation (i.e., the espoused values and behaviours), performance measures relating to employee experience (e.g., engagement and retention data) and interviews with decision makers. Organisations that are frequently involved in transactions where acquisitions are part of their strategy should build regular culture assessments in their own organisation, so they are ready for this comparison analysis.

Day 1 readiness: Before the announcement is made

Senior team alignment on cultural end-state: Based on the M&A objectives and cultural characteristics of both organisations, executive teams should align on the cultural archetype that will maximise deal value. As discussed in the previous section, this archetype could be cultural absorption, transformation, a ‘best of both blend’, or a separate and distinctive preservation. By aligning on the desired end state from the outset, senior leaders can anticipate cultural challenges and apply consistent leadership strategies to encourage the synergy required and drive positive performance.

As leaders, it might be tempting to tightly define exactly what the new culture will look and feel like. However, this is likely to broaden the gap between the articulated and deeply ingrained cultures that are experienced by employees, in turn creating resistance.28 Instead, top teams should align to a cultural archetype, and then create space for organisational members to co-create the culture change accordingly. Even if the decision is to opt for preservation (i.e., keeping the cultures separate and distinct), the M&A will impact both cultures in some way and leaders shouldn’t underestimate this disruption. As with every change, co-creation of the desired future end state is important. Individuals shouldn’t feel like a change is being ‘done to them’, but that there are multiple opportunities for them to add in ideas, thoughts and perspectives. Whilst leaders need to avoid co-creation descending into chaos or unrealistic expectations, by offering everyone a chance to proactively shape the future, you are far more likely to keep people engaged and motivated in the change occurring.

Every organisation has a unique culture and there will be varying degrees of cultural difference in every M&A transaction. Adapting the degree and speed of integration to match the level of cultural difference is of paramount importance to mitigate culture shock, clash, or conflict. Research suggests that when the cultures are similar, the merging organisations are able to integrate quicker and to a greater extent.15,26 In contrast, when the cultures are very different, findings showed the integration was more successful when it was slower and integrated to a lesser extent.

Consider the extent of cultural difference identified in your early assessments. If there are big differences, you may find the integration is smoother when you allow more time for people to familiarise themselves and make sense of their future cultures together. Adapting your integration approach based on culture is an essential part to realising the full performance potential of the M&A.

Day 1 readiness: After the announcement is made

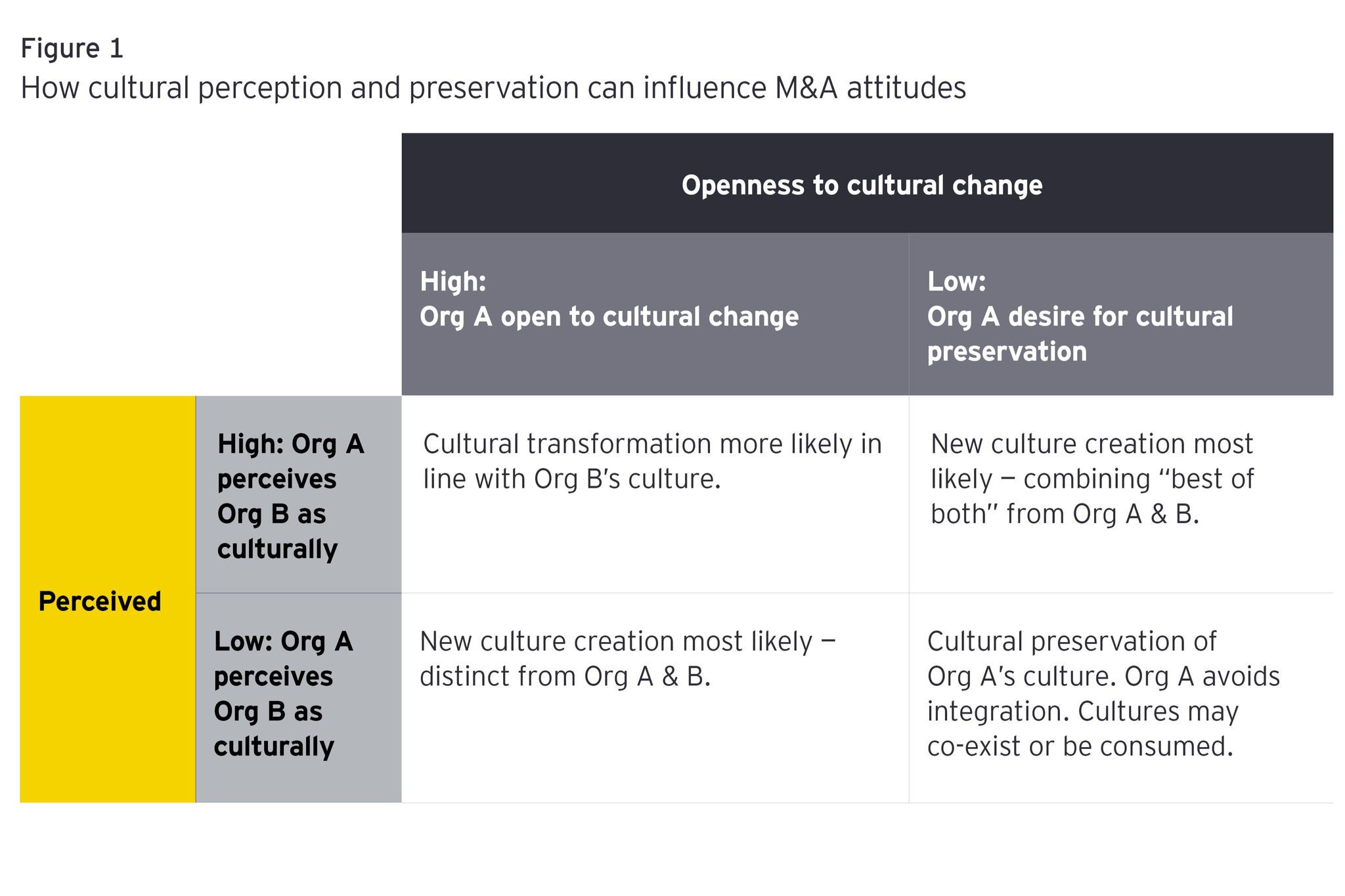

M&As are a form of transformation and the EY study with Oxford Saïd Business School highlighted how transformation success or failure can often be rooted in human emotions. For any transformation initiative to perform well, leaders must invest in building the conditions for success at both a rational and emotional level – otherwise, it leaves the M&A vulnerable to the impact of a negative spiral of emotions.13 Anticipating the emotional journey of change is therefore critical to success, with leaders taking time to support people proactively, patiently and empathetically as they navigate the change. It is also important for leaders to understand the level of attractiveness of the merging organisations and people’s degree of openness to cultural change, as this will help them anticipate challenges and gauge the type of emotional support different groups may require.

Create opportunities to showcase the culture of the merging organisations and celebrate their unique heritage and characteristics. Even if the desired end state is for one culture to be absorbed, it is important to honour the past, what it meant to people and the value it contributed. Senior teams must also be conscious of the fact that, whilst they have been involved in the M&A decision from the start and have had months or years to come to terms with the change that’s happening, for employees, the M&A will be a shock, sparking raw emotions that take time to process. It’s therefore vital that, throughout the integration, leaders patiently support people as they work through the change, rather than imposing their own perceived deadlines on how they expect people to be feeling.