A common understanding of the metaverse is elusive, but it might go something like this: a highly immersive, persistent, three-dimensional experience where participants interact with each other, objects and their environments, with the ability for participants to own digital assets, such as cryptocurrency and virtual land. Metaverse dwellers establish and participate in user-driven economies, and conduct transactions between peers and brands across environments, without dependencies on intermediaries or the developer of the environment in which they are present.

Can the metaverse exist without Web 3.0?

The metaverse and Web 3.0 are often mentioned in the same sentence, sometimes interchangeably. Many are asking, “What’s the difference between Web 3.0 and the metaverse? Are they the same thing? Is one reliant on the other? Can there be a metaverse without Web 3.0?”

What these questions elicit and draw attention to is the gap between what the metaverse is today and what it could be in the future. We live our real lives in three physical dimensions, even when we have our heads buried in our laptops or phones. While we adapted to more of a digital life organically (and forcibly, to deal with a global pandemic), we have also grown a deeper appreciation for in-person human interaction and the joy of physical connection to space.

But we launched this new digital work-life experiment predominantly in two dimensions. Even with the existence of early metaverse gaming experiences, the technologies we adapted to work and socialize from afar were neither rich nor immersive. The technology and behavior were not quite there, so we defaulted to our two-dimensional paradigm and widely adopted new meeting and collaboration models, and the beloved video call cocktail hour — all of which engendered fatigue and diminished personal connection while arguably maintaining, and in some cases increasing, productivity.

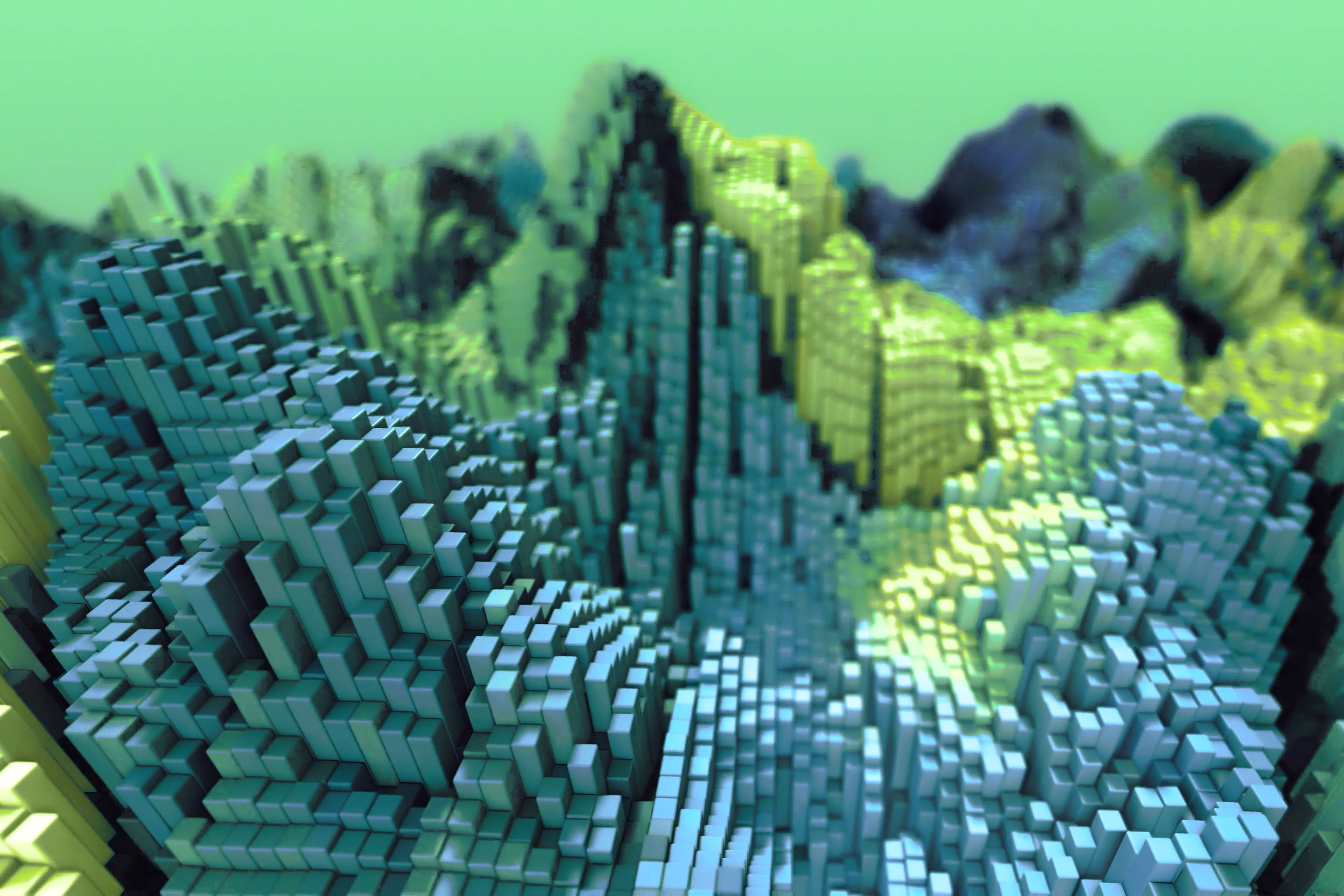

The immersive third dimension of the digital experience is what will define the metaverse in the short term. Whether this third dimension comes to life through augmented reality/virtual reality (AR/VR) devices or in rich worlds modeled by rendering engines, our avatars will explore new ways to interact, and we will feel more “present” in the digital realm. While the nexus between blockchain and the metaverse matures in the form of user-driven economies and ownership of digital assets, we are at the point on the continuum where, for the majority, the metaverse exists predominantly as a presentation layer to the current internet and its content.

In the now, what we see are immersive experiences that enable teams to be more productive in virtual workspaces. We see innovative ways to onboard and train employees at scale and at speed in a consistent fashion, for small and large global organizations alike. Better tools will emerge to visualize accident scenes and train insurance adjusters in augmented reality. We’ll attend various conferences in virtual spaces and form new online communities. And these new experiences and interaction models will lay the groundwork for the ultimate vision of the metaverse, with or without the full integration of blockchain technology or digital assets.

For financial services firms, there is an opportunity to harness immersive experiences to interact in new ways with customers. There’s also an opportunity to provide new products and services that build bridges between the metaverse and the real world. Immersive experiences in the metaverse will augment, not replace, firms’ digital presences, especially for the recent Gen Z and Alpha generations. They’ll replace some events and provide opportunities for financial services firms to deliver value to customers in the form of financial literacy training or financial planning.

In the medium term, the opportunities that the metaverse presents are compelling for firms in the financial services industry. The nature of e-commerce will be different, and we’ll enter an age of digital ownership where we are not just consumers but also owners in shared experiences that are open and available to all. This will segue into clients expecting financial services firms to guide their activities in this new digital economy, such as creating, buying, selling and managing digital assets. This new paradigm introduces a number of considerations, including inclusivity and accessibility, and we must be mindful of the impact on a widening digital and wealth divide.