Hospitals in the US face significant margin challenges, driven by an ever-increasing cost of care and a relentless pressure to reduce reimbursement for those care costs. By contrast, payers are largely concentrated, and those same payers are also competing directly with providers as they extend across the value chain. The whole industry is looking for breakthrough innovation that can disrupt these dynamics and create a healthier, more innovative system of care delivery. In this environment, hospital M&A has an important role to play.

Only 34% of health care executives say they expect to actively pursue M&A in the next 12 months, down from 60% a year earlier, according to the latest EY Capital Confidence Barometer. But CEOs might want to rethink M&A intentions now to improve their hospitals’ long-term growth outlook. Several factors could support M&A in 2021 and beyond, including low interest rates, vertical integration between payers and providers and the need for hospital systems to scale to compete.

We offer some suggestions for assessing specific needs, calibrating investment appetite, and deciding which M&A options are right for their organization.

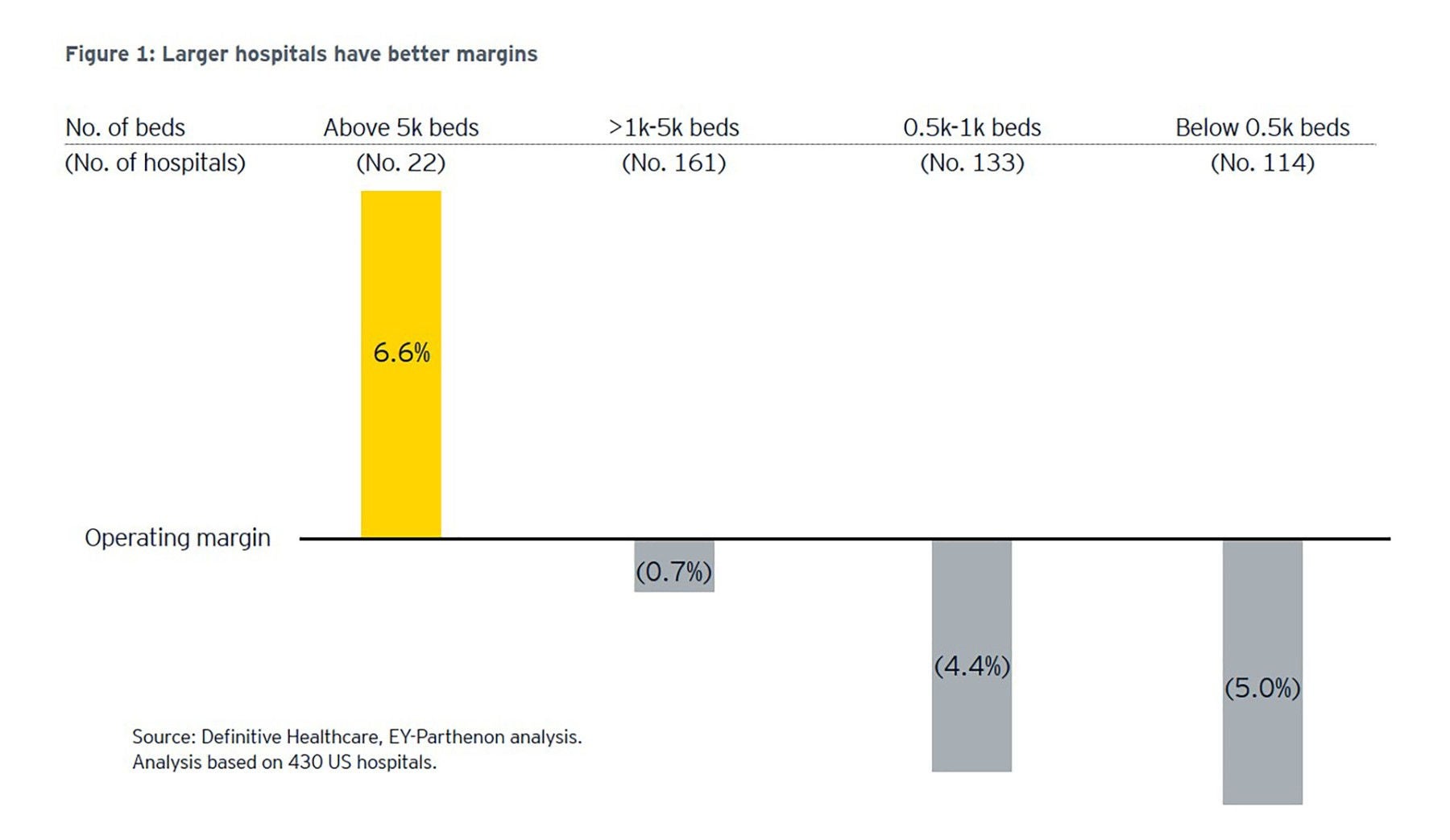

Hospital margins under pressure

Hospital margins have been shrinking over the past several years. The average operating margin fell to 0.3% in 2019 from 1.8% in 2015, according to Kaufman Hall.

Drivers of margin pressure stem from rising labor and other operating costs and the increasing negotiating strength of managed care players. As hospitals shift care to lower-cost, outpatient settings (which is good for patients and our overall health economy), their individual margins often suffer. Hospitals also face new potential pricing pressures after being forced publicly to disclose their rates for the first time in 2021, a move intended to enable easier comparison shopping by patients and payers.

COVID-19, meanwhile, resulted in the delay or wholesale cancellation of elective procedures across a range of categories and caused patients to forego many regular health screenings altogether. This loss in volume, resulting in unexpected unrealized revenue, played out as hospitals also faced a slew of pandemic related costs. And the pandemic’s effects linger, with hospital revenue in 2021 expected to decline by at least $53 billion, according a a study commissioned by the American Hospital Association and as reported by Kaiser Health News.